Dow Jones Forecast: Will Earnings Season Push The Index To Record Highs?

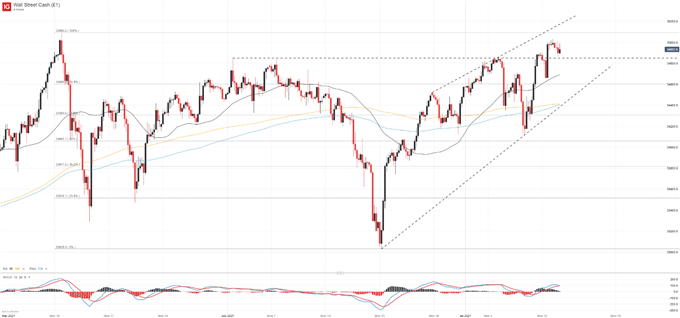

Recent price action has seen the Dow Jones inch toward record levels even after the reflation trade was put on pause amid declining Treasury yields. The move highlights surprising resilience from the index, an encouraging development given the underwhelming trading conditions. Now within reach of new highs amid a lull in market activity, the Dow Jones will likely turn to earnings season for influence as the month progresses.

DOW JONES PRICE CHART: 4 - HOUR TIME FRAME (MAY 2021 – JULY 2021)

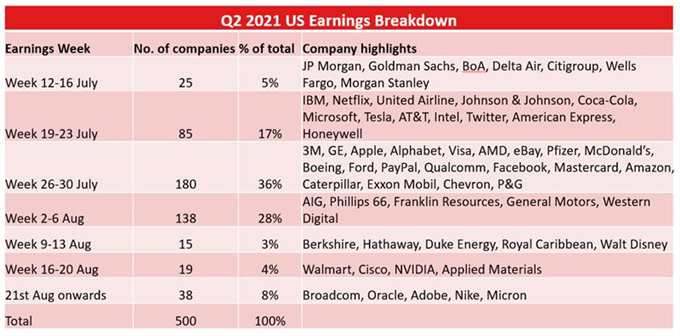

Thankfully for bulls, earnings season began with a strong start after JP Morgan (JPM) and Goldman Sachs (GS) blew past analyst estimates Tuesday morning. Earnings from the country’s largest banks mark the official start to earnings season which will run to approximately mid-August. In the month to come, the vast majority of S&P 500 and Dow Jones constituents will report and offer crucial insight to market participants.

S&P 500 EARNINGS CALENDAR

Source: DailyFX, Bloomberg, Margaret Yang CFA

While earnings provide an opportunity to check up on macroeconomic themes impacting single stocks, the period also allows for increased volatility in single shares that can often spill over into the broader indices. With volume and volatility trending downward during the summer doldrums, the upcoming earnings season presents an enticing prospect for traders in search of volatility. Should quarterly results come in significantly above or below Wall Street estimates, the resultant price action could help revive volatility more broadly.

That being said, a string of strong quarterly reports could also help propel the Dow Jones to new heights above the 35,092 mark which is narrowly above the current trading price. Either way, traders and investors should keep an eye on upcoming earnings releases as they possess the potential to influence equity market price action.

Particularly for option traders, implied volatility crush, or IV crush, following the upcoming corporate reports may be particularly severe given the lower baseline of implied volatility across the market.

Disclaimer: See the full disclosure for DailyFX here.