Don't Fear A Bubble In The S&P 500: Plan For It Instead

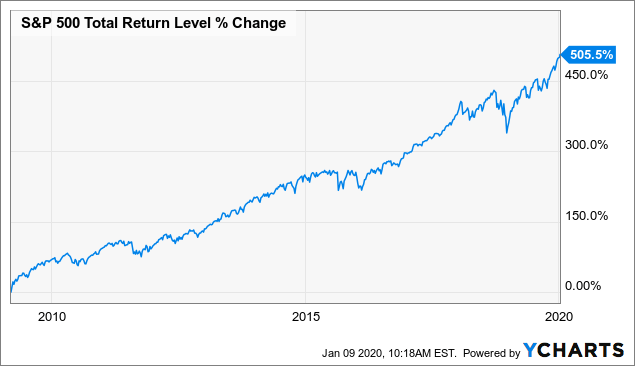

The S&P 500 (SPX) has delivered massive gains over the past decade, rising by more than 500% with dividends included since March 9 of 2009, the lowest point in the financial crisis. The index is trading at all-time highs as of the time of this writing, and many valuation metrics are getting extended. In this context, investors have reasons to wonder if the S&P 500 is in bubble territory.

(Click on image to enlarge)

Data by YCharts

Personally, I don't believe we are in bubble territory at this stage, but this is not a risk to underestimate going forward, especially in times of rising market prices and abundant liquidity from the Fed and other central banks all over the world.

In any case, trying to speculate too much about these things can be hazardous to your wealth. Instead of trying to forecast bubbles, investors should focus on building risk-management strategies that can provide capital protection in all kinds of environments.

Are We In A Stock Market Bubble?

In order to make things simple, we can highlight two main attributes of stock market bubbles. During a bubble, valuations tend to get excessively high and disconnected from fundamentals, and investor sentiment gets irrationally exuberant.

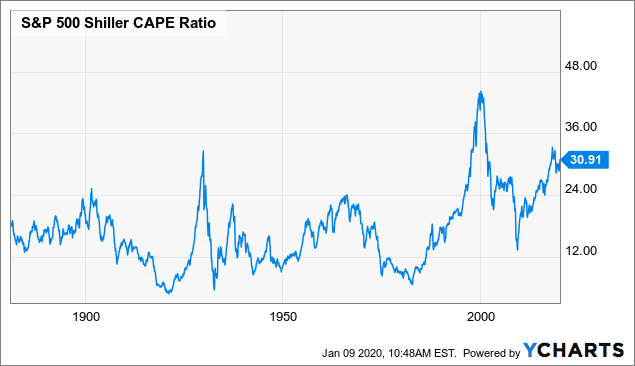

Some valuation indicators for the S&P 500 are clearly getting extended. The Shiller CAPE Ratio is a widely followed long-term valuation indicator, and it is approaching concerning levels.

(Click on image to enlarge)

Data by YCharts

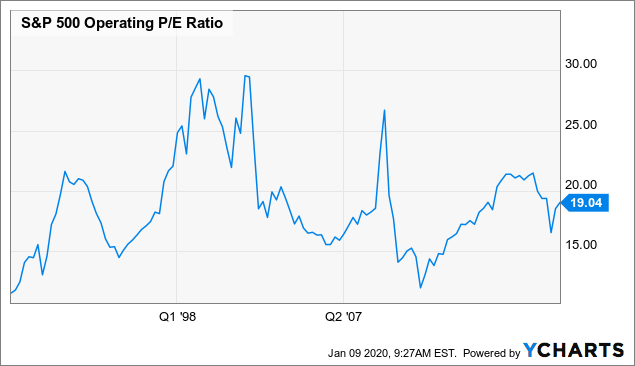

On the other hand, metrics such as operating P/E ratio look more reasonable.

(Click on image to enlarge)

Data by YCharts

Interpreting valuation ratios for the S&P 500 is never easy, and there is a wide range of variables to consider. The fact that interest rates are historically low could mean that the index should trade at higher P/E levels. But we are also looking at earnings in a long expansionary cycle, and if we enter a recession earnings could suffer a material contraction, so the S&P 500 could turn out to be far more overvalued than it seems to be now.

In any case, it is fair to acknowledge that most valuation ratios for the S&P 500 are quite elevated by historical standards. Valuation is not a market-timing tool by any means, but the fact that the market is rather expensive increases the risks for investors going forward.

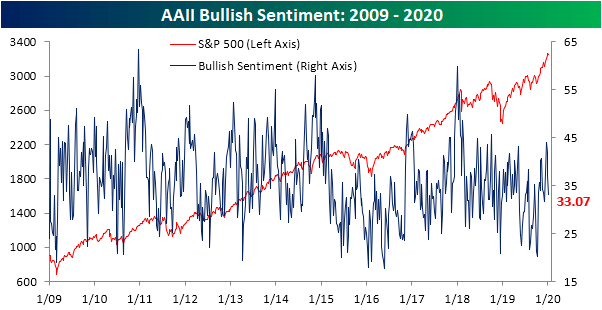

Looking at the market sentiment, some short-term sentiment indicators are turning more bullish recently, but we are not at euphoria levels by most metrics. The AAII survey still looks quite moderate, and bullishness levels are even below their long-term averages based on this survey.

(Click on image to enlarge)

Source: Bespoke

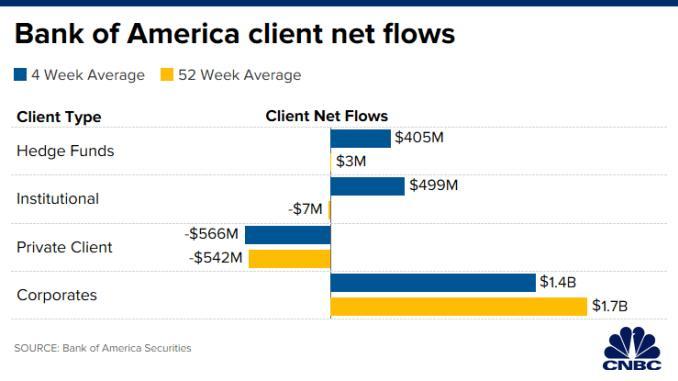

According to data from Bank of America, retail investors have been net sellers of stocks in the past year, so the market sentiment has remained subdued for a long time.

(Click on image to enlarge)

Source: CNBC

But sentiment usually follows price, and price action has been aggressively bullish in the past few months. Importantly, the idea that the Federal Reserve is relentlessly willing to provide support for the market could incentivize dangerous risk-seeking behaviors among investors.

One of the main reasons why the S&P 500 has performed so well in the past decade is that the Fed has provided abundant liquidity and the economy has avoided a recession over this period. This can be a powerful upside fuel for prices, and it can also have a concerning impact on investor behavior.

When the mentality is that all risks should be ignored because the Fed will ultimately do whatever is required to save the market and the economy, this can be the perfect driver for a stock market bubble.

Just to be clear, we don't have enough evidence to say that the S&P 500 is in a bubble right now. But valuations are getting stretched, and the "buy the dip" mentality fostered by abundant liquidity could easily create some excesses in the market.

Now that recession risk seems to be dissipating and valuations are expanding, the possibility of entering a bubble phase is one of the main risk factors to watch in the middle term.

Trend Following And Stock Market Bubbles

Trend following basically means that you only buy an investment when its price is rising. Importantly, the strategy is not about buying high and selling low, trend following is about buying when the price starts rising and selling when the price starts falling. The following chart explains this key distinction.

(Click on image to enlarge)

Source: Behaviorgap via Econonpicdata

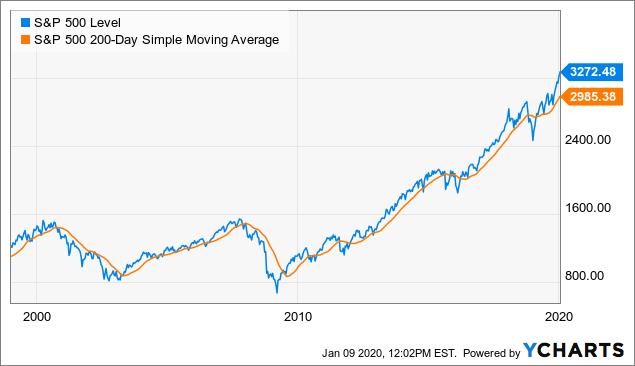

A simple and effective way to implement a trend following strategy is to be invested when the price is above a trend indicator such as the 200-day moving average and sell when the price crosses below such an indicator. The chart below shows the evolution of the S&P 500 index and the 200-day moving average over the long term.

There have been some false signals, of course, but the trend indicator has done a solid job in terms of capturing the big bull and bear markets in US stocks over the decades.

(Click on image to enlarge)

Data by YCharts

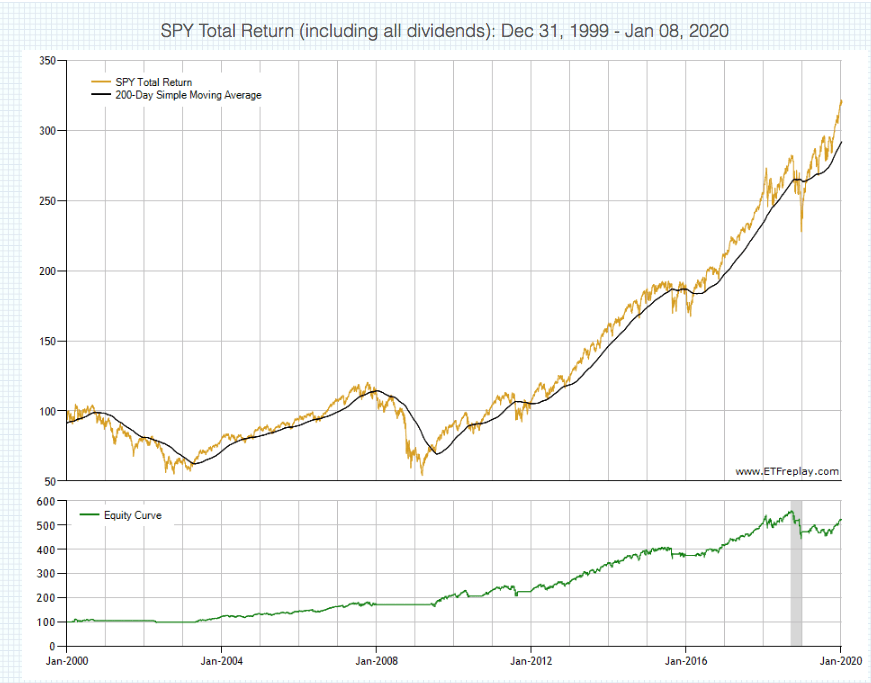

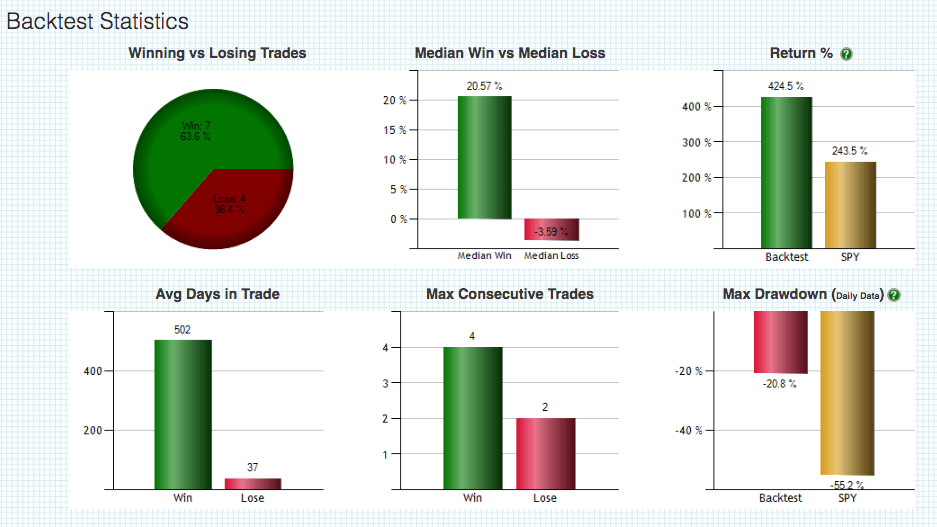

The charts below show the performance statistics for the trend following strategy applied to the SPDR S&P 500 since 2000. The trend-following strategy gained 425.4% versus 243.5% for buy and hold investors.

Even more important, the maximum drawdown, meaning maximum capital loss from the peak, was 20.8% for the trend following strategy, substantially better than the 55.2% decline suffered by buy and hold investors over this period.

(Click on image to enlarge)

Source: ETF Replay

(Click on image to enlarge)

Source: ETF Replay

Trend following strategies are very efficient at capturing big bullish and bearish movements in the market. When the market is rising steeply, the strategy will be invested in stocks, and when the market is declining strongly, the strategy will probably be out of stocks. On the other hand, times of sideways market action tend to produce lots of false signals, and a trend following strategy will probably produce disappointing returns in that kind of environment.

So, trend following strategies will generally disappoint in a lateral market period, but they tend to produce superior risk-adjusted returns during big uptrends and downtrends in the market.

The typical market behavior during a bubble is an exponential bull run followed by massive losses when the bubble bursts. This should mean that trend following strategies could be particularly effective during bubbles.

In fact, a research paper by Mebane Faber entitled Learning To Love Investment Bubbles examines the performance of trend following strategies across 12 of the biggest investment bubbles in history.

The evidence shows that trend-following strategies have proven to be remarkably effective at improving performance and reducing downside risk in these periods.

In this research piece we take a look at some of the more famous market bubbles in history and the extreme volatility and drawdowns they experienced. We then examine a simple trend following approach investors could use to manage their risk. Across twelve market bubbles we find that a trendfollowing system would have improved return while reducing volatility. Most importantly, it would have reduced drawdowns significantly leading to the most important rule in all of investing - surviving to invest another day.

I don't think that the S&P 500 is in a bubble right now, but the risk of entering a bubble phase is increasing. If this happens, investors should obviously consider taking some chips off the table and selling as the markets keep rising to excessive levels. In addition to this, implementing trend-following strategies has proven to be remarkably effective in terms of optimizing performance and reducing downside risk in stock market bubbles.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

Disclaimer: I wrote this article myself, and it expresses my ...

more

Bubble??? Yep!! Bursting??? Maybe??