Domo Could Dip When IPO Lockup Expires

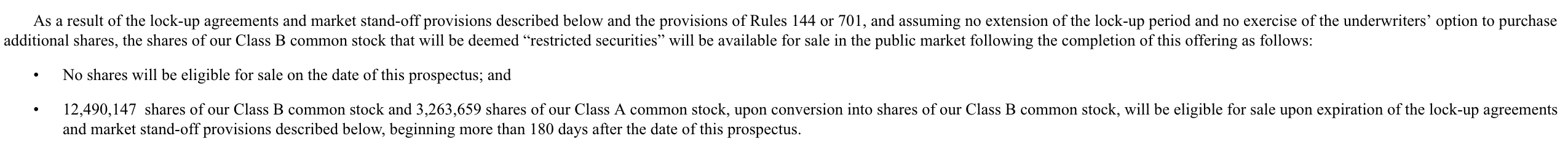

The 180-day lockup period for Domo, Inc. (DOMO) ends on December 26, 2018. When this period ends, the company’s pre-IPO shareholders and insiders will be able to sell nearly 16 million shares of currently-restricted stock.

(Click on image to enlarge)

With just 9.2 million shares of DOMO trading pursuant to the IPO, any significant sales of these restricted shares could flood the secondary marketplace and result in a sharp, short-term downturn in share price when the lockup expires. Aggressive, risk-tolerant investors should consider shorting shares of DOMO ahead of the IPO lockup expiration on December 26th.

Trading in DOMO has been mixed during this six-month period, although the share price is still just above its IPO price. The stock was priced at $21 and closed on its first day of trading at $27.30 for an increase of 30%. The shares dropped to $16.06 on July 30, then climbed back to $23.51 on August 31. DOMO has a return from IPO of -4.7%.

Business Overview: Provider of Business Operations Platform

Domo provides a cloud-based platform that connects senior executives to frontline employees in real-time. The system is designed to provide insights into the systems, data, and people of a company through smartphones. The platform also delivers a Programmatic Revenue Solution that provides data from sell-side platforms and ad servers for deeper insights.

Domo leverages artificial intelligence, alerts and indices, correlations, and machine learning to provide real-time data that is accessible from any device. Domo markets its products to CEOs as a way to manage an entire organization from a smartphone. In its SEC filing, Domo notes that one Fortune 50 CEO logs into his Domo account up to 10 times per day.

Because the platform is cloud-based, it can process massive volumes of data and still maintain high performance objectives. On average, Domo processes between 100 to 200 trillion rows of queries while sustaining a subsecond query response time.

Through April 2018, Domo had a client portfolio of over 1,500 organizations, which includes 385 clients with revenue of over $1 billion. These 385 clients represent approximately 46 percent of revenue during the 2017 to 2018 fiscal years ended on January 31.

Domo uses a land-and-expand operating model. The Domo system is integrated within a specific area of an organization before full expansion. This allows clients to see the value of Domo and then increase user engagement and footprint within the organization. Through January 2018, the company’s 20 largest clients had expanded Domo in their organizations on average nine times from their initial installation. These 20 clients represent 14 percent of revenue for the 2018 fiscal year.

The company was formerly called Domo Technologies. It changed its name in 2011 to Domo, Inc. It has approximately 800 employees and maintains its headquarters in American Fork, Utah.

Company information was sourced from the firm's S-1/A and company website.

Financial Highlights

Domo reported the following financial highlights for the third quarter ended October 30, 2018:

- Total revenue reached $36.8 million, for an increase of 30 percent.

- Subscription revenue was 83 percent of total revenue.

- Subscription gross margin was 73 percent versus 60 percent the previous year.

- GAAP operating expenses decreased 10 percent.

- Non-GAAP operating expenses decreased 14 percent.

- Cash and cash equivalents were $206.0 million.

Financial highlights were sourced from the company's website.

Management Team

CEO and President Joshua James co-founded Domo. He founded or co-founded MyComputer.com, Superstats.com, Plus550, and Silicon Slopes. He has extensive experience from senior positions at Adobe Systems, Omniture, and JP Interactive. Fortune Magazine named him as one of its “40 under 40: Ones to Watch,” in 2011, and one of its “40 under 40” top business executives in 2009. Mr. James studied Business Management and Entrepreneurship at Brigham Young University.

CFO Bruce Felt has been with Domo since 2014. His previous experience comes from serving at Ten-X, SuccessFactors, LANDesk Software, Integral Development Corporation, Qaulix Group, and Deloitte & Touche. Mr. Felt holds a bachelor of science in Accounting from the University of South Carolina and master’s degree in business administration from Stanford University Graduate School of Business. He is a Certified Public Accountant.

Company biographical information was sourced from the company's website.

Competition: SAP, IBM, Tableau, and Others

Domo faces competition from large software developers such as IBM (IBM), SAP (SAP), Oracle (ORCL), and Microsoft (MSFT). In addition, competition comes from business analytics software providers including Tibco Software, Sisense, Looker Data Services, Qlik Technologies, and Tableau Software (DATA). SaaS-based products and services that compete with Domo are offered by Infor and Salesforce.com (NYSE:CRM).

Early Market Performance

The underwriters for Domo priced its IPO at $21, close to the high end of its expected price range of $19 to $22 per share. The stock has had a mixed performance. It reached its highest level on its first day of secondary trading at $27.30, but has declined since then. It currently trades between $22 and $23.

Conclusion: DOMO an Attractive Short Ahead of December 26th Lockup Expiration

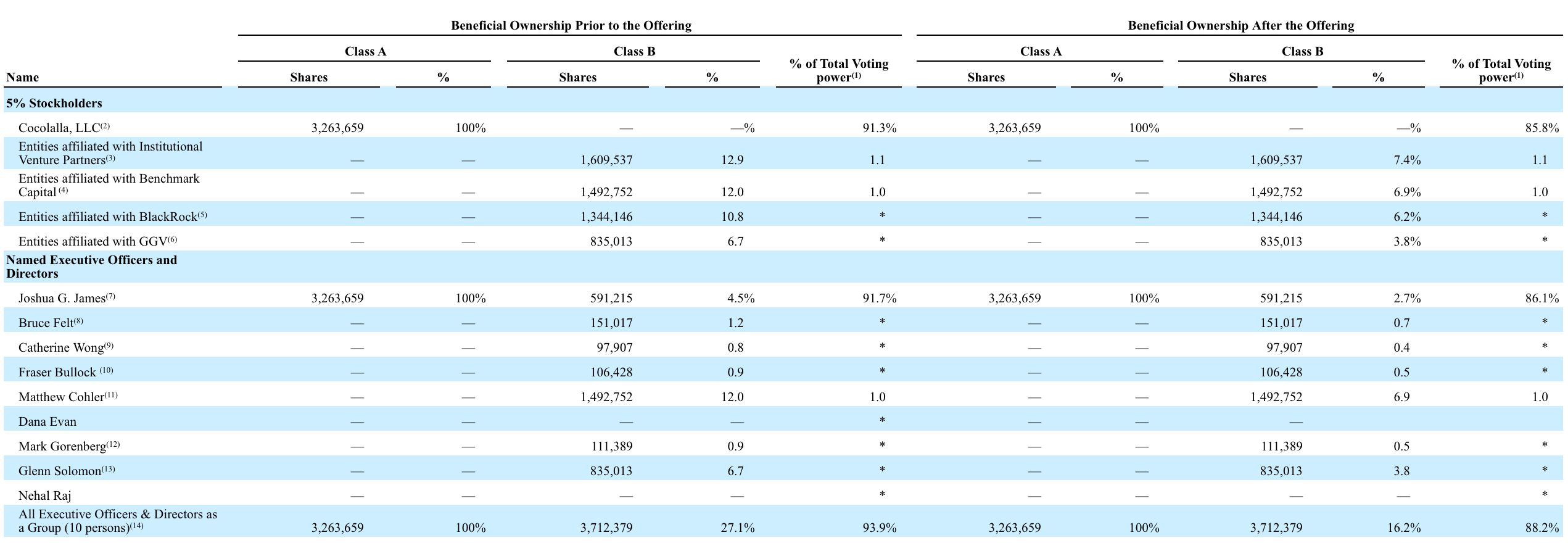

When DOMO's 180-day IPO lockup expires on December 26th, pre-IPO shareholders and company insiders will be able to sell large blocks of currently-restricted shares for the first time. This group of pre-IPO shareholders and company insiders includes ten individuals and five corporate entities.

Significant sales of stock could flood the secondary market and push shares of DOMO lower in the short term when the lockup expires - providing a short opportunity.

Aggressive, risk-tolerant investors should consider shorting shares of DOMO ahead of the company's December 26th IPO lockup expiration. Interested investors should cover shares either late in the trading session on December 26th or over the course of the trading session on December 27th.

Disclosure: I am/we are short DOMO.

Disclaimer: I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any ...

more