Does MPT Simply Just Produce Herd Behavior?

This is the best line in this whole piece:

Perhaps, the greatest risk of MPT is in its being a mathematical model. It produces identical decisions for every investor simultaneously. When was this ever a safe thing for investors to do?

“Davidson” submits:

Is Modern Portfolio Theory (MPT), articulated in 1952, with its mechanical investing approach that is presented as ‘modern’, ‘scientific’, ‘efficient’, ‘safe’ in fact not safe at all? It is worth asking this question when it has become nearly ubiquitous. Wall Street firms deploy it as the academic Nobel-Prize-winning methodology to reduce liabilities from customer complaints. Hedge funds, long-geared to short-term algorithmic trading platforms, deploy their strategies using it to reduce risk to highly levered positions on a daily basis. Financial Planning offered to individual investors globally is spoken of as ‘safe’ and offering ‘guaranteed returns’ on which to retire. Many tout the ability to tailor individual strategies to investors when the basis is in fact minor adjustments to an identical untailored mathematical analysis used across millions of investors advising Trillions.

Understanding the issues MPT brings with its application in nearly every nook and cranny of investing and even business planning requires understanding its basis. Some key factors are listed:

- MPT is a mathematical price-trend strategy-fundamental analysis is not part of the equation

- The world of investments is broken into asset classes, portfolios allocated by a risk assessment based on short-term volatility and rebalanced between asset classes based on statistical variations from multi-year averages

- MPT meant to eliminate human decision input which is deemed fundamentally faulty

- MPT creators and subsequent researchers have received multiple Nobel Prizes which in effect lower the liabilities of advisory firms recommending strategies based on it

- MPT has been accepted to such a degree by business schools that these programs appear more like an extension of applied mathematics devoid of understanding differences in corporate management skills

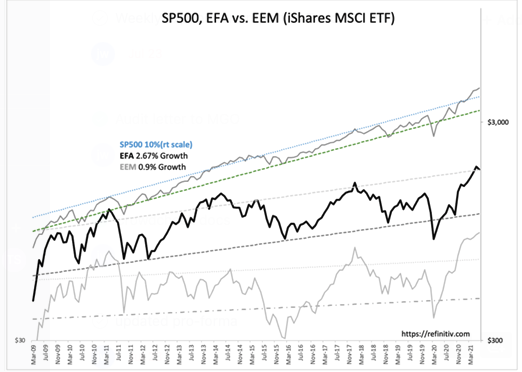

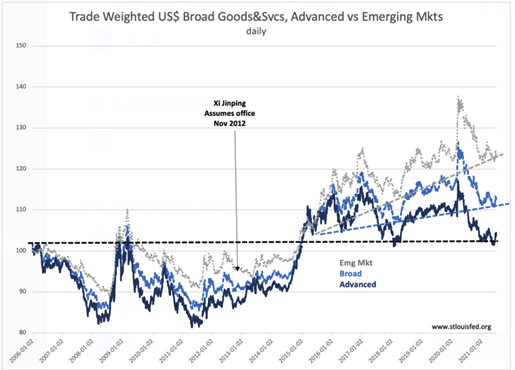

Two key features of MPT which are likely to prove problematic are 1) the concept that smaller-higher volatility equities = higher growth opportunities and 2) rebalancing on a regular basis substantially reduces risk and overall portfolio volatility leading to the claims of ‘safely guaranteed returns’ offered by many. The first key feature underlying MPT applies to EmgMkt investing. In prior notes, the concept of investing in EmgMkts seeking higher returns is at the heart of MPT’s smaller-higher volatility equities = higher growth opportunities. There is zero consideration that no country has the property protections found in the US under the US Constitution. What is done is to assume that EmgMkt companies offer higher returns under the same laws as in the US. Then one performs a simple comparison of financial metrics and declares them cheaper than the US and allocates capital accordingly. The issue which is ignored is that EmgMkt governments are rife with autocratic leaderships deploying confiscatory policies required for their financial support. The SP500, EFA vs. EEM… chart reveals that US markets as superior to Developed(EFA) and Emerging Markets(EEM). The outperformance is nearly 4x for Developed Markets(Europe and etc.)by more than 10x for EmgMkts. In my opinion, the less free the marketplace the lower the return. That US markets have been a steady draw for global capital is revealed in the Trade Weighted US$… chart with the US$ strengthening in particular since Xi became President of China.

The currency trends indicate capital has been flowing from EmgMkts back to US markets on a continuous basis since April 2011 and accelerated after Xi’s Presidential ascension in 2012. My interpretation attributes this as the direct result of Western Capital flows seeking higher returns in EmgMkts without consideration of property rights protections. To understand this one must pay attention to the many advisor recommendations that promote EmgMkt positions in portfolios which includes every financial institution and business school. After 2010, 10yr Sovereign rates began to fall below historic relationships to inflation and actual rates approached zero turning negative not long afterwards to the consternation and complete confusion of many. Low rates and the fall into negative rates does not make financial sense till one views the world through the eyes of native investors in EmgMkts.

What makes sense for a native investor whose business just became liquid in an EmgMkt with a confiscatory government with access to globally liquid markets? It is a simple decision. Transfer enough of one’s wealth to feel comfortable to a safer haven. In the process you drive the native currency lower and the target currency higher. With enough capital transfers, it becomes obvious is a relative strengthening of the favored currency. This is what is seen in the Trade Weighted US$ Broad Goods&Svcs vs EmgMkts chart. The capital transfers are strong enough to dominate the combined global Trade Weighted US$ index which includes the trade data with Advanced countries (Developed Mkts). The net impact of Western investors deploying capital into EmgMkts has had a boomerang effect, converting Western equity effectively back into Sovereign Debt and real estate. Especially so with the US as EmgMkt investors send that capital into safer havens. While Western investors are confused by negative rates in their Sovereign Debt, it makes perfect financial sense to a native EmgMkt investor. Native EmgMkt investors benefit from a rising US$ relative to native currencies despite negative rates. Western investors have mistakenly believed low rates are an expression of concern of global financial stability. This has spurred Central Bank buying of debt to counter this fear. Low rates can be better attributed to the rise in autocratic leadership globally making the US and other Western countries preferred as a safe havens when economic indicators remain as strong as they have.

The second key feature of MPT is the blind belief in rebalancing portfolios to reduce volatility which is defined as ‘risk’ based on the historical combinations of asset class returns long-term and the variation of returns in each asset class short-term. The mix of assets has remained some proportion of Fixed Income vs Equity roughly balanced about a relative 40%/60% allocation. As equity prices rise, portfolios sell equity to fund debt or the reverse. if equity prices fall. It is called ‘Rebalancing’, and the process is performed at regular intervals. In the current climate of low rates, MPT is pouring even more capital into fixed income at a time when rates are well below their historical relationship to inflation due to global forces not accounted for by MPT.

If one takes into account economic fundamentals and the impact of unequal protections for property rights, one will sidestep any advice from MPT and Financial Planners. Not only does MPT lead one’s portfolio blindly, it leads towards investing in underperforming assets. With rates this low, the only safe decision for longer-term investment are equities in the US marketplace. Even though there is volatility, volatility evens out over time for a long-term holder and periodically provides better than average buying and selling opportunities if one is attentive. This is a very different approach from MPT which in my opinion is not at all suited for the global changes we are in today when it was theorized only using US markets in 1952.

Perhaps, the greatest risk of MPT is in its being a mathematical model. It produces identical decisions for every investor simultaneously. When was this ever a safe thing for investors to do?

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or ...

more