DocuSign: An Antifragile Stock In Times Of Coronavirus

Some things benefit from shocks; they thrive and grow when exposed to volatility, randomness, disorder, and stressors and love adventure, risk, and uncertainty. Yet, in spite of the ubiquity of the phenomenon, there is no word for the exact opposite of fragile. Let us call it antifragile. Antifragility is beyond resilience or robustness. The resilient resists shocks and stays the same; the antifragile gets better. - Source: Nassim Taleb. Antifragile: Things That Gain from Disorder (Incerto)

The sanitary and economic crisis produced by COVID-19 will have long-lasting effects on society and the economy. Some businesses will recover well from the crisis, while others will suffer permanent and irreparable damage. Importantly, some antifragile companies such as DocuSign (DOCU) will emerge from this crisis in a stronger than ever shape.

DocuSign Is Strong And Getting Stronger

DocuSign is a market leader in electronic signatures and contracts life cycle management software. The company is modernizing the contracting process by transforming the paper-based manual sequences of steps into an automated digital and collaborative system. This has enormous advantages in terms of time savings, cost reductions, and all kinds of efficiencies.

In addition to cost and efficiency advantages, DocuSign drives major enhancements in security. Documents signed through DocuSign are court-admissible and they contain an audit trail that considers variables such as IP address, location, and chain of custody. Besides, reducing paper use has huge advantages from an ecological perspective.

The big surge in work from home during the coronavirus pandemic will drive a material increase in demand for the services provided by DocuSign, and most of the companies that digitalize their paperwork and contracts will never go back to managing their documents in the old ways. On the contrary, DocuSign typically starts selling a relatively simple solution, and then it expands its relationship with more services over time.

DocuSign typically puts a foot in the door with electronic signatures, and over time it cross-sells its broader document management solutions. The company has a good selling argument, since it not only saves costs and increases efficiencies, it also reduces security risks and improves the customer experience.

Companies are eagerly looking to save costs and to adapt to the new social distancing environment nowadays, and DocuSign has a lot to offer in this area.

Growing At Full Speed

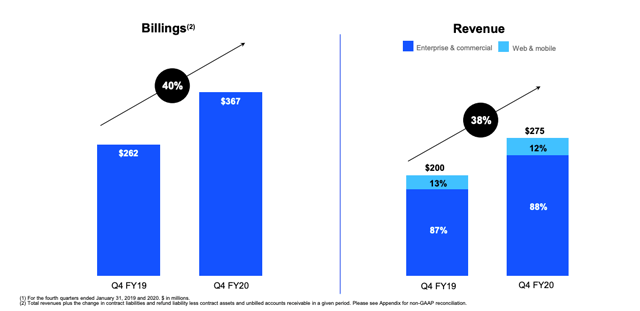

DocuSign reported earnings on March 12, and the business is firing on all cylinders according to the numbers. Revenue during the period amounted to $274.9 million, an increase of 38% year over year and surpassing Wall Street expectations. Fourth-quarter billings rose 40% to $367 million and billings for the full year increased 38% to $1.1 billion.

(Click on image to enlarge)

Source: DocuSign

DocuSign added almost 27,000 new customers in the quarter; including nearly 6,000 direct customers, this represents a 33% increase in total customers year over year. The company ended the quarter with 589,000 customers worldwide, and the dollar net retention rate came in at 117%.

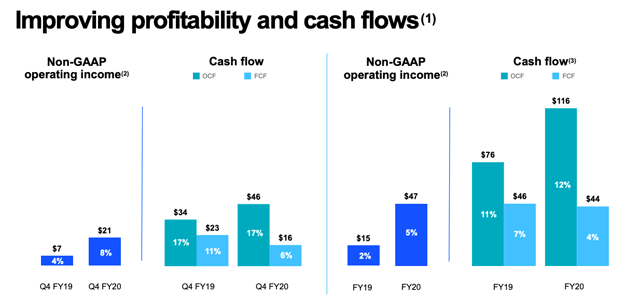

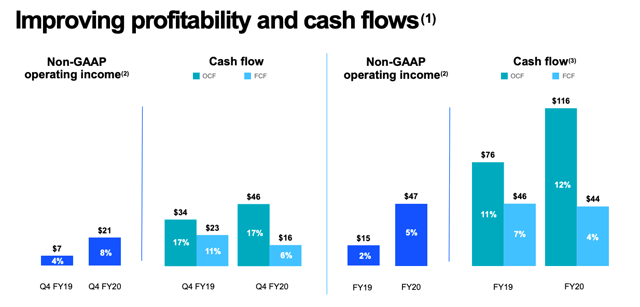

(Click on image to enlarge)

Source: DocuSign

High growth software companies typically operate at a loss due to the highly demanding investments needed to support growth. But DocuSign is already benefitting from expanding profitability metrics due to scale and operating leverage. Operating cash flow increased 33% year over year to $46 million in the fourth quarter compared to $34 million in the same quarter a year ago.

(Click on image to enlarge)

Source: DocuSign

Management is quite optimistic about the long-term growth opportunities and the company's position to profit from growing demand for all kinds of document digitalization and cloud-based agreement services.

From the conference call:

We see agreements increasingly integrated with the cloud software suites like sales, service, marketing, HR and finance. Our belief is that organizations will need an Agreement Cloud to act as a platform of record for agreements and agreement processes, which will be connected to the other clouds. For example, integrating with the HR system for offer letters or the CRM system for sales contracts.

As we have said, we believe this represents the next big cloud opportunity. Over the past fiscal year, we have broadened our product and service offerings to cover every stage of the agreement process.

Risk And Reward Going Forward

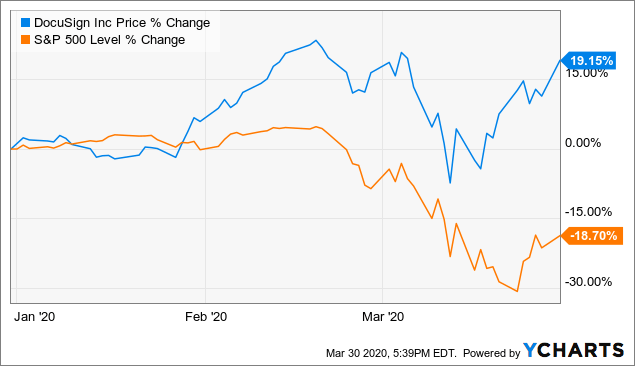

DocuSign stock has crushed the market during the recent selloff, the stock is up by over 19.15% while the S&P 500 is down by -18.7% on a year-to-date basis. This makes a lot of sense since the company is positioned to not only survive the recession but even to accelerate its growth and emerge from the crisis in a stronger-than-ever shape.

DocuSign is currently offering an interesting trade-off for investors. If the coronavirus crisis gets deeper and markets keep going down in the near term, then DocuSign will probably remain as one of the most defensive plays in such an environment, and the stock will continue outperforming the market by a wide margin.

(Click on image to enlarge)

Data by Ycharts

Alternatively, if the coronavirus situation evolves for the better in the short term and the markets make a big recovery from current levels, maybe DocuSign will not rise as much as other beaten-down stocks, but chances are that DocuSign will still deliver solid returns in a bull market environment.

In simple terms, DocuSign can be expected to outperform the market by a wide margin in a sustained bear market. If the markets start rising in a V-shaped recovery, the stock will probably underperform in comparison to cheaper names, but it will most likely still deliver positive returns in a bullish stock market environment.

The main drawback is valuation. While the rest of the market has gotten much cheaper in terms of valuation over recent weeks, DocuSign is still trading at valuation levels that are not particularly low. The stock trades at a forward price to sales ratio around 12; this is in line with valuation levels for other successful players in the software industry, but hardly a bargain in comparison to the broad market.

The average price target among the analysts following the stock is currently 86.3, which is roughly in line with current prices. In other words, we could say that DocuSign is fairly valued, but not particularly undervalued. If you are looking for massively undervalued opportunities in this market, then DocuSign is not the ideal candidate to consider.

That said, high growth companies such as DocuSign rarely trade at cheap valuations, and you many times miss the boat if you wait for a cheaper valuation and the stock never comes down to your intended entry price. A good middle ground can be buying a small position at current prices and keeping some cash on the sidelines in case the stock becomes cheaper down the road.

From a fundamental perspective, success attracts the competition, and DocuSign will be facing rising competitive pressure in the near term. Adobe (ADBE) is a particularly relevant competitor to watch because it has the presence and the strategic resources to make big inroads in the sector.

Those risk factors being acknowledged, DocuSign looks like an interesting idea to consider. The company is well-positioned to continue doing well during a recession, and it also benefits from abundant growth prospects in the years ahead.

Disclosure: I/we have no positions in any stocks mentioned, but may initiate a long position in DOCU over the next 72 hours.

Disclaimer: I wrote this article myself, and it expresses my own ...

more