Do Value And Growth Stocks Exist?

In Warren Buffett’s 1992 letter, he wrote about value and growth investing. More importantly, it’s how he defined that is often ignored. Investors classify stocks as either value or growth. As per Buffett’s 1992 letter:

… most analysts feel they must choose between two approaches customarily thought to be in opposition: ‘value’ and ‘growth.’ Indeed, many investment professionals see any mixing of the two terms as a form of intellectual cross- dressing.

We view that as fuzzy thinking (in which, it must be confessed, I myself engaged some years ago). In our opinion, the two approaches are joined at the hip: Growth is always a component in the calculation of value, constituting a variable whose importance can range from negligible to enormous and whose impact can be negative as well as positive.

Regardless of what type of stock you invest in, there is always a component of growth.

The original net net strategy of Ben Graham assigns a value of zero to growth. It doesn’t mean growth is ignored. It’s just saying that the stock can’t be relied upon to have any growth.

On the flip side, there are stocks where people expect growth at an absurd level like 1000%. This is a case where the dial on “value” is turned off to zero.

Here’s Buffett’s take on it, from the same letter:

In addition, we think the very term ‘value investing’ is redundant. What is ‘investing’ if it is not the act of seeking value at least sufficient to justify the amount paid? Consciously paying more for a stock than its calculated value – in the hope that it can soon be sold for a still-higher price – should be labeled speculation (which is neither illegal, immoral nor – in our view – financially fattening).

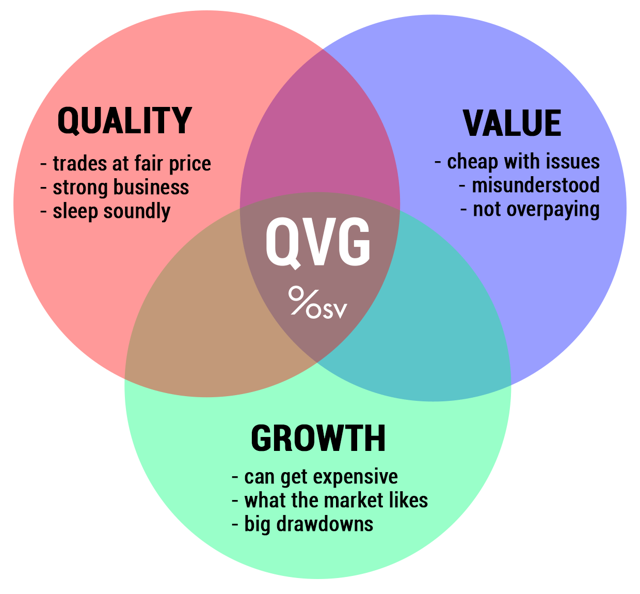

By this very definition, every stock is a value + growth stock. One of the reasons why I look at every stock through a classic Quality, Value and Growth lens.

Just as value and growth are joined at the hip, quality also belongs there. Every company can be judged on these three terms.

Here’s a visual of what I use to remind myself of what type of stock I’m looking at.

I like to look for stocks that lie in the middle. This is where QVG stocks swim.

The problem is, this long bull market has dried up such QVG investment opportunities.

So, for today’s case, let’s visit Value + Growth.

Seeking Value And Growth Stocks

This is the criteria which defines the “value score” of a stock based on:

-

P/FCF: biggest impact to the score with the best values being less than 10.

-

EV/EBIT: one of the best valuation ratios to identify cheap stocks. Best range is less than 11.

- PIOTROSKI SCORE: included in the value rating as a preliminary filter to demote low Piotroski score stocks.

The “growth score” is defined as:

- SALES CHANGE%: must be positive to seek growing companies within the last year.

- 5YR + TTM SALES CAGR%: must be positive to eliminate perennial losers inconsistent companies.

- GROSS PROFIT to ASSETS: measures the growth of profitability. In other words, are the assets profitable? A GPA of 0.5 means the company is generating profits of $0.50 for every dollar of assets.

Here’s a look at some stocks that score well for this criteria.

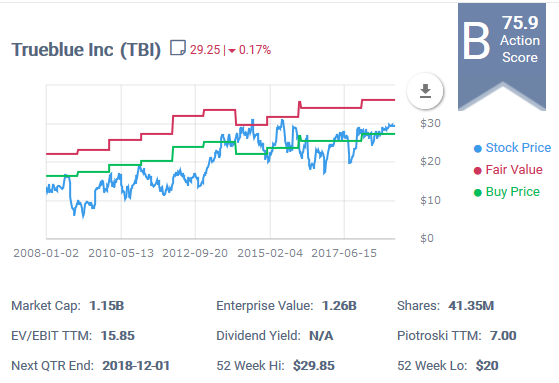

Trueblue Inc (TBI)

This is an outsourcing company that provides temp workers and process outsourcing. They staff blue-collar work for construction, manufacturing, warehousing and other types of labor.

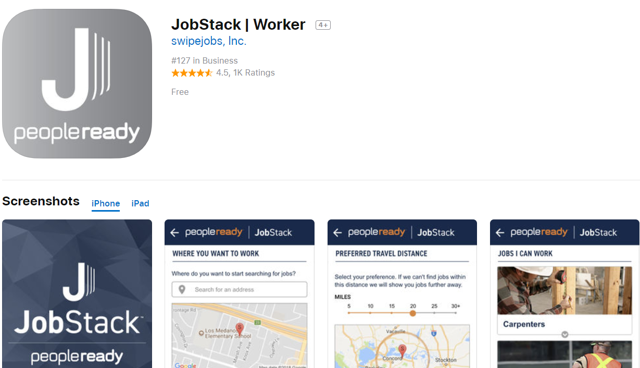

The company is also trying to diversify their offerings by becoming more tech savvy with their own app platform to match jobs with workers.

Source: itunes store

While I’m 100% sure it works better than craigslist, with so much competition related to job apps or outsourcing companies, how can Trueblue continue to grow?

They are facing struggles trying to replace the revenue being lost with Amazon as their biggest customer. While the stock price has remained fairly flat this year, past experiences show that Trueblue is very dependent on the economy and the continued growth of companies around them.

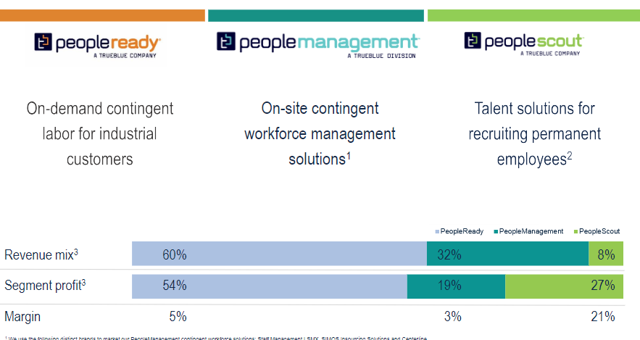

Here’s a clear example of why Trueblue is continuing to shift their strategy towards HR solutions.

Source: Trueblue investor presentation

60% of revenue is coming from the PeopleReady segmet which offers 5% margin.

Compare that to 21% for the HR segment. This is also where competitors like Robert Half International (RHI) and Korn Ferry (KFY) operate in.

Tough competition.

While this sounds all down and out for Trueblue, they have fundamentals on their side.

Balance sheet is healthy. Plenty of cash to cover debt and expenses.

While revenue CAGR has been positive and they have been able to right the ship after losing a lot of Amazon’s business the past couple of years, the growth is still limited as this is a very fragmented business.

There is value and growth with TBI, just not the level I want to see.

Growth is limited with downside potential being bigger than the upside potential, Trueblue isn’t a stock that I’m willing to bet on.

Conn’s Inc. (CONN)

I have a love hate relationship with Conn’s. At last I’m not the only one. This is a good article on the battleground status of Conn.

A long time ago, it was part of my portfolio and I ended up selling to soon.

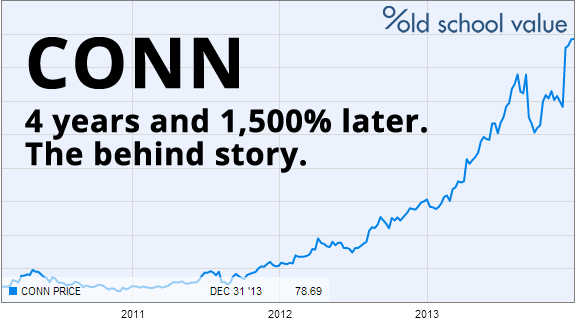

I posted this image in 2014, 4 years after I sold it at a loss.

After the massive rise in 2014, it promptly dove to near record lows again because it started bouncing up again based on their turnaround.

This was all before I had an objective system. Now, it’s simply trusting my screener to do the job objectively and I can go back to focusing on the business and numbers.

In case you haven’t seen a Conn’s store before, they sell furniture, appliances and electronics with their target audience being lower income people. But mostly all sales are done via credit.

i.e. a monthly payment instead of upfront 100% payment.

This has caused the historical issues as Conn’s business is that of a retailer operating as a bank.

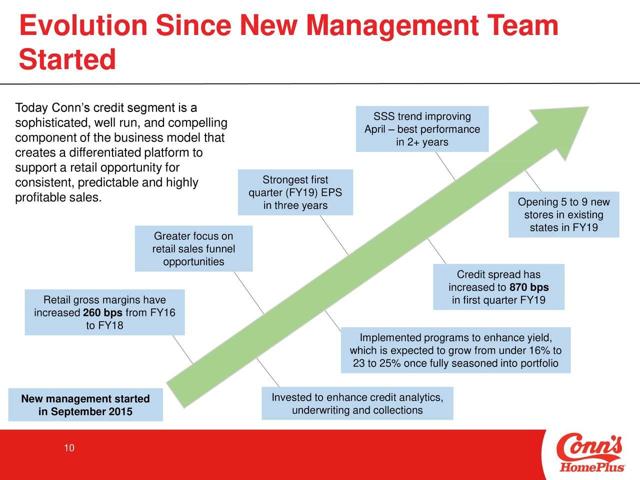

Without getting into the long history of it, here’s a snapshot of what’s been happening.

For Conn to publish this in their investor presentation, goes to show how serious of a problem it has been.

The qualifying question is really whether you believe their business model is working and sustainable.

Selling majority of appliances and big home goods to low income people on credit and making sure they pay on time is a dicey move.

Which is why Conn’s is the only retailer I know of that does this.

If you are committed with management and think the issues have been resolved with growth back on track, current valuations aren’t horrible.

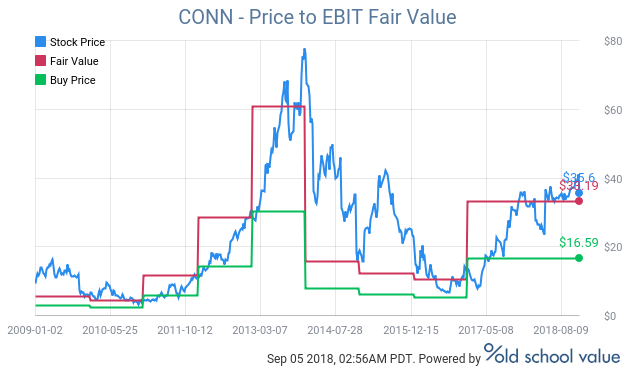

With a P/FCF of 15 and EV/EBIT of 16, it’s around fair value.

If you look at this historical valuation chart showing the stock price to EBIT multiples, the current stock price at hovering near fair value.

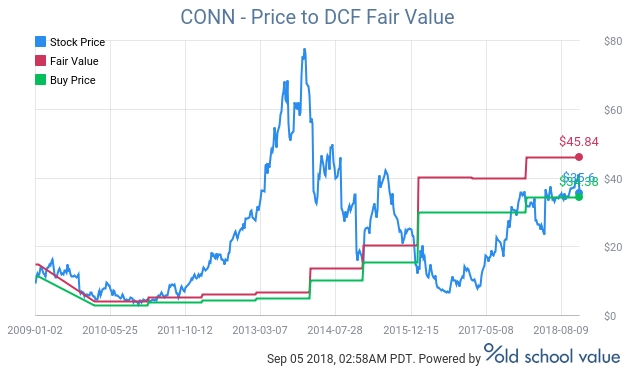

Using a DCF model to see what the potential fair value range can be:

Do Value and Growth Stock Exist?

Buffett has been writing for years that his elephant gun is loaded and ready.

I was actually hoping to come up with a couple of stocks that showed good signs of growth possibilities and value, but as you can see, I’m left empty handed.

Back to the original question.

Do value and growth stocks exist?

Yes. Just not many in this market.

I think Buffett is going to have to wait a while before he can use his elephant gun.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.