'DJIA Earnings To Rise 41% By Mid-2019': Birinyi

According to Birinyi Associates Inc., the 12-month forward DJIA P/E multiple based on last Friday’s price DJIA is estimated at 16.59

To achieve this, the DJIA operating earnings will need to rise 41% over the next 12 months to $1,534.12, by far a record.

Assuming a DJIA dividend payout ratio of 50%, the dividend should also rise to a record $767.6.06 to yield 3.01% on Friday’s price.

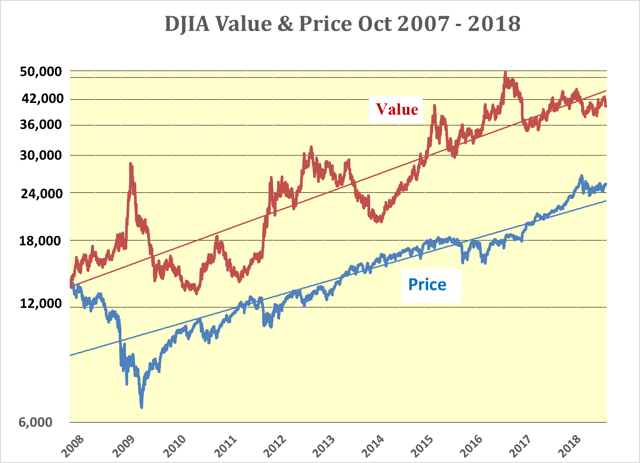

Using Friday’s 30 year T bond yield of 3.08%, the Fed value of the DJIA will be 48,809 and the dividend discount value 57,527.

Assuming the Fed funds rate returns to “Normal” it should reach 3% by mid-2019, possibly pushing the 30 year T bond yield up to 4%. This would result in Fed and dividend discount values of the DJIA of 38,353 and 44,296, respectively.

Impact of tax changes and GDP growth coming now through mid-2019

The following table was published on July 27, 2018, in Barron’s Market Laboratory. The forward 12-month estimate of the DJIA P/E multiple is 16.59. At first glance, it seems to be a reasonable consensus estimate. No arguments about its acceptability from the P/E worriers!

DOW INDEXES

Friday, July 27, 2018

|

P/E RATIO |

DIV YIELD |

||||||

|

7/27/2018† |

Year ago† |

Estimate^ |

7/27/2018† |

Year ago† |

|||

|

Dow Industrial |

23.31 |

19.83 |

16.59 |

2.13 |

2.29 |

||

|

Dow Transportation |

11.74 |

18.15 |

15.94 |

1.42 |

1.38 |

||

|

Dow Utility |

18.96 |

35.03 |

17.71 |

3.29 |

3.24 |

||

† Trailing 12 months

^ Forward 12 months from Birinyi Associates; updated weekly on Friday.

P/E data based on as-reported earnings; estimate data based on operating earnings.

Sources: Birinyi Associates; WSJ Market Data Group

However, this multiple is based on Friday’s closing price for the DJIA of 25,451. With this price, a 16.59 multiple means that estimated operating earnings will be up 41% from the just reported earnings of $1087.19 a record $1,532.61 by this time next year.

This is a substantial increase in 12 months given that the average earnings of the DJIA over the 5 years since mid-2013 are $1,043.17, close to today’s level of $1,087.19. The price of the DJIA over the same period has increased by 64% while the dividend has risen by 49% and the 30 year T Bond has fallen from 3.63% to 3.08%.

As far as the forecast is concerned It does not look as though Birinyi and associates are aware of what the full impact of such a jump in earnings means in such a short space of time. Certainly, they do not appear to be emphasizing its importance. Rather.it is hidden it away in Barron's disguised in the form of a nice safe consensus P/E multiple of 16.59 to which nobody will object.

Either that or the comfortable multiple was chosen first and the earnings are the product of dividing the price of the DJIA by said multiple. However, they failed to work out what that means in terms of earnings.

It is hard to believe that with DJIA earnings of $1,532.61 there will be no commensurate rise in the dividend. The payout ratio is 53%; assuming a ratio of 50% next year, the DJIA dividend will be $767.06 to yield 3.01% at Friday’s close.

To work out the value of the DJIA using the estimated earnings and dividends one needs to know what the yield of the 30 year T bond will be 12 months hence. Using Friday’s 30 year T bond yield of 3.08%, the Fed value will be 48,809 while the dividend discount value will be 57,527.

Chart created by the author from FRED and Dow Jones Data

It will, of course, be argued that the yield of the 30 Year T Bond will rise and put downward pressure on both values. On a dividend discount measure, for the current DJIA price of 25,451 to be correct in 12 months, the 30 year T bond yield will have to rise to 7% for the dividend discount value of DJIA to be in equilibrium with today’s price.

That would imply a Fed funds rate of at least 7% for a flat yield curve and more for an inverted one. Such an outcome seems extremely unlikely. If the Fed is to be taken at its word, then a gradual increase in the funds' rate over the next year back to “Normal” at “3%” seems more probable.

While short rates can be pushed up by the Fed, the substantial excess commercial bank reserves held at the Fed are being pushed out along the yield curve through the lower IOER. This is holding the long end of the curve in check, which is the reason why the yield curve has been flattening of late. This could mean that the 30 year T bond yield will also be in the region of 3% next year.

At worst the short to long spread could stay at the present 1% and the 30 year T bond yield will hit 4%. This would result in the Fed and dividend discount values of the DJIA of 38,315 and 44,255 respectively. With both a 3% and 4% 30 year T bond yield giving substantially higher Fed and dividend discount values than the current DJIA price, upward pressure on the price should continue. Thus, with a 30 year T bond yield of either 3% or 4%, the DJIA remains a “STRONG BUY”.

For a more in-depth discussion of the impact of changes in the monetary base on 30 year T bond rates and equity markets valuations please see my recent article DJIA Poised For Run To 30,000 In Second Half 2018

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am ...

more