Dividends On Pipeline Stocks Remain High

Markets finished the strongest quarter sine 1987 yesterday, led by the energy sector. The American Energy Independence Index, which comprises North America’s biggest pipeline stocks, is still down 29% for the year. Some investors are weary of years of underperformance against the broader market, combined with high volatility.

The volatility is largely a function of the investor base. In March, Closed-End Funds (CEFs) that were forced to cut leverage at the lows added to the indiscriminate selling (see The Virus Infecting MLPs). Fund managers such as Kayne Anderson and Tortoise were to blame for not having the good sense to reduce risk earlier. The good news is that the consequent destruction of capital has rendered these CEFs less able to repeat because they’re now a lot smaller.

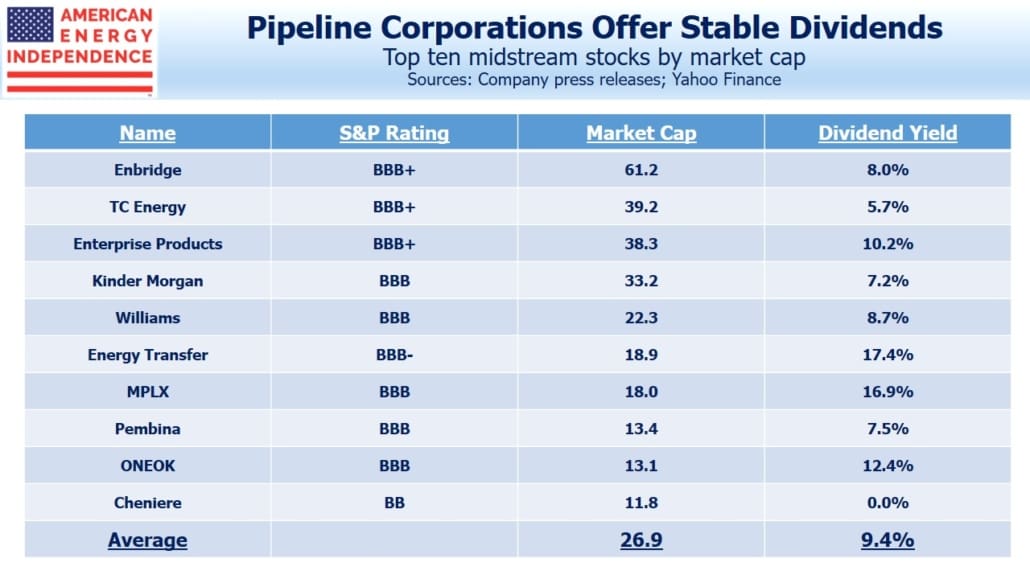

Back in March, investors had many concerns about dividend sustainability. The top ten companies, which represent over half the sector’s $490BN market cap, all maintained payouts (Cheniere doesn’t pay a dividend). A recurring question we get from investors is, what’s the catalyst that will get stock prices higher? Putting aside higher crude oil, which usually coincides with improving sentiment, we believe the continued high dividend yields will draw in more buyers.

In Pipeline Cash Flows Will Still Double This Year, we explained how falling spending on new projects is driving cash flows higher. Covid-19 has produced few positives, but one of them is an acknowledgment by the energy industry that investing in new production and its supporting infrastructure needs to be cut. It may not be what executives want, but investors can find plenty to like about reduced spending.

In the next few weeks, companies will report earnings and updated guidance. We don’t expect any of the biggest pipeline companies to cut dividends. Oneok (OKE) is probably the most at risk, but since they recently completed a secondary offering of common equity it would seem odd timing for them to cut.

These top ten companies have an average market cap of $27BN and an average yield of 9.4%, including Cheniere. Every three months pipeline stocks pay in dividends more than two years’ worth of interest on ten-year treasury notes. Energy has been too volatile, but the improving free cash flow picture that is supporting dividends contrasts positively with others. We don’t know of another sector that is going to double its free cash flow this year.

Conversations with investors continue to reveal widespread caution about the overall market. The news on Covid-19 is rarely positive, and many find it difficult to maintain a constructive outlook against this backdrop. But Factset is still forecasting 2021 S&P 500 earnings to be flat to 2019, fully recouping the Covid-19 drop in just one year. This, combined with low bond yields, continues to drive long term investors into stocks (see The Stock Market’s Heartless Optimism and Stocks Look Past The Recession and Growing Debt).

The dividend yield on the top ten pipeline stocks is a staggering five times that of the S&P 500. As investors become increasingly comfortable that these are sustainable, yields will be driven down by new buying. Earnings reports in the coming weeks will provide an important opportunity for companies to provide confirmation.

The information provided is for informational purposes only and investors should determine for themselves whether a particular service or product is suitable for their investment needs. Graphs and ...

more