Dividends By The Numbers In 2018

2018 has gone out with a bang for dividend-paying stocks in the U.S. stock market. Here's the dividend metadata for December 2018:

- In December 2018, 5,934 U.S. firms declared dividends, an increase of 2,210 over the 3,724 recorded in November 2018. That figure is also an increase of 1,428 over the number recorded in December 2017 and the largest number ever recorded for a data series that extends back to January 2004.

- 179 U.S. firms announced they would pay an extra, or special, dividend to their shareholders in December 2018, an increase of 87 over the number recorded in November 2018. That figure is also an increase of 35 over the total recorded in December 2017.

- 138 U.S. firms hiked their dividend payments to shareholders in December 2018, a decrease of 27 from the number recorded in November 2018, which is an increase of 12 over the total recorded in December 2017.

- A total of 40 publicly traded companies cut their dividends in December 2018, an increase of 20 over the number recorded in November 2018 and a decrease of 14 from the 54 recorded in December 2017.

- Just 1 U.S. firm omitted paying their dividends in December 2018, the same as the number recorded in November 2018. That figure is also a decrease of 6 from the number of firms that omitted paying dividends back in December 2017.

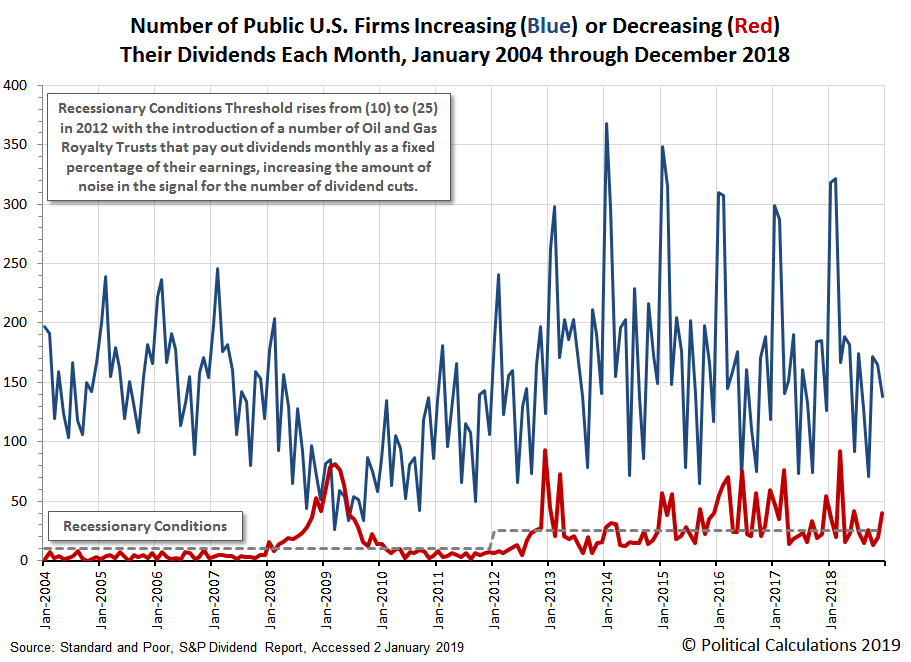

The following chart illustrates the number of dividend increases and decreases recorded in each month from January 2004 through December 2018:

(Click on image to enlarge)

In addition to going out with a bang, dividend paying companies also exited 2018 on a cautionary note, with the number of dividend cutting firms rising above the threshold indicating recessionary conditions developing for the U.S. economy for the month of December 2018.

Looking back at the final quarter of 2018 however, we find positive improvements across the board for all but one of the U.S. stock market's basic dividend metrics.

- 2018-Q4 had 13,312 firms issue dividend declarations, compared with 11,102 in 2017-Q4.

- 369 firms announced they would pay an extra dividend to their shareholders in 2018-Q4, up from the 294 that acted to pay special dividends back in 2017-Q4.

- The number of dividend rises announced in 2018-Q4 was 475, which was disappointing when compared to 2017-Q4's total of 495.

- 2018-Q4 saw 73 firms announce dividend reductions, which was down from 2017-Q4's count of 95.

- Just 4 firms omitted paying dividends in the fourth quarter of 2018, significantly lower than the 19 that suspended paying their dividends in the final quarter of 2017.

We do have more information on the dividend cutting firms for 2018-Q4, where our near real-time sample captured 46 of the quarter's 73 reductions. In the following summary, companies listed more than once cut their dividends more than once.

- Cal-Maine Foods (NYSE: CALM)

- BP Prudhoe Bay Royalty Trust (NYSE: BPT)

- MV Oil Trust (NYSE: MVO)

- Black Hills Corporation (NYSE: BKH)

- Dorchester Minerals (NASDAQ: DMLP)

- Cross Timbers Royalty Trust (NYSE: CRT)

- PermRock Royalty Trust (NYSE: PRT)

- Hi-Crush Partners (NYSE: HCLP)

- Permianville Royalty Trust (NYSE: PVL)

- Golar LNG Partners (NASDAQ: GMLP)

- Manning & Napier (NYSE: MN)

- SandRidge Permian Trust (NYSE: PER)

- SandRidge Mississippian Trust I (NYSE: SDT)

- KKR CL A (NYSE: KKR)

- Pacific Coast Oil Trust (NYSE: ROYT)

- CBL & Associates Properties (NYSE: CBL)

- Viper Energy (NASDAQ: VNOM)

- General Electric (NYSE: GE)

- Big 5 Sporting Goods (NASDAQ: BGFV)

- North European Oil Royalty Trust (NYSE: NRT)

- Owens & Minor (NYSE: OMI)

- Sturm Ruger (NYSE: RGR)

- Buckeye Partners (NYSE: BPL)

- Chesapeake Granite Wash Trust (NYSE: CHKR)

- Buckeye Partners (NYSE: BPL)

- North Eur Oil Royalty Tr (NYSE: NRT)

- Garrison Capital (NASDAQ: GARS)

- Dean Foods (NYSE: DF)

- Sanchez Midstream Partners (NYSE: SNMP)

- Mesa Royalty Trust (NYSE: MTR)

- Permian Basin Royalty Trust (NYSE: PBT)

- PermRock Royalty Trust (NYSE: PRT)

- San Juan Basin Royalty Trust (NYSE: SJT)

- Pebblebrook Hotel Trust (NYSE: PEB)

- Mesa Royalty Trust (NYSE: MTR)

- Sabine Royalty Trust (NYSE: SBR)

- Ellington Residential Mortgage REIT (NYSE: EARN)

- Communications Systems (NASDAQ: JCS)

- Capstead Mortgage (NYSE: CMO)

- Anworth Mortgage Asset (NYSE: ANH)

- Kayne Anderson Midstream/Energy Fund (NYSE: KMF)

- Kayne Anderson MLP/Midstream Investment Company (NYSE: KYN)

- Pebblebrook Hotel Trust (NYSE: PEB)

- Cross Timbers Royalty Trust (NYSE: CRT)

- San Juan Basin Royalty Trust (NYSE: SJT)

- Pacific Coast Oil Trust (NYSE: ROYT)

The following chart tallies the number of dividend cuts in our sample by industrial sector:

(Click on image to enlarge)

By far and away, the oil and gas industry saw the greatest amount of distress during the fourth quarter of 2018, accounting for 63% of our sample and coinciding with a significant decline in oil prices during the quarter as global demand diminished. The financial sector, including Real Estate Investment Trusts (REITs), came in second with 17.4% of the dividend cuts in our sample, where the Fed's rate hikes negatively impacted eight of these interest rate-sensitive firms. Food producer and the manufacturing sector each recorded 2 dividend cutting firms each (manufacturing included the highly distressed GE), while the technology, mining, consumer goods and utilily industries rounded out our sample with just one dividend cut recorded in each.

References

Standard and Poor. S&P Market Attributes Web File. [Excel Spreadsheet]. Accessed 2 January 2019.

Seeking Alpha Market Currents. Filtered for Dividends. [Online Database]. Accessed 2 January 2019.

Wall Street Journal. Dividend Declarations. [Online Database]. Accessed 2 January 2019.

Disclaimer: Materials that are published by Political Calculations can provide visitors with free information and insights regarding the incentives created by the laws and policies described. ...

more