Dividend Stock Spotlight: Clorox (CLX)

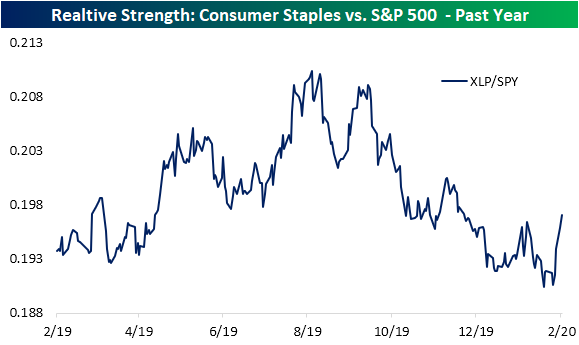

Safe havens like gold and US Treasuries have been surging but safe havens within the equities space, like Consumer Staples (XLP), have been unable to escape declines. While down about 3% over the past week, XLP, in addition to other defensive sectors like Utilities (XLU) and Real Estate (XLRE), have still managed to outperform the S&P 500. As shown in the relative strength chart below, the line over the past few days has risen sharply indicating outperformance of Consumer Staples versus the S&P 500.

One name worth mentioning within this sector is household cleaning product manufacturer Clorox (CLX). This is one of just 26 stocks in the S&P 500 that is trading higher today as of this writing. Since CLX has managed to shrug off the recent downturn, the stock has broken out of its sideways range between the low $160s and low $140s that has been in place for much of the past couple of years.

With a bullish technical backdrop, CLX’s fundamentals are looking more promising as well. The past few quarters have seen the company report negative year-over-year revenue growth for the first time since 2014. But the most recent quarterly report from earlier this month showed these declines slowed to a 1.6% YoY rate. Meanwhile, the recent run in price still leaves the price-to-earnings ratio well off of its highs and in the middle of its range of the past few years. Meanwhile, the price-to-book ratio remains historically low albeit on the rise over the past couple of years.

Given bond yields have continued to decline to record lows while equity declines have raised dividend yields, stocks now yield more than bonds by the highest margin in recent years as we discussed yesterday. The dividend yield of Clorox is the third-highest of the S&P 500’s Household & Personal Products industry group at 2.52%. That is also a higher yield than the 2.11% average yield for the broader Consumer Staples sector. Not only is CLX a high yielder but the dividend also seems to be a safe bet over the long run. The payout ratio remains at fairly healthy levels at 59.75%, meaning the company appears to have room to continue to pay shareholders and/or grow the dividend. On top of this, Clorox has a long history of uninterrupted dividend payments going back to the late 70’s. Not only has the company been paying shareholders for the past several decades, but it has also grown the dividend for 42 consecutive years, placing it in the club of Dividend Aristocrats (a group of stocks that have 25+ consecutive years of dividend increases).

Disclaimer: To begin receiving both our technical and fundamental analysis of the natural gas market on a daily basis, and view our various models breaking down weather by natural gas demand ...

more