Dividend Kings In Focus: PPG Industries

PPG has maintained its long history of dividend increases thanks to a superior position in its industry. Its competitive advantages have fueled the company’s long-term growth.

As we see the potential for continued growth in PPG’s core markets, the company should keep increasing its dividend each year.

However, we also view the stock as overvalued right now.

This article will discuss PPG’s business model, growth potential, and valuation.

Business Overview

PPG Industries is the world’s largest paints and coatings company. Its only competitors of similar size are Sherwin–Williams and Dutch paint company Akzo Nobel.

PPG Industries was founded in 1883 as a manufacturer and distributor of glass (its name stands for Pittsburgh Plate Glass) and today has approximately 3,500 technical employees located in more than 70 countries at 100 locations.

The company generates annual revenues of about $17 billion.

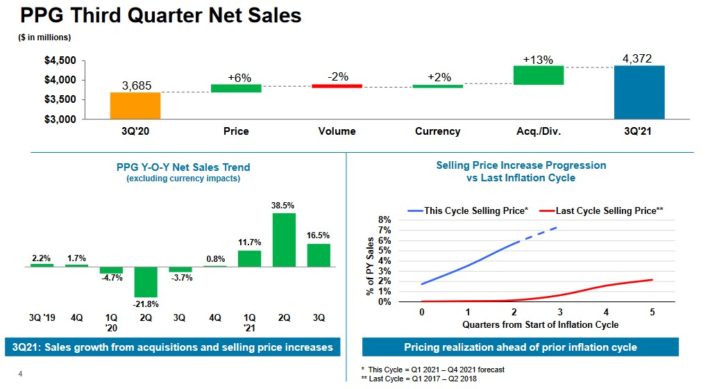

PPG Industries announced third-quarter results on 10/20/2021. Revenue grew 18.8% to $4.37 billion, beating expectations by $120 million.

Supply chain constraints kept the company from fulfilling many of its orders, putting a cap on revenue growth. Still, organic sales grew 6% for the quarter.

You can see a breakdown of the company’s quarterly sales performance in the image below:

Source: Investor Presentation

Adjusted net income of $406 million, or $1.69 per share, compared to adjusted net income of $481 million, or $1.93 per share, in the prior year. Adjusted earnings–per–share topped consensus estimates by $0.10.

Inflation was a headwind, with raw material costs spiking 25% year–over–year. But PPG Industries was able to raise prices 6% company-wide to help offset this.

Performance Coatings revenue was up by 23% to $2.76 billion. Growth was due mostly to higher selling prices and acquisitions, which easily offset a 1% decline in volumes.

Industrial Coatings segment sales increased 13% to $1.6 billion. Again, the benefits of higher selling prices, acquisitions, and favorable currency movements offset a 4% decline in segment volumes.

Looking ahead, PPG Industries expects volumes to be down 8% to 10% in 2021. The company is expected to earn $6.67 to $6.73 per share this year.

Growth Prospects

PPG Industries’ earnings–per–share have a growth rate of 5.8% over the last decade. We expect earnings–per–share to

grow at a rate of 8% through 2026, up from our prior estimate of 7%.

PPG Industries’ demand dropped significantly due to the impact of COVID–19 in 2020. However, we expect the recovery from the pandemic to offer a higher rate of growth for the company.

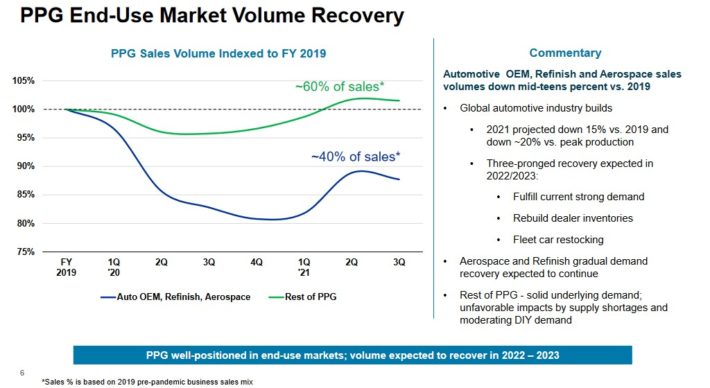

The company is benefiting from the steady economic recovery in the past year, but it has been an uneven recovery.

Source: Investor Presentation

As the above image shows, approximately 40% of the company’s sales volumes have not fully recovered to pre-pandemic levels.

Specifically, the automotive, refinish, and aerospace sales volumes are down in the mid-teens on a percentage basis, since 2019.

That said, PPG management believes there will be a continued recovery over the next two years, driven by better demand fulfillment, and a restocking of vehicle fleets.

Acquisitions are another component of the company’s future growth plan. PPG has historically used smaller, bolt-on acquisitions to complement its organic growth.

The company has made five recent acquisitions that cumulatively added $1.7 billion in annual sales. Going forward, similar deals should provide at least a couple of percentage points in annual revenue growth.

Competitive Advantages & Recession Performance

PPG enjoys a number of competitive advantages. It operates in the paints & coatings industry, which is economically attractive for several reasons.

First, these products have high-profit margins for manufacturers. They also have low capital investment, which results in significant cash flow.

With that said, the paint and coatings industry is not very recession-resistant because it depends on healthy housing and construction markets. This impact can be seen in PPG’s performance during the 2007-2009 financial crisis:

- 2007 adjusted earnings-per-share: $2.52

- 2008 adjusted earnings-per-share: $1.63 (35% decline)

- 2009 adjusted earnings-per-share: $1.02 (37% decline)

- 2010 adjusted earnings-per-share: $2.32 (127% increase)

PPG’s adjusted earnings-per-share fell by more than 50% during the last major recession and took two years to recover. The silver lining during a recession is that homeowners may be more likely to paint their houses than to move or take on more costly home renovations.

As PPG’s 2020 results showed, the decline in new construction is the dominant factor for PPG during a recession. However, over the course of its history, the company has shown an ability to successfully navigate recessions.

Valuation & Expected Returns

We expect PPG to generate earnings-per-share of $6.70 this year. As a result, the stock is currently trading at a price-to-earnings ratio of 24.8. We consider 19 to be a fair earnings multiple for this stock.

As a result, we view PPG stock as overvalued right now.

If the P/E multiple declines from 24.8 to 19 over the next five years, shareholder returns would be reduced by 5.2% per year.

Dividends and earnings-per-share growth will boost shareholder returns. PPG shares currently yield 1.4%. And, we expect 8% annual EPS growth over the next five years.

Putting it all together, PPG stock is expected to generate annual returns of 4.2% over the next five years.

Final Thoughts

PPG Industries is one of the newest additions to the Dividend Kings list, having raised its dividend for the 50th consecutive year in 2021.

The company has maintained a long history of dividend increases each year, even during recessions, despite operating in a cyclical industry that is reliant on the health of the U.S. economy.

2020 was a very challenging year for the company due to the coronavirus pandemic. And while 2021 has gone much better, multiple end markets have not returned to their sales volumes from 2019.

PPG is experiencing a significant increase in raw material costs and supply chain issues are also impacting results. While some of inflationary costs have been passed along to the consumer, PPG Industries is expecting to see volumes decline by a meaningful amount this year.

We believe the stock is overvalued, which could limit future returns. With expected returns in the mid-single-digits, we rate this Dividend King a hold.

Disclaimer: Sure Dividend is published as an information service. It includes opinions as to buying, selling and holding various stocks and other securities. However, the publishers of Sure ...

more