Dividend Kings In Focus Part 29: Stanley Black & Decker

Companies with long track records of dividend growth are among our favorite stocks. This is because long dividend growth streaks demonstrate a company’s ability to increase its distributions through a recession. Investors’ income needs don’t disappear during recessions, so they have to be as confident as possible that their investments will continue to pay and raise dividends.

Companies with more than 50 years of dividend growth have managed to navigate multiple recessions and still increase their payments. Achieving at least five decades of dividend growth is no small accomplishment. Only 30 stocks in the entire market have earned the right to call themselves a Dividend King. You can see all 30 Dividend Kings here.

This milestone is impressive for any company, but even more so for those that are extremely sensitive to the conditions of the economy.

One of our favorite cyclical Dividend Kings is Stanley Black & Decker (SWK). This article will examine the company’s business, prospects for growth, and future returns in an effort to determine if now is the right time to purchase this Dividend King.

Business Overview

Stanley Black & Decker is a global leader in the area of power tools, hand tools, and related products. The company maintains the top position in tools and storage sales worldwide. Stanley Black & Decker has the number two position in commercial electronic security and engineered fastening. The current edition of the company was created when Stanley Works and Black & Decker merged in 2010. This Baltimore, MD based company can trace its history all the way back to 1843.

Stanley Black & Decker generated revenue in excess of $14 billion in 2019 and has a current market capitalization of more than $28 billion. The company is composed of three segments:

- Tools & Storage (70% of sales)

- Industrial (16% of sales)

- Security (14% of sales)

Stanley Black & Decker reported second-quarter earnings results on July 30, 2020.

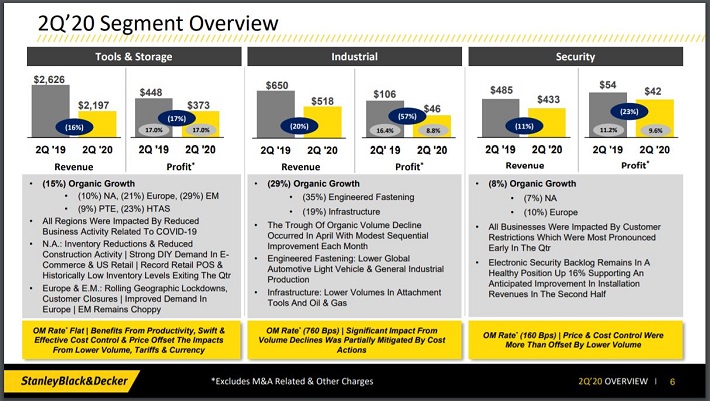

Source: Second Quarter Earnings Presentation

Results showed significant losses compared to the prior year. Revenue fell 16.3% to $3.15 billion but was $24.6 million better than expected. Earnings-per-share decreased 25% to $1.60 but came in $0.35 ahead of estimates. Much of these declines were due in large part to the ongoing coronavirus pandemic. Each segment of the company posted negative organic growth rates.

Tools & Storage, which contributes more than two-thirds of sales, suffered a 15% decline in organic growth. All regions saw lower amounts of business activity due to COVID-19, with Europe being the most severely impacted. One area of strength was in the do-it-yourself e-commerce channel in the U.S., which saw gains from consumers looking to improve their homes while following social distancing directives.

Industrial sales were down 29%, mostly due to weakness in engineered fastening. A reduction in light vehicle production and weakness in attachment tools and the oil and gas industry were the primary contributors to the decline.

Security sales held up the best, with organic growth falling just 8%. Electronic security remains popular and the company expects better performance in installation revenues in the back half of 2020.

The company is also taking steps to reduce costs, including $175 million during the second quarter. Stanley Black & Decker has targeted cost reductions of $500 million for 2020 and $1 billion in total. Stanley Black & Decker expects earnings-per-share of $6.51 for the year, which would be a decline of 23% from the previous years.

Stanley Black & Decker has increased its dividend for 53 years. The company announced at the end of August that it was raising its dividend by 1.5% for the September 15, 2020 payment. Stanley Black & Decker’s annualized dividend of $2.80 equates to a dividend yield of 1.6%.

Growth Prospects

Stanley Black & Decker has performed well over the last decade as adjusted earnings-per-share grew with an annual rate of almost 8% between 2010 and 2019.

The company has been able to produce this level of growth due to its key brands.

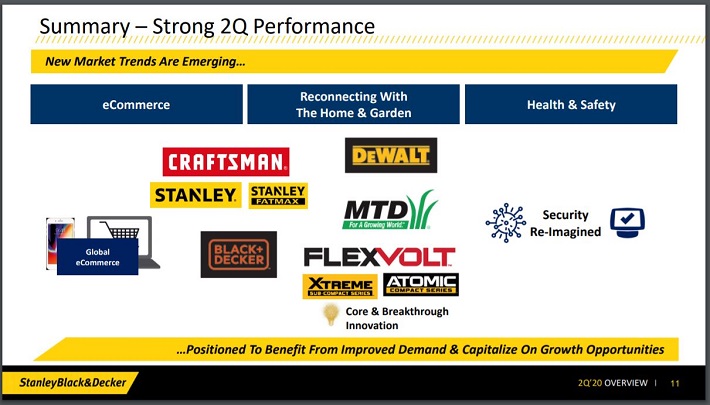

Source: Second Quarter Earnings Presentation

Stanley Black & Decker has become the worldwide leader in tools and related products because of its iconic brands like Stanley, DeWalt, and Black & Decker. These names are known and trusted by professional contractors as well as do-it-yourself customers. This gives Stanley Black & Decker pricing power.

While organic growth has been solid during this period of time, the company has also benefited from strategic acquisitions.

For example, Stanley Black & Decker added Newell Brands’ Tools business for almost $2 billion. This purchase gave the company access to high-quality and well-known Irwin and Lenox brand tools.

Perhaps its most significant acquisitions was the purchase of the Craftsman brand from Sears Holdings for $900 million in 2017. Outside of the first half of 2020, Craftsman has led to organic growth in North America every quarter that it has been part of Stanley Black & Decker. The company expects this acquisition to generate more than $1 billion going forward.

More recently, Stanley Black & Decker invested $234 million for a 20% stake in MTD Products, a privately-held manufacturer of outdoor power equipment. MTD’s product lines include Troy-Bilt, Remington, and MTD Genuine Parts. This purchase gives Stanley Black & Decker more of a foothold in the outdoor power equipment space. The company has the option to purchase the remaining interest in MTD.

Despite its top billing in its industry, Stanley Black & Decker continues to seek out acquisitions, both large and small, to augment its core businesses. The company had expected revenue to ramp up to as much as $20 billion by 2022 due to a mix of organic and acquisition-related growth. That expectation has been muted following the impact of COVID-19 on this year’s results, but Stanley Black & Decker maintains this long-range forecast.

Competitive Advantages & Recession Performance

Stanley Black & Decker's key competitive advantage remains its well-known brands and its ability to supplement this portfolio with names like Craftsman and MTD. The company also spends heavily on research and development in order to bring new products to market. Listed below are the company’s R&D budgets for the past five years.

- 2015 research-and-development expense of $188 million

- 2016 research-and-development expense of $204.4 million

- 2017 research-and-development expense of $252.3 million

- 2018 research-and-development expense of $275.8 million

- 2019 research-and-development expense of $255.2 million

Like most cyclical companies, Stanley Black & Decker needs a financial healthy consumer and for the economy to be on solid ground to deliver bottom-line growth.

This was not the case during the Great Recession. Listed below are the company’s adjusted earnings-per-share results before, during, and after the last recession.

- 2006 adjusted earnings-per-share: $3.47

- 2007 adjusted earnings-per-share: $4.00 (15.3% increase)

- 2008 adjusted earnings-per-share: $3.41 (14.8% decrease)

- 2009 adjusted earnings-per-share: $2.72 (20.2% decrease)

- 2010 adjusted earnings-per-share: $3.96 (45.6% increase)

- 2011 adjusted earnings-per-share: $5.24 (32.3% increase)

As you can see, Stanley Black & Decker was far from immune from the last recession. Adjusted EPS fell more than 30% from 2007 to 2009. However, the company rode the ensuring recovery and posted a new high for adjusted EPS by 2010. Adjusted EPS has increased every year since outside of 2012.

Valuation & Expected Returns

Stanley Black & Decker’s current share price is ~$179. Using expected EPS of $6.51 for 2020, the stock trades with a price-to-earnings ratio 27.5.

This is considerably higher than our five-year target price-to-earnings ratio of 15.7, which is in-line with the stock’s long-term average valuation. If the stock were to revert to our target, then valuation would be a 10.6% headwind to annual results over this period of time.

Total returns would consist of the following:

- 8% earnings growth

- 10.6% multiple reversion

- 1.6% dividend yield

In total, Stanley Black & Decker is projected to produce negative annual returns of 1% through 2025. This exercise demonstrates the importance of avoiding stocks when they become significantly overvalued, as it can lead to negative returns for shareholders, even if the company continues to grow its earnings and pay its dividend.

Final Thoughts

Stanley Black & Decker is the undisputed leader in its industry. The company continues to invest in R&D as well as pursue acquisitions that should enable the company to continue to grow. Stanley Black & Decker also has more than five decades of dividend growth, proving itself capable of growing its dividend even under adverse economic conditions.

That said, shares of the company are very expensive relative to their historical average. Reverting to our five-year valuation target would more than offset earnings growth and dividend yield. While we find the company and its dividend growth streak impressive, we rate shares of Stanley Black & Decker as a sell due to negative projected total returns over the next five years.

Disclosure: Sure Dividend is published as an information service. It includes opinions as to buying, selling and holding various stocks and other securities.

However, the publishers of Sure ...

more