Dividend Kings In Focus: National Fuel Gas

In 2020, National Fuel Gas (NFG) raised its dividend for the 50th consecutive year. That puts the company among the elite Dividend Kings, a small group of stocks that have increased their payouts for at least 50 consecutive years. You can see the full list of all 30 Dividend Kings here.

National Fuel Gas has remained a relatively small company, trading at a market capitalization of just $3.7 billion. However, a small market cap is not a negative feature when investing; quite the contrary.

Despite its small size, National Fuel Gas has promising growth prospects and an attractive valuation and hence it is likely to offer compelling returns to its shareholders in the upcoming years. In addition, its 4.4% dividend yield is much higher than the broad market’s yield (1.6%), and there is a lot of room for more dividend raises down the road.

Business Overview

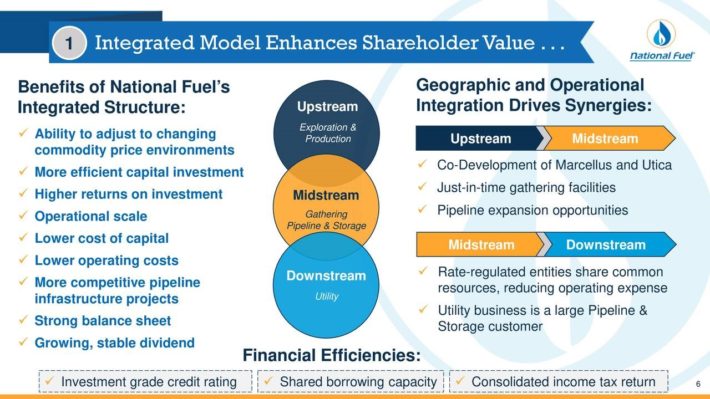

National Fuel Gas is a diversified and vertically integrated company that operates in four segments: Exploration & Production, Pipeline & Storage, Gathering, and Utility. The upstream segment (exploration & production) is by far the most important one, as it generates 42% of the EBITDA of the company. Given also that natural gas comprises approximately 90% of the output of the company, it is easy to understand the high sensitivity of its earnings to the underlying price of natural gas.

The midstream division (pipeline & storage and gathering) generates 37% of EBITDA while the downstream segment (utility) generates the remaining 21% of EBITDA.

While National Fuel Gas seems to be a pure commodity stock on the surface, with all the disadvantages related to the boom-and-bust cycles of commodity producers, the company has a superior business model when compared to commodity producers. Thanks to its vertically integrated business model, it enjoys great synergies.

(Click on image to enlarge)

Source: Investor Presentation

Its midstream and downstream businesses provide a strong buffer when the price of natural gas decreases. Moreover, the company enjoys higher returns on its investments, as both its upstream and midstream divisions benefit from its investments in production growth projects.

National Fuel Gas is currently facing a strong headwind due to the coronavirus crisis, which has caused a severe recession. However, the pandemic has affected the natural gas market much less than the oil market thanks to the somewhat inelastic residential and commercial demand for natural gas.

In its fiscal third quarter, which ended on June 30th, National Fuel Gas grew its production only 2%, as it chose to store its Appalachian volumes in order to sell them in the near future, at meaningfully higher prices. During the quarter, the average realized price of natural gas decreased 19%, from $2.36 in the prior year’s quarter to $1.92, and thus the adjusted earnings per share fell 20%, from $0.71 to $0.57.

A decrease in earnings is never welcome but a 20% decrease in the earnings of a commodity producer in a uniquely adverse quarter marked by lockdowns, is an outstanding performance. This confirms National Fuel Gas’ superior business model compared to other commodity producers.

Growth Prospects

National Fuel Gas pursues growth by growing its natural gas production and expanding its pipeline network. However, it has grown its earnings per share at an average annual rate of only 2.9% over the last decade. This is a stern reminder of the sensitivity of the earnings of the company to the prevailing prices of natural gas.

On the other hand, the company has promising growth prospects ahead. A major growth driver will be a more favorable business environment, as the price of natural gas has plenty of potential upside and limited downside in the long run from its current suppressed level.

Moreover, in July, National Fuel Gas acquired the assets of SWEPI LP, a subsidiary of Royal Dutch Shell, in one of the most prolific areas of Appalachia. This acquisition will greatly increase the output of the company and its gathering volumes in 2021. Management expects the net production in Seneca to grow 32% and gathering volumes to grow 35% in fiscal 2021.

Thanks to this steep increase in the output, management expects to grow the earnings per share by about 25% in fiscal 2021, from $2.85 this year to $3.40-$3.70. If National Fuel Gas exceeds earnings per share of $3.45, it will post all-time high earnings per share next year.

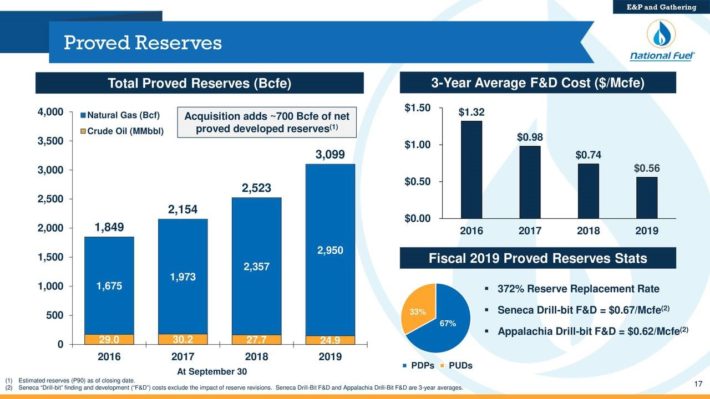

It is also worth noting that National Fuel Gas has consistently grown its proved reserves while the recent acquisition added another 700 Bcfe of proved reserves.

(Click on image to enlarge)

Source: Investor Presentation

The consistent growth of the proved reserve base of National Fuel Gas bodes well for the growth prospects of the company, indicating that the growth potential will not be exhausted next year after the recently acquired reserves begin to contribute to the existing production base.

Overall, we expect National Fuel Gas to grow its earnings per share by about 6.0% per year on average over the next five years, primarily thanks to the strong production growth expected next year and somewhat more favorable prices of natural gas in the future.

Competitive Advantages & Recession Performance

As mentioned above, the upstream segment generates 42% of its total EBITDA, with natural gas comprising 90% of the total output. It is evident that the company is highly sensitive to the price of natural gas. This sensitivity was apparent in 2015 and 2016 when the price of natural gas collapsed and the company posted hefty losses.

On the other hand, thanks to its vertically integrated business model, National Fuel Gas is more resilient to downturns than most oil and gas producers, as its midstream and utility businesses provide a strong buffer during downturns.

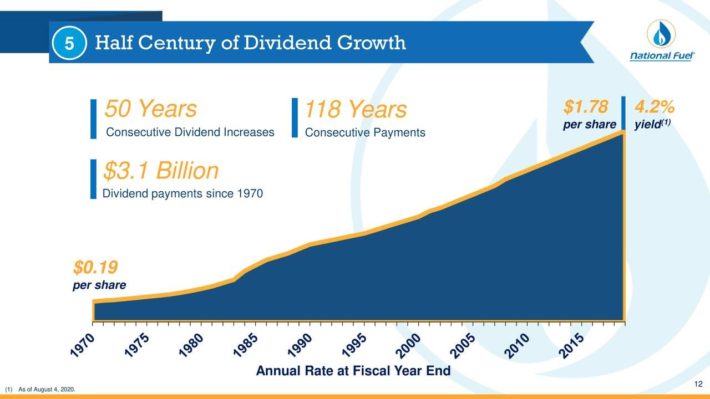

The superior business model of National Fuel Gas helps explain its admirable dividend growth record.

Source: Investor Presentation

The company has paid uninterrupted dividends for 118 consecutive years and has raised its dividend for 50 consecutive years. This is an impressive achievement for a commodity producer, as commodities are infamous for their high cyclicality, which results in dramatic boom-and-bust cycles.

Moreover, National Fuel Gas is currently offering a 4.4% dividend yield, which is more than twice the dividend yield of the S&P 500. Given the healthy payout ratio of 62% and the decent balance sheet of the company, the dividend can be considered safe for the foreseeable future.

Management has consistently targeted a payout ratio around 50% throughout the last decade but the payout ratio has somewhat increased this year due to the downturn from the pandemic. Nevertheless, a payout ratio of 62% amid the worst recession of the last decade is certainly healthy and confirms the safety of the dividend. We expect National Fuel Gas to continue raising its dividend for many more years.

Valuation & Expected Returns

National Fuel Gas is currently trading at 14.4 times its expected earnings of $2.85 per share this year. This earnings multiple is much lower than the average price-to-earnings ratio of 17.5 over the last decade. If the stock reverts to its average valuation level over the next five years, it will enjoy a 4.0% annualized gain in its returns.

Given 6% expected earnings-per-share growth, the 4.4% dividend, and a 4.0% annualized expansion of the price-to-earnings ratio, we expect National Fuel Gas to offer a 13.2% average annual return over the next five years. This makes the stock a buy in our view.

Final Thoughts

National Fuel Gas generates nearly half of its earnings from the production of natural gas. Consequently, it is highly sensitive to the gyrations of the price of natural gas. On the other hand, its midstream and utility segments provide a strong support to its results during downturns.

Overall, the midstream and utility segments provide reliable cash flows while the upstream segment offers significant growth potential thanks to strong production growth and a potential improvement in the price of natural gas off its current suppressed level, which has been caused by the pandemic.

In addition, thanks to the pandemic, National Fuel Gas is cheaply valued right now. Thanks to its promising growth prospects, its 4.4% dividend, and its cheap valuation, we believe the stock is likely to offer compelling returns going forward.

Disclosure: Sure Dividend is published as an information service. It includes opinions as to buying, selling and holding various stocks and other securities.

However, the publishers of Sure ...

more