Dividend Kings In Focus: Johnson & Johnson

Johnson & Johnson (JNJ) has increased its dividend for 58 consecutive years, one of the longest growth streaks found anywhere in the stock market.

This healthcare giant is one of the most popular dividend growth stocks because of its excellent recession-resistant business model, and dividend track record. Johnson & Johnson appears slightly overvalued right now, but the stock remains an excellent holding for long-term dividend growth.

Business Overview

Johnson & Johnson was founded in 1886 and has transformed into one of the largest companies in the world. The company has a market capitalization of $390 billion which makes it a mega-cap stock. You can see all 20 mega-cap stocks here.

Johnson & Johnson operates a diversified business model, allowing it to appeal to a wide variety of customers within the healthcare sector. The company generated $82 billion in revenue in 2019. Johnson & Johnson operates 3 business segments:

- Pharmaceuticals ~54% of sales

- Medical Devices ~29% of sales

- Consumer Health ~17% of sales

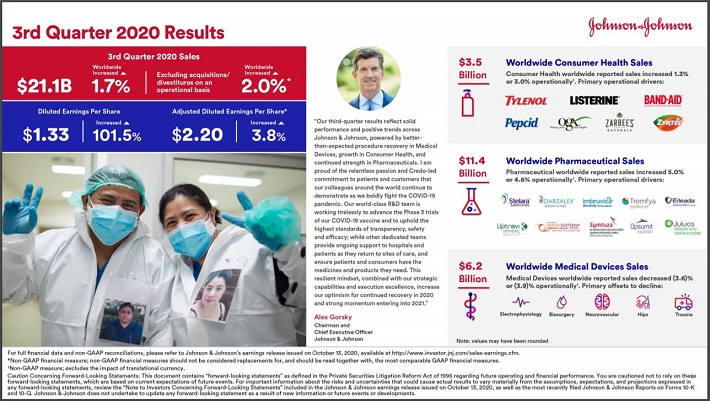

The company reported third quarter earnings results on October 13.

Source: Johnson & Johnson’s Third Quarter Earnings Presentation

Revenue of $21.8 billion was a 1.7% increase from the previous year. Adjusted earnings-per-share increased $0.08, or 4%, to $2.20. Both figures were sizeable beats of consensus estimates.

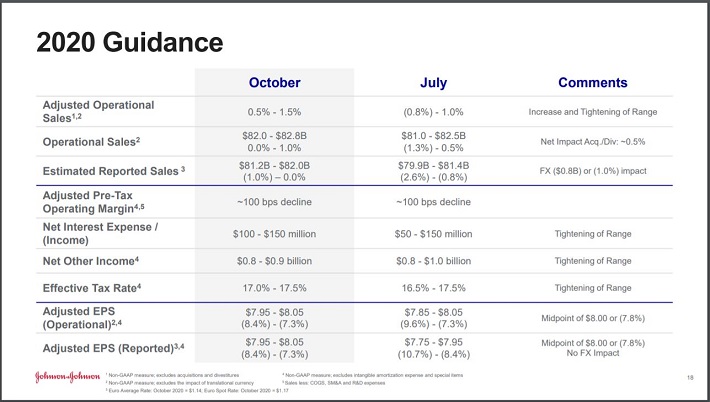

Johnson & Johnson also updated its 2020 outlook.

Source: Johnson & Johnson’s Third Quarter Earnings Presentation

For the second consecutive quarter, Johnson & Johnson raised its revenue and earnings-per-share guidance for the year. The company now expects revenue in a range of $81.2 billion to $82 billion, up from $79.9 billion to $81.4 billion previously. Adjusted earnings-per-share is now expected in a range of $7.95-$8.05, up from $7.75-$7.95 previously.

Growth Prospects

Johnson & Johnson primary source of growth comes from its Pharmaceutical segment. In the third quarter, sales of Daralex, a treatment for multiple myeloma, grew 44% to $1.1 billion as a result of share gains in the U.S. and European Union. Imbruvica, which treats lymphoma, grew 12% to $1 billion due to higher global demand. Meanwhile, Stelara, which treats immune-mediated inflammatory diseases, had revenue growth of 15% to $1.9 billion due to higher uptake rates for treatment of Crohn’s Disease and Ulcerative Colitis.

Separately, Invega Sustenna/Xeplion/Trinza/Trevicta, which are used to treat mental illnesses such as schizophrenia, bipolar disorder and depression, had 9% revenue growth to $926 million. Gains were due to strength in Susetenna/Xeplion and new patient starts in Invega Trinza/Trevicta. Tremfya, the company’s treatment for moderate to severe plaque psoriasis, grew 13.1% to $327 million, primarily due to an increase in treatment for psoriasis.

Johnson & Johnson is also in the process of bringing other products to market as well as seeking extensions for additional treatment usage. For example, Stelara received approval from the U.S. Food and Drug Administration to be used for treatment in pediatric patients with moderate to severe plaque psoriasis. With a massive R&D budget (more than $11 billion in 2019), Johnson & Johnson will likely be able to continue to find new breakthrough medicines to treat illnesses and aliments allowing for future growth.

Competitive Advantages & Recession Performance

Johnson & Johnson has multiple advantages over its competitors. The company’s size and scale are nearly unmatched in its industry. Johnson & Johnson also has a AAA credit rating from Standard & Poor’s and Moody’s Investors Service. This is a higher credit rating than the U.S. government. The only other company to have a AAA credit rating is Microsoft Corporation (MSFT).

The company’s size and scale, in addition to its credit rating, provide Johnson & Johnson the financial flexibility to make acquisitions to fuel further growth. Johnson & Johnson also invests heavily in research and development in order to bring new products to market. The company’s R&D budget in 2019 was $11.4 billion, representing 14% of total revenue that year.

Lastly, the company’s diversified business model allows it to continue to grow even if one segment is facing headwinds. For example, the Medical Device segment has been challenged in recent quarters due to the COVID-19 pandemic. Elective surgeries have been delayed in many parts of the world as the healthcare system attempts to control the pandemic. Medical Device revenue fell almost 4% during the most recent quarter, but the performance in Pharmaceutical and Consumer Health led to overall revenue growth for the company.

These competitive advantages have allowed Johnson & Johnson to weather multiple recessions. Listed below are the company’s earnings-per-share results before during and after the last recession

- 2006 earnings-per-share: $3.76

- 2007 earnings-per-share: $4.15 (9.4% increase)

- 2008 earnings-per-share: $4.57 (10.1% increase)

- 2009 earnings-per-share: $4.63 (1.3% increase)

- 2010 earnings-per-share: $4.76 (2.8% increase)

- 2011 earnings-per-share: $5.00 (5% increase)

Johnson & Johnson had EPS growth of almost 12% from 2007 through 2009, an impressive accomplishment given the circumstances of the Great Recession.

The company’s dividend also continued to grow. And with nearly 6 decades of dividend growth, it is likely that Johnson & Johnson shareholders will continue to receive annual dividend raises well into the future. Johnson & Johnson’s competitive advantages and its recession performance make the stock an excellent defensive name to hold.

Valuation & Expected Returns

With a current share price of $148 and an expected earnings-per-share of $8.00 for the year, Johnson & Johnson has a price-to-earnings ratio of 18.5. The stock’s long-term average price-to-earnings ratio is 15.8. Reverting to this multiple by 2025 would result in valuation reducing annual returns by 3.1% over this period of time.

Fortunately, total returns will also consist of earnings growth and dividend yield. Johnson & Johnson’s earnings-per-share have a compound annual growth rate of 6% over the last decade. Given the company’s competitive advantages and recent business performance, we feel that this growth rate is achievable over the next five years.

Finally, using the annualized dividend of $4.04, Johnson & Johnson currently offers a dividend yield of 2.7%. Therefore, total returns are expected as follows:

- 6% earnings growth

- -3.1% multiple reversion

- 2.7% dividend yield

Overall, Johnson & Johnson is expected to offer a total annual return of 5.6% through 2025. This makes the stock a hold, but not a buy due to the overvaluation of the stock at the present time.

Final Thoughts

When it comes to the Dividend Kings, few are as well known or as popular amongst dividend growth investors as Johnson & Johnson. And for good reason. Johnson & Johnson’s diversified business model has allowed the company to endure several recessions and still increase its dividend for the past 58 years. This growth streak is nearly unmatched.

That said, projected returns earn the stock a hold recommendation from Sure Dividend at this time. However, we continue to believe that Johnson & Johnson should be a cornerstone of a dividend growth portfolio. Investors primarily concerned with income safety may find shares of Johnson & Johnson attractive enough to purchase at the current price.

Disclosure: Sure Dividend is published as an information service. It includes opinions as to buying, selling and holding various stocks and other securities.

However, the publishers of Sure ...

more