Dividend Kings In Focus: Genuine Parts

Genuine Parts Company (GPC) has increased its dividend for over 60 consecutive years, giving it one of the longest streaks of annual dividend raises in the entire stock market. It has achieved this growth with a top brand in an industry that has seen consistent growth over many years. There remains a clear path ahead for continued growth.

While Genuine Parts stock appears overvalued at the present time, shares offer a yield above 3% and a high likelihood of continue dividend hikes for many years.

Business Overview

Genuine Parts traces its roots back to 1928 when Carlyle Fraser purchased Motor Parts Depot for $40,000. He renamed it, Genuine Parts Company. The original Genuine Parts store had annual sales of just $75,000 and only 6 employees.

Today, Genuine Parts has the world’s largest global auto parts network, with more than 10,500 locations worldwide. Genuine Parts generated nearly $20 billion of revenue in 2019 and has a current market capitalization of $13.8 billion. Genuine Parts is a distributor of automotive replacement parts, industrial replacement parts, office products, and electrical materials.

Source: Investor Presentation, slide 2.

It operates four segments, led by automotive parts, which houses the NAPA brand. The industrial parts group sells industrial replacement parts to MRO (maintenance, repair, and operations) and OEM (original equipment manufacturer) customers. Customers are derived from a wide range of segments, including food and beverage, metals and mining, oil and gas, and health care.

The office products segment distributes business products in the U.S. and Canada. Customers include office products dealers, office supply stores, college bookstores, office furniture dealers, and more. Genuine Parts also distributes electrical and electronic materials to original equipment manufacturers and industrial assembly firms.

Genuine Parts reported third-quarter earnings on 7/30/20 and the impact from COVID-19 was felt on both the top and bottom-line. Revenue decreased 22.5% to $3.8 billion due to social distancing restrictions and the closing of non-essential businesses in many regions of the world. Comparable sales, which measures sales at retail stores open at least one year, was lower by almost 14% from the same quarter a year ago. Currency translation was a 0.6% headwind to results.

The core Automotive business fell 10.1%, though acquisitions were a 3.2% benefit to results. Revenues for the Industrial parts business declined 21.1%, or 10.2% excluding the divestiture of the company’s Electrical Specialties Group. Adjusted earnings-per-share decreased 16% to $1.32, though this was $0.40 higher than expected.

The company pulled its guidance for the year, citing the unknowns regarding COVID-19 pandemic, but we expect earnings-per-share of $4.79 for 2020. Still, Genuine Parts is expected to generate long-term growth due to a very favorable industry trend.

Growth Prospects

Genuine Parts is primed for success, as the environment for auto replacement parts is highly positive. Consumers are holding onto their cars longer and are increasingly making minor repairs to keep cars on the road for longer, rather than buying new cars. As average costs of vehicle repair increase as a car ages, this directly benefits Genuine Parts.

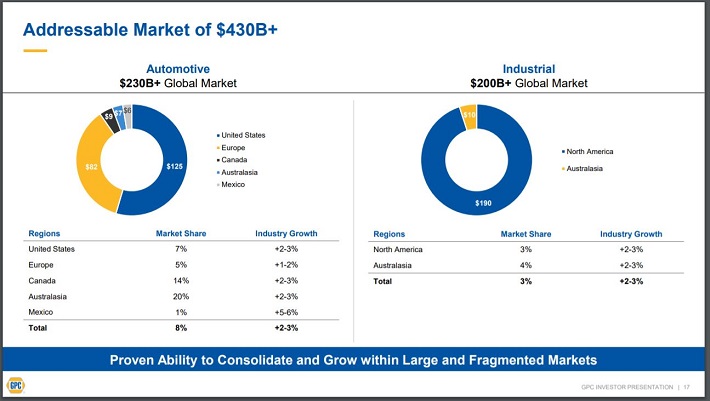

According to Genuine Parts, vehicles aged six years or older now represent over 70% of cars on the road. This bodes very well for Genuine Parts. In addition, the total addressable market for automotive aftermarket products and services and industry products is significant.

Source: Investor Presentation, slide 17.

Genuine Parts has a sizable portion of the $200 billion and growing automotive aftermarket business. One specific way Genuine Parts has captured market share in this space has historically been acquisitions. It frequently acquires smaller companies, in the U.S. and in the international markets, to boost market share in existing categories or expand in new areas. Genuine Parts has made several acquisitions over the course of its history.

These acquisitions have helped lead to earnings growth in eight out of the last 10 years. For example, Genuine Parts acquired of Alliance Automotive Group for $2 billion. Alliance is a European distributor of vehicle parts, tools, and workshop equipment. This was an attractive acquisition, as Alliance Automotive holds a top 3 market share position in Europe’s largest automotive aftermarkets: the U.K., France, and Germany. The deal added $1.7 billion of annual revenue to Genuine Parts, along with additional earnings growth potential from cost synergies.

In 2018, Genuine Parts agreed to acquire Hennig Fahrzeugteile, a Germany-based supplier of light and commercial vehicle parts. The acquisition expanded Genuine Parts’ reach in Europe, and also gave it further exposure to the commercial market. Genuine Parts expects the acquired company will boost its annual sales by $190 million.

More recently, Genuine Parts has made several acquisitions that should add to the company’s leadership position in several different markets. On 6/1/2019, Genuine Parts completed its acquisition of PartsPoint. Based in the Netherlands, PartsPoint is a leading distributor of automotive aftermarkets parts and accessories.

The company completed its purchase of leading industrial distributor Inenco at the beginning of July. Inenco has operations in Australia, New Zealand and Indonesia. Later that month, Genuine Parts announced it was adding Todd Group, a leader in the heavy-duty aftermarket segment in France.

Overall, it is clear that Genuine Parts’ multiple acquisitions have helped the company generate long-term growth.

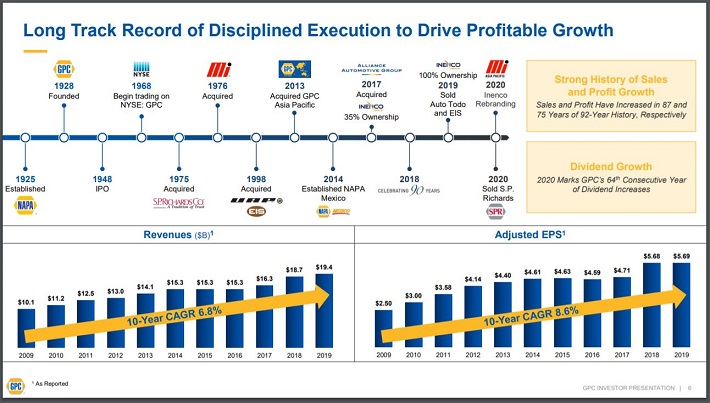

Source: Investor Presentation

These three deals completed last year added a combined total of $815 million to Genuine Parts’ annual sales. The results of Genuine Parts’ growth strategy speak for themselves. The company has generated record sales in 7 of the last 10 years, along with record EPS in 8 of the last 10 years.

Genuine Parts divested its S.P. Richards US operations and it’s the Safety Zone and Impact Products operations, as it continues to optimize its portfolio. The company has consistently generated growth over the long term. Future earnings growth is still attainable, through organic growth, acquisitions, and share repurchases.

Competitive Advantages & Recession Performance

The biggest challenge facing the retail industry right now is COVID-19 as the virus caused much of the world to shut down during parts of the second quarter. Genuine Parts did note that sales did improve as the second quarter progressed. Volumes in much of the world has already returned to pre-COVID-19 levels by the end of June.

The other threat to retail remains e-commerce competition, but automotive parts retailers such as NAPA are not exposed to this risk. Automotive repairs are often complex, challenging tasks. NAPA is a leading brand, thanks in part to its reputation for quality products and service. It is valuable for customers to be able to ask questions to qualified staff, which gives Genuine Parts a competitive advantage.

Genuine Parts has a leadership position across its businesses. All four of its operating segments represent the #1 or #2 brand in its respective category. This leads to a strong brand, and steady demand from customers.

Genuine Parts’ earnings-per-share during the Great Recession are below:

- 2007 earnings-per-share of $2.98

- 2008 earnings-per-share of $2.92 (2.0% decline)

- 2009 earnings-per-share of $2.50 (14% decline)

- 2010 earnings-per-share of $3.00 (20% increase)

Earnings-per-share declined significantly in 2009, which should come as no surprise. Consumers tend to tighten their belts when the economy enters a downturn.

That said, Genuine Parts remained highly profitable throughout the recession, and returned to growth in 2010 and beyond. In fact, the company has experienced just one year of earnings decline (2016) since this period of time. There will always be a certain level of demand for automotive parts, which gives Genuine Parts’ earnings a high floor.

Valuation & Expected Returns

Based on our expected earnings-per-share of $4.79 for 2020, Genuine Parts has a price-to-earnings ratio of 19.9. Our fair value estimate for Genuine Parts is a price-to-earnings ratio of 16.0. As a result, Genuine Parts is overvalued at the present time. A declining valuation multiple would negatively impact future returns to the tune of 4.3% per year over the next five years. Fortunately, Genuine Parts’ total returns will also include earnings growth and dividends.

We expect Genuine Parts to grow its earnings-per-share by 3% annually over the next five years. The stock has a 3.3% current yield, which is significantly higher than the average yield of the S&P 500 Index. And, Genuine Parts raises its dividend each year, including a 3.6% increase in 2020. Genuine Parts Company’s dividend growth streak now stands at 64 consecutive years.

Genuine Parts has a highly sustainable dividend. The company has paid a dividend every year since it went public in 1948. The dividend is likely to continue growing for many years to come. That said, investors should also consider the impact of valuation when it comes to a stock’s total returns.

Genuine Parts’ total annual returns would consist of the following:

- 3% earnings growth

- 3.3% dividend yield

- 4.3% multiple reversion

In total, Genuine Parts is expected to offer a total annual return of 2% through 2025.

Final Thoughts

Genuine Parts has a long history of steady growth, as it has benefited from rising demand for automotive parts. The aging vehicle fleet in the U.S. should provide continued growth moving forward. In the meantime, shareholders should receive annual dividend increases as has been the case for over 60 consecutive years.

While we find the stock overvalued, meaning now is not the right time to buy Genuine Parts, we would recommend the stock after a meaningful decline in the share price. Still, Genuine Parts has a solid dividend yield above 3% and offers annual dividend increases, making it a worthwhile holding for income-focused investors.

Disclosure: Sure Dividend is published as an information service. It includes opinions as to buying, selling and holding various stocks and other securities.

However, the publishers of Sure ...

more