Dividend Kings In Focus: Dover

Dover Corporation (DOV) has raised its dividend for 66 consecutive years, giving it one of the longest dividend growth streaks in the entire stock market. There are only three companies that have longer dividend growth streaks than Dover.

The company has achieved such an exceptional dividend growth record thanks to its strong business model, its decent resilience to recessions, and its conservative payout ratio, which provides a wide margin of safety during recessions.

Due to its conservative dividend policy, the stock is offering just a 1.8% dividend yield, which is only slightly higher than the broad market’s yield (1.6%). On the other hand, there is a lot of room for more dividend raises down the road. Dover is a time-tested dividend growth company, although the stock seems overvalued right now.

Business Overview

Dover is a diversified global industrial manufacturer, which provides equipment and components, consumable supplies, aftermarket parts, software, and digital solutions to its customers. It has annual revenues of about $7.0 billion, with 57% of its revenues generated in the U.S., and operates in five segments: Engineered Systems, Fueling Solutions, Pumps & Process Solutions, Imaging & Identification, and Refrigeration & Food Equipment.

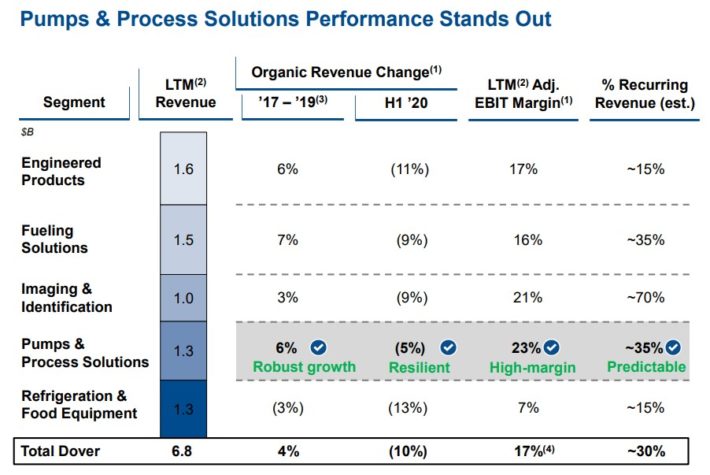

As shown in the chart below, the total sales of Dover are almost equally split across the five operating segments of the company.

Source: Investor Presentation

Pumps & Process Solutions is the best-performing segment. It grew its organic revenue at a 6% average annual rate in the last two years, before the onset of the pandemic. It has proved the most resilient segment in the first half of this year amid the pandemic, primarily due to the critical nature of its products, which are essential to Dover’s customers. This segment also has the highest operating margin and a significant portion of its revenues (35%) is recurring.

Dover is currently facing a strong headwind due to the coronavirus crisis. As its customers are industrial manufacturers, they have been significantly hurt by the global recession caused by the pandemic. It is thus natural that the pandemic has taken its toll on the performance of Dover.

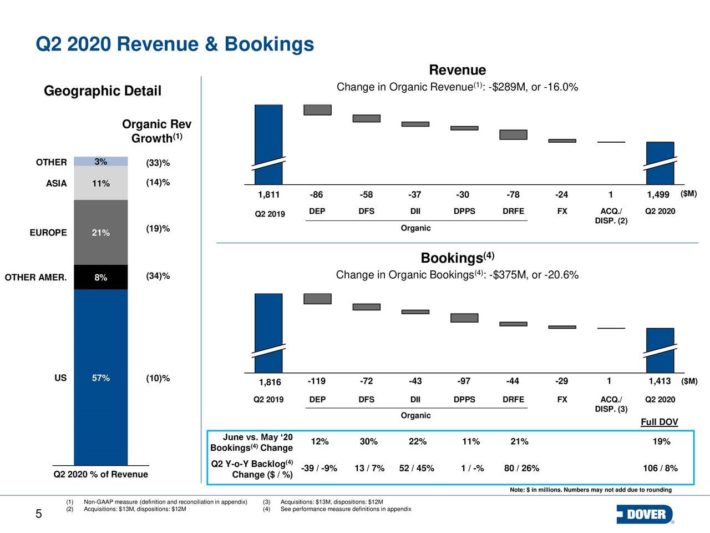

In the second quarter, its revenue and its orders decreased 16% and 21%, respectively, over the prior year’s quarter. As new orders decreased faster than sales, the backlog fell 8%.

Source: Investor Presentation

The decrease in revenue was pronounced in all the regions where the company is present. Moreover, adjusted earnings per share decreased 28% over the prior year’s quarter, from $1.57 to $1.13. On the bright side, the company proved more resilient than expected and thus its earnings per share exceeded the analysts’ consensus by $0.21.

It is also remarkable that Dover has exceeded the analysts’ consensus in earnings per share for 14 consecutive quarters. This indicates that the company has been doing its best in the factors it can control.

Furthermore, management has observed favorable business trends lately and thus expects improved business performance in the second half of the year. New orders exceeded its sales in August for the first time since the onset of the pandemic, which led to a recovery in the backlog. Dover also expects sequentially higher revenues in the third and fourth-quarter and provided guidance for adjusted earnings per share of $5.00-$5.25 this year.

Management also raised the quarterly dividend marginally (by 1%) and lifted the suspension of share repurchases. While these measures will not enhance shareholder returns meaningfully this year, they are important because they reflect Dover’s resilience in the ongoing downturn and management’s confidence in its recovery from the pandemic.

Growth Prospects

Dover has pursued growth by expanding its customer base and by performing bolt-on acquisitions. Management recently reaffirmed that it is looking for attractive takeover targets in its core markets, particularly in the divisions of Pumps & Process Solutions and Imaging & Identification, which are characterized by high margins and recurring revenues.

Dover has already executed a series of bolt-on acquisitions this year:

Source: Investor Presentation

Dover is also likely to enhance its earnings per share via opportunistic share repurchases. The company has reduced its share count at a 2.5% average annual rate over the last decade. Overall, the company has grown its earnings per share at a 4.0% average annual rate over the last decade.

However, it is important to note that this year will form a low comparison base due to the effect of the pandemic on the results of the company. As a result, we expect Dover to grow its earnings per share at an 8.0% average annual rate over the next five years.

Competitive Advantages & Recession Performance

Dover is a manufacturer of industrial equipment, and some investors may think that the company has no moat in its business due to little room for differentiation. However, the company offers highly engineered products, which are critical to its customers. It is also uneconomical for its customers to switch to another supplier because the risk of lower performance is material.

Therefore, Dover essentially operates in niche markets, which offer a significant competitive advantage to the company. This competitive advantage helps explain the consistent long-term growth trajectory of Dover.

On the other hand, due to its reliance on industrial customers, Dover is vulnerable to recessions. In the Great Recession, its earnings per share were as follows:

- 2007 earnings-per-share of $3.22

- 2008 earnings-per-share of $3.67 (14% increase)

- 2009 earnings-per-share of $2.00 (45% decline)

- 2010 earnings-per-share of $3.48 (74% increase)

Dover got through the Great Recession with just one year of decline in its earnings per share and the company almost fully recovered from the recession in 2010. That performance was certainly impressive.

Dover was also hurt in the downturn of the energy sector, which was caused by the collapse of the price of oil from $100 in mid-2014 to $26 in early 2016. Its earnings per share decreased 28%, from $4.54 in 2014 to $3.25 in 2016. However, in 2018, Dover spun off its energy division, Apergy, and thus it essentially eliminated its exposure to the cycles of the oil industry.

Given its sensitivity to the economic cycles, it is impressive that Dover has grown its dividend for 66 consecutive years. The exceptional dividend record can be attributed to the aforementioned decent resilience of the company to recessions. Another reason is the conservative dividend policy of management, which aims a payout ratio around 30%. This policy provides a wide margin of safety during rough economic periods.

Moreover, management has become remarkably conservative in its dividend raises in the last five years. During this period, Dover has raised its dividend at a 3.8% average annual rate. Overall, Dover will certainly continue to raise its dividend for many more years thanks to its low payout ratio, its decent resilience to recessions, and its healthy balance sheet. But its 1.8% dividend yield and its modest dividend growth rate render the stock unattractive for income-oriented investors.

Valuation & Expected Returns

Dover stock has recovered nearly all its pandemic-driven losses and as a result, is currently trading at 21.4 times its expected 2020 EPS of $5.13. This earnings multiple is much higher than the average price-to-earnings ratio of 16.2 of the stock over the last decade, but it can be somewhat justified by the temporary dip in earnings caused by the pandemic this year.

As we expect Dover to begin to recover next year, its earnings growth will be partially offset by the reversion of its earnings multiple towards its historical average. If the valuation multiple declines to its average price-to-earnings ratio, it will incur a 5.4% annualized drag in its annual returns over the next five years.

Including 8% expected annual earnings-per-share growth, the 1.8% dividend yield, and a 5.4% annualized contraction of the price-to-earnings ratio, we expect Dover to offer a 3.9% average annual return over the next five years. This is a fairly low expected rate of return that does not bring the stock a buy recommendation at this time.

Final Thoughts

Dover has an impressive dividend growth record, with 66 consecutive years of dividend raises. This is an impressive achievement, particularly given the dependence of the company on industrial customers, who suffer in every recession.

However, due to its conservative dividend policy, the stock is offering a mediocre 1.8% dividend yield while its 3.8% average annual dividend growth rate in the last five years is lackluster. As a result, the stock is not suitable for investors who are focused exclusively on income.

On the bright side, Dover has consistently grown its earnings per share over the years, primarily thanks to a series of bolt-on acquisitions. The company has ample room to keep growing via this strategy for many more years. On the other hand, the stock has retrieved nearly all its pandemic-driven losses and thus it is somewhat overvalued right now.

In other words, the market has already priced in a strong recovery from the pandemic. As a result, investors should wait for a meaningful correction of the stock before buying.

Disclosure: Sure Dividend is published as an information service. It includes opinions as to buying, selling and holding various stocks and other securities.

However, the publishers of Sure ...

more