Dividend Kings In Focus: 3M Company

It is not an exaggeration to say that the Dividend Kings are dividend royalty. To gain entrance to this exclusive club, companies must have at least 50 years of dividend growth. There are just 30 such companies that have met this lone qualification for entrance. You can see all 30 Dividend Kings here.

You can also download an Excel spreadsheet with the full list of Dividend Kings (plus important metrics such as price-to-earnings ratios and dividend yields) by clicking on the link below:

Click here to download my Dividend Kings Excel Spreadsheet now. Keep reading this article to learn more.

Even among these dividend stalwarts, few can touch 3M Company’s (MMM) history of dividend growth. The company has increased its dividend for more than six decades. While recent results have been hampered by the COVID-19 pandemic, 3M offers an attractive ~3.5% yield as well as annual dividend increases like clockwork.

Business Overview

3M is truly a global company as it has operations in more than 70 countries and sells its products to customers in more than 200 countries. The company’s portfolio includes more than 60,000 products that are used every day in homes, office buildings, schools and hospitals among other customers.

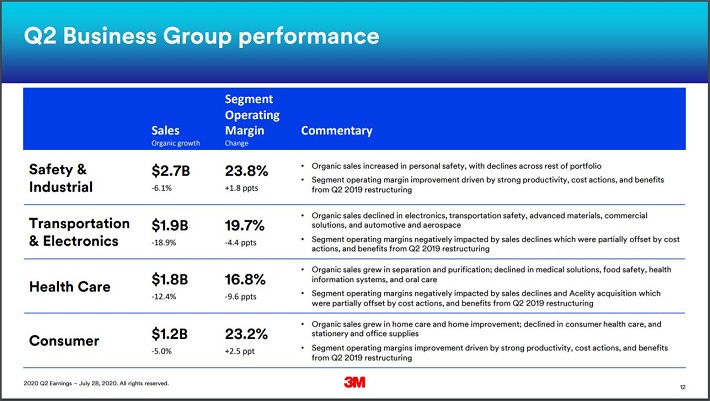

As of the second quarter of 2020, 3M is now composed of four business segments:

- Safety & Industrial (35% of sales)

- Transportation & Electronics (25% of sales)

- Health Care (24% of sales)

- Consumer (16% of sales)

Each of these segments struggled during the last quarter.

Source: 3M’s Second Quarter Earnings Results Presentation

Organic growth has been difficult to come by in recent years. For example, organic growth declined 2.6% for 2019.

This trend continued in the most recent quarter as organic growth fell more than 13% in the second quarter, a much steeper decline than analysts had expected. Much of this decline was due to North America, where organic growth was down 15.6%. Europe/Middle East/Africa were also down by a mid-double-digits. Asia Pacific was the best performer, but was lower by 8% on an organic basis.

Nearly all of this decline was due to the COVID-19 pandemic as consumers and businesses alike pulled back on spending due to the unknown impact of the virus on the economies of the world.

However, business results have improved since the second quarter. July sales improved 6% year-over-year while August had a 2% growth from the previous year. Health care has performed extremely well, with total sales growing 23% in August alone due to increased demand for personal protective equipment and ventilators.

Earnings-per-share are expected to decrease at a high single-digit rate for 2020, but the performance of in July and August show that 3M’s products remain in demand among customers, which should bode well for the company in future years.

Growth Prospects

3M has posted adjusted earnings-per-share growth in nine out of the last 10 years. This is a solid track record, one made possible by the company’s long-term priorities.

Source: 3M’s Second Quarter Earnings Results Presentation

As stated earlier, 3M has a massive portfolio of products, one that continues to grow each year with new patents.

3M has also been busy divesting itself of non-core assets. For example, the company completed its sale of its drug delivery business to an affiliate of Altaris Capital Partners, LLC. On May 1. 3M received $650 million for this business while retaining a 17% interest in the new company.

3M also invests heavily in new products, spending upwards of almost $2 billion on research and development annually. Listed below are 3M’s R&D budgets for the past few years:

- 2014 research-and-development expense of $1.77 billion

- 2015 research-and-development expense of $1.76 billion

- 2016 research-and-development expense of $1.73 billion

- 2017 research-and-development expense of $1.9 billion

- 2018 research-and-development expense of $1.8 billion

- 2019 research-and-development expense of $1.9 billion

3M’s portfolio of products and innovation have allowed the company to raise it dividend for the past 62 years. The most recent increase of 2.1% was for the dividend payment distributed March 12, 2020. This was far below the company’s five-year average increase of 7%, but gives 3M one of the 10 longest dividend growth streaks in the market.

Competitive Advantages & Recession Performance

Perhaps 3M’s most crucial competitive advantage is its innovation. The company invests heavily in research and development. R&D totaled $424 million in the second quarter and $961 million in the first half of 2020, representing 6% and 6.3% of total sales, respectively. This is very much in-line with 3M’s stated goal of 6%of annual sales.

These investments have paid off handsomely for 3M as almost a third of sales last fiscal year came from products that weren’t in existence five years ago. 3M has more than 118,000 patents and receives roughly 4,000 new patents each year.

Listed below are 3M’s adjusted earnings-per-share results before, during and after the Great Recession:

- 2006 adjusted earnings-per-share: $5.06

- 2007 adjusted earnings-per-share: $5.60 (10.7% increase)

- 2008 adjusted earnings-per-share: $4.89 (12.7% decrease)

- 2009 adjusted earnings-per-share: $4.52 (7.6% decrease)

- 2010 adjusted earnings-per-share: $5.75 (27.2% increase)

- 2011 adjusted earnings-per-share: $5.96 (3.7% increase)

As an industrial company, 3M is not immune to the effects of a recession. As seen above, the company suffered earnings declines in both 2008 and 2009. EPS fell 19.3% from 2007 through 2009. However, 3M quickly rebounded and made a new EPS high the very next year. In fact, 3M has performed so well since the last recession that the company has only posted one year where EPS declined since this period of time (2019).

While it is very likely that 3M’s results will suffer a double-digit decline in the next recession, the company’s product offerings and innovation will likely lead to a rebound during the following recovery.

Valuation & Expected Returns

Shares of 3M currently trade at $170. The company hasn’t issued guidance for 2020 due to the COVID-19 pandemic, but analysts expect that 3M will produce earnings-per-share of $8.35 for the year. This gives the stock a price-to-earnings ratio of 20.4.

We have a five-year target price-to-earnings ratio of 16.5 for the stock. If shares were to revert to this target by 2025, then valuation would be a 4.2% annual headwind to results over the next five years.

3M’s earnings-per-share have a compound annual growth rate of 4.7% over the last decade. Given the company’s prospects for growth and competitive advantages, we forecast an earnings growth rate of 5% annually over the next five years.

With an annualized dividend of $5.88, 3M currently offers a dividend yield of 3.5%, nearly a full percentage point above the sock’s 10-year average yield of 2.6%. 3M’s dividend payout ratio of 70% is elevated, especially compared to the stock’s 10-year average payout ratio of 47%. This is the likely reason for the small increase announced at the beginning of the year.

Still, the current yield is rarely seen by the stock. In fact, only twice in the last fifteen years has 3M averaged a 3%+ yield for an entire year (2009 and 2019).

Total returns for 3M would consist of the following:

- 5% earnings growth

- 4.2% multiple reversion

- 3.5% dividend yield

Altogether, shareholders of 3M are projected to receive annual returns of 4.3% over the next five years.

Final Thoughts

Organic growth for 3M has been difficult to come by over the past year or so, much of which is due to the COVID-19 pandemic. This was true even before the pandemic impacted results.

However, there is still a lot to like about 3M. The company spends heavily on R&D, which has allowed it to create numerous new products that add materially to results. And, 3M’s dividend track record is nearly unmatched and the current 3.5% dividend yield is very attractive.

That said, 3M’s total projected returns are not high enough to earn a buy recommendation from Sure Dividend at this time, though we can see the obvious appeal of 3M as a long-term holding for income investors.

Disclosure: Sure Dividend is published as an information service. It includes opinions as to buying, selling and holding various stocks and other securities.

However, the publishers of Sure ...

more