Dividend Increases Up To 25% Could Be In The Cards For These Energy Stocks

Before the energy commodity and stock sector crash in 2015, energy midstream stocks paid steadily growing dividends that income investors loved. The steady stream of dividend increases propelled share higher. It was a strategy that worked for years, buy energy midstream stocks with attractive yields and growing dividends to generate great total return year after year. Until it stopped working.

In 2015 energy sector stock prices crashed, taking down the business model used by the midstream companies. They would issue debt and equity to fund growth projects (growth Capex), and as the projects came online, the revenue allowed the dividends to keep growing.

After the crash, companies in this sector were not rewarded with rising share prices if management teams continued to grow dividends. Share prices bottomed in early 2016 and stayed down through 2019.

With the dividend growth game broken, midstream companies changed their strategies. For the last four years, companies have been cutting dividends to pay down debt and restructuring businesses to use internally generated cash flow to fund growth Capex.

Before 2015, distributable cash flow (DCF) coverage of 1.05 to 1.10 times the distributions was viewed as adequate. Now companies target DCF coverage of 1.3 to 1.5 times or higher.

Now that debt loads are reduced and cash flow coverage is at levels that support both Capex and dividend payments, energy midstream companies are in a position to resume dividend growth with meaningful dividend increases. Large dividend increases can propel stock prices higher, giving the double benefit of growing income and capital gains. Here are three energy midstream companies that should announce big dividend increases soon.

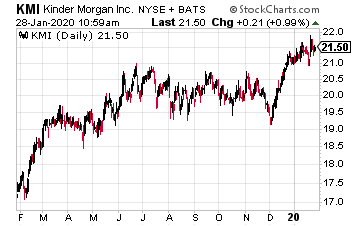

In 2016, Kinder Morgan, Inc (KMI) slashed its dividend by 75%, from $0.51 per share down to $0.125. The rate stayed at 12.5 cents for two years.

It was increased to $0.20 per share in 2018 and up another 25% to $0.25 per share in 2019.

For the 2019 fourth quarter, Kinder reported DCF of $0.59 per share, well over two times the dividend rate.

Expect another 20% to 25% dividend increase with the next dividend announcement in April.

KMI currently yields 4.6%.

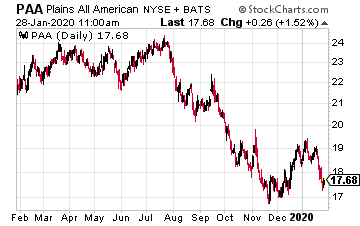

Plains All American Pipelines LP (PAA) is a master limited partnership (MLP) that owns the largest independent network of crude oil a natural gas liquids (NGLs) pipelines and storage facilities.

Plains hit a rough patch following the energy sector crash in 2015, and the company cut its dividend twice in 2016 and 2017, respectively.

The business has been stabilized, and now distributable cash flow is almost double the distribution rate. At the beginning of 2019, Plains increased its dividend by 25%.

I am looking for a 10% to 20% increase again in 2020.

Now trading around $1.50, this could easily be a $25 stock by the second half of this year. PAA yields 8%.

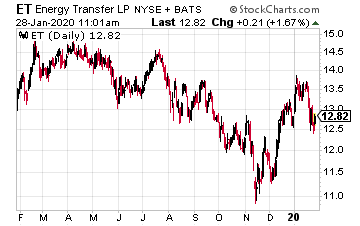

Energy Transfer LP (ET) stopped growing its dividend rate in the fourth quarter of 2017.

Over the last two years, ET focused on consolidating the different publicly traded companies it controlled and strengthening the balance sheet.

EBITDA growth has been at an 18% compound growth rate since 2015. If with the dividend not growing, Energy Transfer’s business and profits have been.

For the first three quarters of 2019, DCF coverage was 1.98 times the dividends paid. Management is targeting a 1.7 to 1.9 times long-term coverage ratio.

Management has also indicated dividend growth will resume in 2020.

I am looking for a 10% to 15% dividend increase this year. ET now yields 9.6%.

Disclaimer: The information contained in this article is neither an offer nor a recommendation to buy or sell any security, options on equities, or cryptocurrency. Investors Alley Corp. and its ...

more