Dividend Income Update October 2017

We all know what it’s like to come off our September highs of dividend income and report on less than spectacular numbers for October. It’s all part of dividend investing as we covet those end of quarter months the most and are often less enthusiastic about the first month of every quarter. As long as we can report progress each month and our annual goals are intact, who cares. With that being said, let’s take a look back at my October 2017 dividend income.

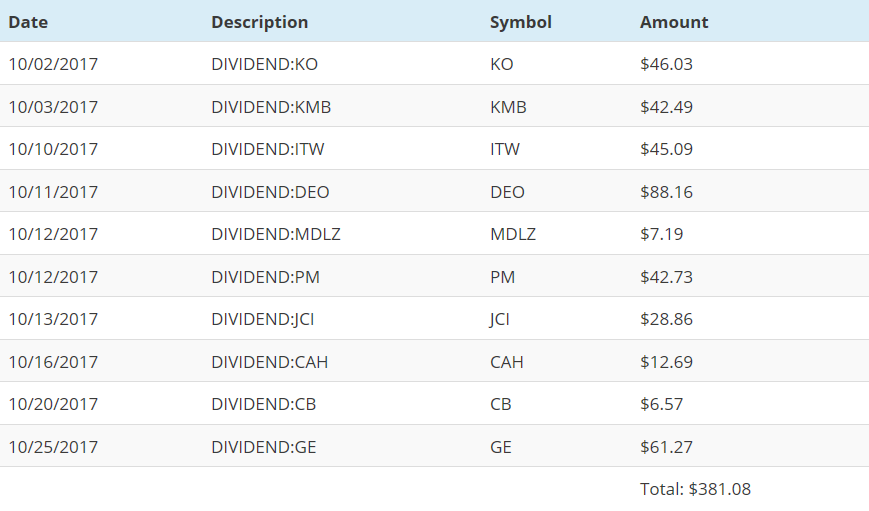

Dividend income from my taxable account totaled $381.08 up from $296.19 an increase of 28.7% from October of last year.

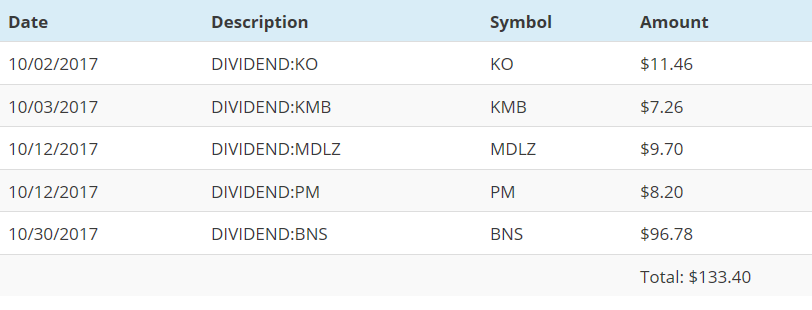

Dividend income from my ROTH account totaled $133.40 down from $137.69 an decrease of -3.1% from this time last year.

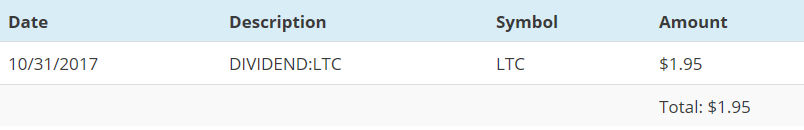

Dividend income from my IRA account totaled $1.95 up from $0.00 last October.

Grand total for the month of October: $516.43 an increase of 19.0% from October 2016.

Brokerage Account

Year to date dividends: $3,871.24

ROTH Account

Year to date dividends: $1,548.75

IRA Account

Year to date dividends: $494.91

So there you have it. No complaints from me about a nice double digit year over year gain. It just goes to show that with consistent investing, diversification, reinvesting, adding fresh capital and not getting shaken out of the market because of scary financial headlines, it is possible to create and grow an ever increasing passive income stream which is at core to dividend growth investing.