Dividend Income Portfolio Update Q4 2017

Every quarter I like to review baby DivHut’s portfolio and dividend income. Generally speaking there is not much change in his portfolio on a month to month basis as fresh capital is not always available to make trades for him. Still, with dividend reinvestments, stock spin offs and a small buy I made, his portfolio continued to grow in size from last quarter. Of course, the aim of his portfolio is not necessarily to achieve capital appreciation rather dividend growth with the ability to generate an ever increasing passive income stream.

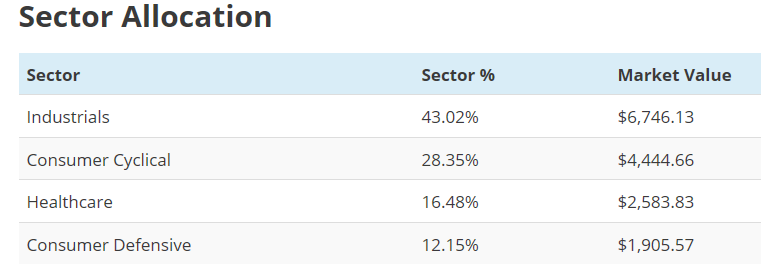

With the stock market continuing to chug along it was nice to see some impressive gains made in his portfolio that’s only about two years old. As you already know, I never try and time the market nor my buys. I simply buy when cash is available and let time work its compounding magic. See, when baby DivHut was born it could have been said, in fact it was, that 2015 wasn’t the best possible time to invest. The energy markets were in a tailspin and, if you recall, going into 2016 we were welcomed with one of the worst starts for the stock market as a whole. Of course, the upcoming U.S. election, at the time, was throwing a lot of doubt on stocks too. What I’m trying to say is that there will always be negative headlines and always a reason to not invest. Looking back I’m happy to have started investing for baby DivHut soon after he was born and not wait for the “best” time to put his money to work. With that being said, let’s take a look at baby DivHut’s current holdings, sector allocation and dividend income for Q4 2017.

Total Investment Balance $15,680.19

Gain or Loss $5,262.72

Q4 dividend income: $86.48

Grand total for 2017 dividends: $300.05 an increase of 30.2% from 2016. As you can imagine, seeing these results made me feel very proud to be able to start my little guy own his own DGI path at such an early age. Taking advantage his greatest asset, time, should create a nice compounded return over the coming decades.

Disclosure: Long all above.