Dividend Cuts & Spiking Unemployment

Dividend Cuts Coming Fast & Furious

As of March 30th, 24 companies suspended their buyback programs in 2020 for a total of over $200 billion. Financials have led the charge with $127 billion in cuts. Financials probably have led the charge because of their energy loans. Obviously, the entire economy is in a recession, but some of the oil loans are in big trouble. And financials are also being squeezed by low rates. It’s the worst-case scenario for these firms.

Perhaps financials are outpacing energy because many energy companies were in a weak place heading into the year. Even though energy has had a bad quarter, don’t forget that the situation wasn’t positive before this recession. Energy sector ETF $XLE was only up about 8% in 2019 which was terrible since the S&P 500 was up almost 28%. Many of these firms didn’t have money to spend on buybacks!

There have been heavy criticisms of buybacks lately because firms just bought stocks last year; now they have capital constraints. Personally, I find this criticism harsh because no one knew a recession catalyzed by a virus was going to destroy business for a few months. There’s a fair criticism of debt-fueled buybacks, but not all buybacks are debt-fueled. Literally a few months ago investors complained if a company had too much cash on the balance sheet; now they want firms to have cash.

(Click on image to enlarge)

It’s not just buybacks that are being cut now. Dividends are being cut as well. Buybacks are easier to cut. Most firms that have gone ex-dividend are paying that money to shareholders even though the situation has gotten much worse in the past few weeks. In fact, I heard of one company suspending a payment that was expected.

As you can see from the chart above, dividend cuts are becoming more common. We’ve seen some stocks rally on dividend cut announcements because they mean companies will have more liquidity to deal with a further downturn. In 2020, dividends are being discontinued faster than at any point during the last recession. Some are also being omitted.

Omitting a dividend means it is suspended. So far, 11 S&P 500 companies have discontinued or cut their dividends which amounts to $2.6 billion which is 2% of the index’s dividends paid in Q4. 80% of S&P 500 firms paid a dividend in Q4.

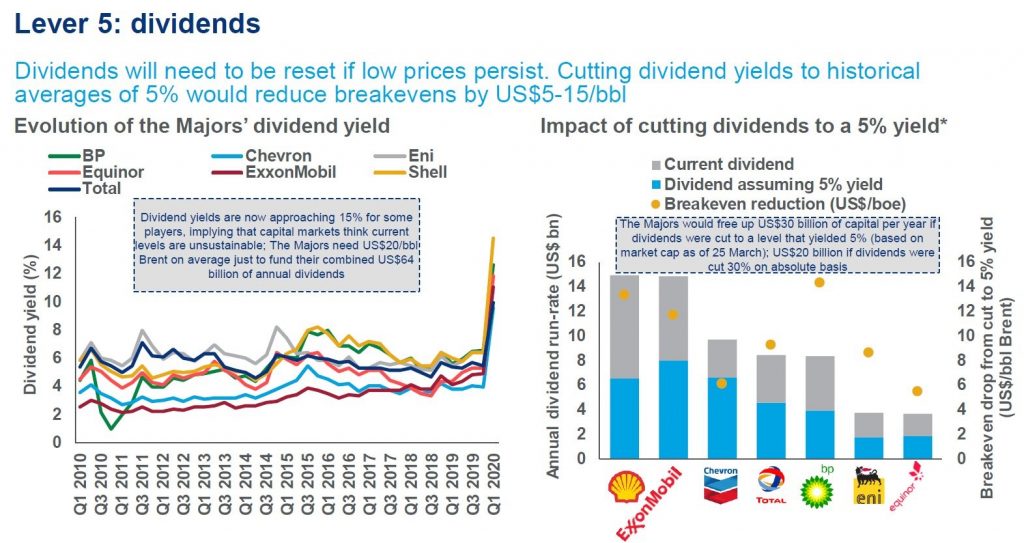

We should expect more cuts coming. And we can expect Exxon & Schlumberger to cut their dividends shortly. The chart below details the major oil firms’ ability to pay their dividends. As you can see, their yields skyrocketed in March. The graphic shows when a yield gets above 15%, it means the company isn’t expected to be able to pay it. My threshold is 10% with some exceptions. It’s always a case by case basis. It’s simply a red flag if the yield is 10% or higher.

As you can see, it would help these firms if they cut their yields to 5%. Their breakevens would fall substantially. BP’s Brent price per barrel breakeven would fall by $15. No companies can make money with WTI oil in the high teens. We are looking for these firms to minimize their losses.

(Click on image to enlarge)

Consumer Is Losing Confidence

This past week's spending growth slowed because the initial rush to buy goods before everything closed-ended. Plus, the initial rush to stock up on groceries and other essentials ended. Now people are truly hunkering down. Their jobs are either suspended or gone completely which is inspiring savings. This narrative is supported by the numbers.

In the week of March 28th, weekly RedBook same-store sales growth fell from 9.1% to 6.3%. We expect sales growth to fall further in April. There won’t be the usual boost in sales related to Easter.

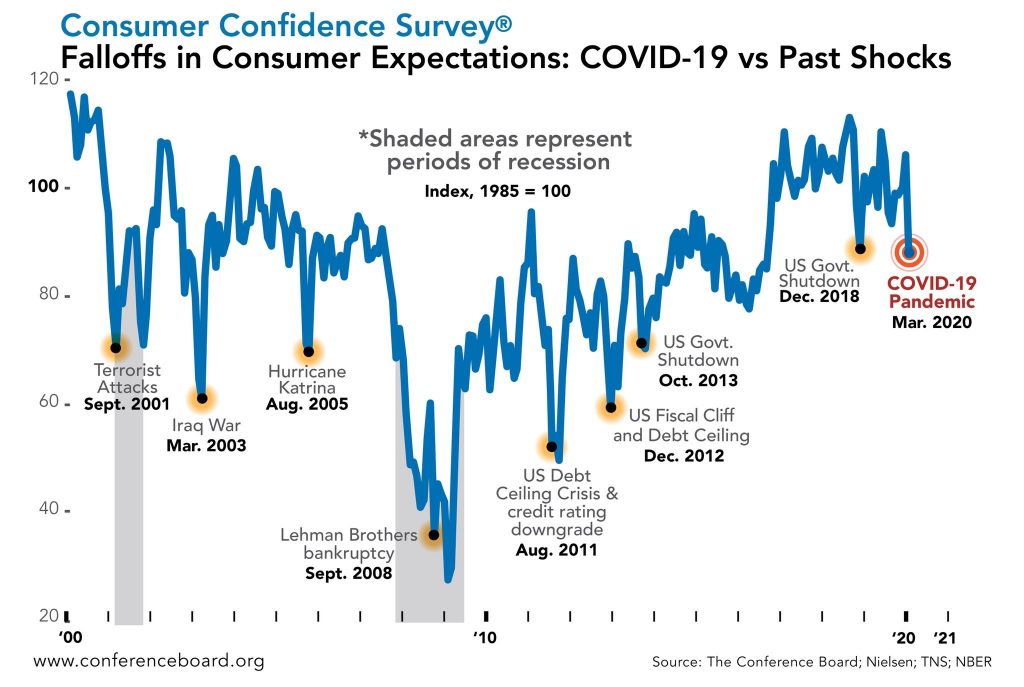

The consumer confidence index from the Conference Board fell in March as you can see from the chart below. It actually was above estimates as it was down from 132.6 to 120. Estimates were for 110. The highest estimate was 120. The reason it wasn’t a disaster is the cutoff day for the report was March 19th.

On March 19th, the economic situation was terrible, but it wasn’t as bad the week prior which was also included in the data. Only the end of the report includes the current dire situation.

(Click on image to enlarge)

Specifically, the present situation index fell from 169.3 to 167.7. And the expectations index fell from 108.1 to 88.2. Let’s focus on the details of the expectations index. The percentage expecting business conditions to improve fell from 20.6% to 18.2%. The percentage expecting business conditions to worsen increased from 7.2% to 14.9%.

Therefore, the net expecting better conditions fell from 14.4% to 3.2%. Those expecting more jobs in the next 6 months fell from 16.6% to 15.5% and the percentage expecting fewer jobs rose from 12% to 17.1%. The net fell from 2.4% to -1.6%.

Very Weak Labor Market

That leads me to discuss the incoming terrible labor market. To be clear, the labor market is terrible now. Data just doesn’t show it yet. March labor report this Friday will be okay because the report is from the week of March 12th. Consensus calls for the unemployment rate to increase 0.2% to 3.7%. That’s still a low rate. We expect it to more than double in the April report.

As you can see from the chart below, Oxford Economics is predicting 20 million job losses and the unemployment rate to rise to 12%. That would be the highest rise in unemployment since WWII. Consensus only expects 140,000 job losses in March because the cut off date of the survey is early in the month. This is still historically important because the record streak of positive job creation will end.

Unfortunately, because the economy and markets are moving so quickly, monthly labor reports are useless. Weekly jobless claims report is the best to review because it’s more up to date. Even it isn’t great to trade off because reporters are highlighting early data from states before official releases.

(Click on image to enlarge)

Disclosure: None.