Dividend Aristocrats: International Business Machines

For the 2021 Dividend Aristocrats In Focus series, first up is International Business Machines (IBM). Last year, IBM raised its dividend for the 25th year in a row, making it one of the newest members of the Dividend Aristocrats.

IBM has struggled through a prolonged turnaround effort in the past few years. The company has invested heavily in new areas such as artificial intelligence, data, and cloud services while attempting to divest slow-growth legacy businesses. These efforts have had mixed results, as the company is still having difficulty returning to growth.

However, IBM has continued to raise its dividend each year. With a high dividend yield above 5% and consistent dividend increases each year, IBM stock could be viewed favorably by income investors.

Business Overview

IBM is a global information technology company that provides integrated enterprise solutions for software, hardware, and services. In the services business, IBM is the world’s largest IT provider with 5.5% market share. In software, IBM’s software business is mostly middleware, which is the software layer that connects applications and devices to each other.

In hardware, IBM sells the z15 mainframes, storage, and the Power-based servers. The company has five business segments: Cloud & Cognitive Software, Global Business Services, Global Technology Services, Systems, and Global Financing.

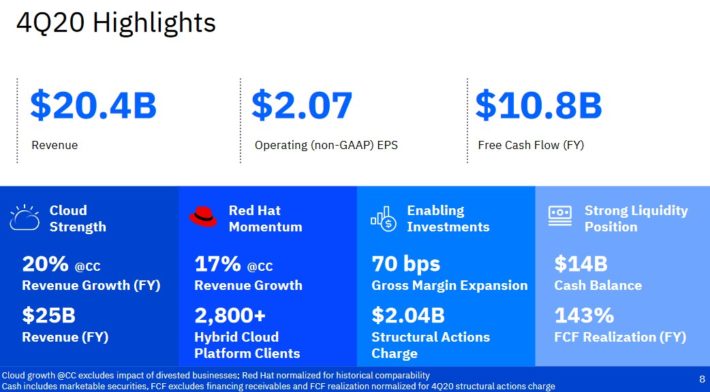

On January 21st, IBM reported fourth-quarter and full-year financial results. For the fourth quarter, revenue of $20.4 billion declined 6% year-over-year, or 8% adjusting divested businesses and currency fluctuations.

Source: Investor Presentation

The company absorbed a pre-tax charge of $2.04 billion resulting from restructuring actions taken during the fourth quarter. As a result, quarterly diluted earnings-per-share from continuing operations declined 66% from the same quarter last year.

For the full year, revenue of $73.6 billion declined 4% adjusting for divested businesses and currency. Diluted earnings-per-share from continuing operations was $6.13 compared to $10.57 in 2019, a decline of 42% for 2020. IBM’s disappointing EPS performance was due largely to the one-time charge as well as the impact of the coronavirus pandemic.

Meanwhile, IBM’s revenue declines were much more manageable, and an indication that the company’s turnaround may finally give way to growth in 2021.

Growth Prospects

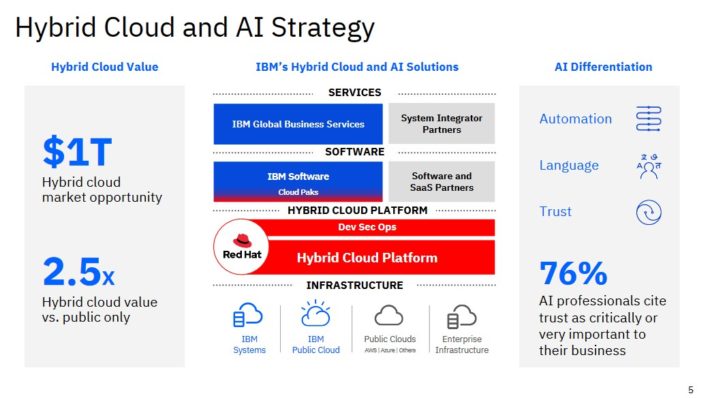

IBM’s headline numbers look fairly weak, given the continued declines in revenue and earnings-per-share. But underneath the surface, there are signs emerging that IBM’s turnaround is gaining traction. The company’s strategic imperative is to become a leader in artificial intelligence and hybrid cloud solutions. It has invested aggressively in these areas, such as the $34 billion acquisition of Red Hat in 2019.

IBM sees the hybrid cloud as a $1 trillion market, and its biggest opportunity to return to growth in the future.

Source: Investor Presentation

Some of these initiatives are already showing positive results. In the 2020 fourth quarter, IBM’s total cloud revenue of increased 8% adjusted for divested businesses and currency, reaching $7.5 billion. Red Hat revenue increased 17% for the fourth quarter. The core Cloud & Cognitive Software segment saw 6% growth in Cloud & Data Platforms, led by Red Hat. Segment cloud revenue increased 36% for the quarter. For the full year, IBM’s total cloud revenue rose 20%, exceeding $20 billion.

As growth areas such as the cloud become a larger portion of IBM’s overall revenue, there is hope that the company will return to growth in 2021. For its part, IBM management expects to grow revenue for the full year 2021. It also expects adjusted free cash flow of $11 billion to $12 billion in 2021. This would represent growth from 2020, in which IBM generated free cash flow of $10.8 billion.

We expect 4% annual EPS growth for IBM over the next five years. This forecast takes into account modest revenue growth, as well as share repurchases which we expect to resume in the years ahead.

Competitive Advantages & Recession Performance

Despite its lack of growth in the past few years, IBM still enjoys meaningful competitive advantages, primarily its industry leadership position and scale. IBM is set to split into two companies by the end of 2021. The new IBM will be the #1 hybrid cloud platform, with annual revenue of $59 billion.

In addition, the New Company (referred to as NewCo) will be the #1 Managed Infrastructure Services provider with annual revenue of $19 billion. NewCo will have approximately 4,600 clients including over 75% of the Fortune 100, along with a $60 billion services backlog, approximately 45% of which is cloud services.

Holding such strong positions in its core strategic areas gives IBM a reasonably good chance of successfully turning itself around and returning to growth in the years ahead.

In terms of recession performance, IBM receives mixed reviews. As a global technology company, IBM is exposed to the fluctuations of the broader economy. For example, in 2020 the company’s revenue and earnings-per-share declined as the global economy fell into recession due to the coronavirus pandemic.

That said, IBM performed relatively well in the Great Recession of 2007. IBM’s performance during that recession is listed below:

- 2008 earnings-per-share: $8.93

- 2009 earnings-per-share: $10.01 (12% increase)

- 2010 earnings-per-share: $11.52 (15% increase)

- 2011 earnings-per-share: $13.06 (13% increase)

It is quite impressive that IBM was able to grow its earnings-per-share in each year of the Great Recession. Moreover, the dividend kept increasing as well. While the company’s recession performance was not as strong in 2020, it did remain highly profitable, which allowed it to keep its dividend increase streak alive.

Valuation & Expected Returns

IBM shares look attractive on a valuation basis, as the stock trades for a price-to-earnings ratio of 13.9 based on 2020 EPS from continuing operations of $8.67. Investors should also keep in mind that EPS is coming off a low base from 2020. Even so, the stock trades above our fair value P/E estimate of 11. The impact of a declining valuation multiple could reduce annual returns by 4.6% per year over the next five years.

These negative returns could be offset by earnings-per-share growth and dividends. As previously mentioned, we expect 4% annual EPS growth through 2026. In addition, the stock has a high current dividend yield of 5.4%. Overall, we estimate total returns at 4.8% per year.

This is a decent, albeit modest, expected rate of return. Therefore, we rate the stock a hold. However, IBM could be an attractive stock specifically for income investors in search of high yields. We believe the dividend is safe, given the company’s strong cash flow generation.

Final Thoughts

IBM is among the 2021 inductees to the prestigious Dividend Aristocrats list, but investors may not have noticed due to the company’s ongoing fundamental difficulties. But despite the persistent decline in revenue over the past few years, IBM has continued to raise its dividend each year, due to the company’s steady profitability and strong free cash flow.

With a high dividend yield above 5%, and a rising dividend each year, we view IBM stock favorably for income investors.

Disclosure: Sure Dividend is published as an information service. It includes opinions as to buying, selling and holding various stocks and other securities.

However, the publishers of Sure ...

more

Interesting point of view, which I question a bit. IBM is not losing by any interpretation, instead the complaint is "lack of growth," which sounds to me like speculators screaming "More, More, More!"

Totally ignoring very respectable and consistent dividends and demanding increases in share price smells a lot like greed from where I stand. And constantly changing the direction is always a bit risky, since much of the future is not so very obvious to us.

Of course, it seems that those loud shareholders demanding growth, no matter what the risk, do have the ear of the board. But folks do need to keep in mind that with every gamble there is a risk of losing. As we are repeatedly reminded, "Past performance does not guarantee future performance."