Dividend Aristocrats In Focus: United Technologies

It is not every day that a company is added to the Dividend Aristocrats. To become a member of this group, a company must increase its dividend for at least 25 consecutive years. The Dividend Aristocrats are such an exclusive group, that there were only 53 such companies with this title as of the end of 2018.

Four companies were added to the Dividend Aristocrats list in 2019, including industrial giant United Technologies (UTX).

United Technologies gave investors a 5% dividend increase last October. The stock currently yields just under 2.6%, but well above the 2% yield of the S&P 500. This article will examine if its dividend history and business performance is enough to warrant purchasing shares of the company.

Business Overview

United Technologies was founded in 1934. Today, the company has more than 200,000 employees around the world, and the stock has a market capitalization of nearly $100 billion.

United Technologies is a commercial aerospace and defense company. For the time being, United Technologies is composed of four business divisions: Pratt & Whitney, which manufactures and services engines for commercial and military customers; Otis, the world’s largest producer and servicer of elevators and escalators; UTC Climate, which produces HVAC equipment; and UTC Aerospace, which creates aerospace and industrial products.

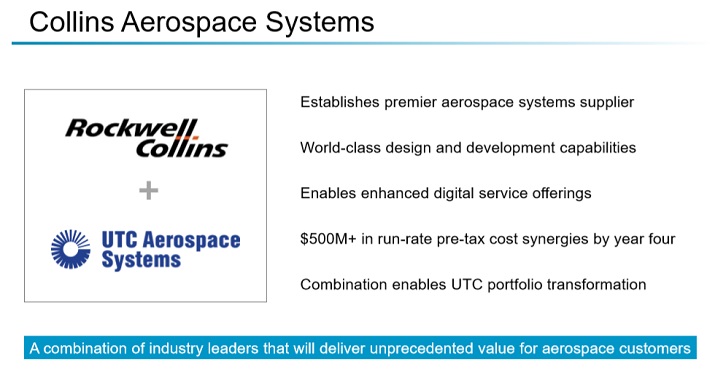

This is a period of great change for United Technologies. After spinning offing certain businesses, United Technologies will be composed of two business divisions: Pratt & Whitney and Collins Aerospace Systems, which creates aerospace and industrial products.

The company’s $30 billion acquisition of Rockwell Collins closed on November 26th of last year.

Source: Investor Presentation

This purchase helped to diversify United Technologies’ aerospace business as well as add approximately $8 billion in annual sales.

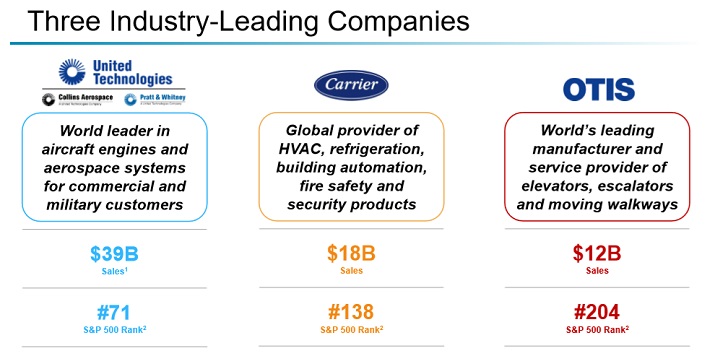

Separately, United Technologies announced near the end of last November that it would be spin offing certain low growth businesses in order to focus on Aerospace and Defense. Otis, the company’s elevator and escalator business, will become an independent entity under the same name. The company’s Climate, Controls and Security businesses will take the Carrier name.

Source: Investor Presentation

These portfolio moves were made to focus United Technologies’ operations on its most attractive areas of growth. By making the company leaner and more efficient, United Technologies believes it can produce higher margins and greater earnings growth in the years ahead.

Growth Prospects

The aerospace and defense industries have seen a renaissance in recent years. Air travel is expected to double in the next two decades. Only 20% of the world’s population has flown by airplane. It is expected that more people will be able to travel by air as the middle-class forms in emerging markets.

In addition, the world’s fleet of airplanes is quite old. Boeing (BA), the world’s largest manufacturer of commercial airplanes, expects that the world will need as many as 43,000 new planes over the next twenty years.

Defense spending has also increased. The U.S. had a defense budget of $700 billion for fiscal year 2019. That spending is expected to increase in future years as well.

Taking these factors into account, it is no surprise that United Technologies remaining businesses have performed very well recently. The company released financial results for the fourth quarter and fiscal year 2018 on January 23rd. Adjusted earnings-per-share (EPS) grew 18% to $1.95 for the quarter. Adjusted EPS for the year improved 14% to $7.61 For reference, EPS grew just 1.2% from 2013 to 2017.

While a lower adjusted effective tax rate ( 22.1% for 2018 vs 27.8% for 2017) explains a portion of this increase, 8% organic revenue growth was a major driver for results last year. United Technologies’ remaining businesses post-spinoff of Pratt & Whitney (22%) and Collins Aerospace Systems (9%) showed organic growth rates above the company average.

United Technologies has increased EPS at an annual rate of 3% for the past ten years.

Competitive Advantages & Recession Performance

As we just discussed, United Technologies core businesses performed very well in the last year. Sales for the company grew 11% in 2018 and management expects sales for 2019 to improve at least 13.5%, with organic growth in the range of 3%-5%.

Pratt & Whitney had revenue growth of 24% in the fourth quarter. Commercial OEM was higher by 74% as the company experienced a surge in large commercial engine deliveries. Total Geared Turbofan deliveries nearly doubled in the fourth quarter while military sales increased 17%. Aftermarket services were up 11%.

The company expects to deliver ~2,500 Geared Turbofan engines over the next three years, so aftermarket services should increase as United Technologies install base grows.

While United Technologies has done well recently, the company’s results were mixed during the last recession.

- 2007 earnings-per-share of $4.27

- 2008 earnings-per-share of $4.90 (14.8% increase)

- 2009 earnings-per-share of $4.12 (16% decrease)

- 2010 earnings-per-share of $4.74 (15% increase)

Industrial companies depend on a growing economy in order to perform well. A global recession would likely cause customers to pause large purchases. With this in mind, United Technologies actually held up fairly well during the last recession. The company remained profitable throughout the Great Recession and quickly surpassed pre-recession earnings levels by 2010.

We caution, however, that the company will be less diversified after the completion of the Otis and Carrier spin-offs, which could effect earnings results.

United Technologies’ products, like elevators and jet engines, are in high demand when the economy is growing. One item investors need to be aware of is that United Technologies does a significant amount of business in China, especially its Otis division. A potential trade war with China could impact the company’s earnings results.

Overall, United Technologies is not a highly recession-resistant business. Earnings-per-share would likely decline in the event of a recession over the next few years, although the company should remain profitable and continue to pay its dividend even during an economic downturn.

Valuation & Expected Returns

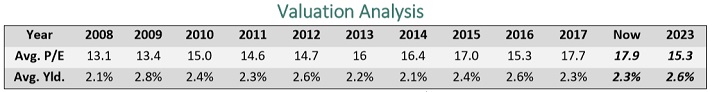

Based on the recent closing price of $116 and expected EPS for 2019 of $7.85, shares of United Technologies trade with a price-to-earnings ratio of 14.8. This compares favorably to the average price-to-earnings ratio of 20.4 for the S&P 500. United Technologies has a ten-year average price-to-earnings ratio of 15.3.

A breakdown of United Technologies’ historical valuation can be seen in the table below:

Note: The price-to-earnings calculation of 14.8 reflects 2019 expected earnings-per-share of $7.85.

As a result, shares of United Technologies appear to be slightly undervalued on a forward price-to-earnings basis. If shares were to revert to their average valuation, shareholders would see an additional 0.7% in annual returns through 2024.

United Technologies can generate returns from earnings growth and dividends as well. A breakdown of total returns is as follows:

- 3% earnings growth

- 0.7% multiple expansion

- 2.6% yield

We expect a relatively modest earnings growth rate of 3% over the next five years. While United Technologies is a high-quality business with a leadership position in the industry, we acknowledge the various risks facing the future outlook of the company.

Potential risk factors include integration risk with the large Rockwell Collins acquisition, geopolitical risk, and the risk of a global economic slowdown. In total, United Technologies could offer shareholders an annual return of 6.3% through 2024.

Final Thoughts

United Technologies is in the process of transforming itself. After acquiring Rockwell Collins and separating its low growth businesses, the company is poised for future growth. Focusing on its aerospace and defense businesses will likely put United Technologies in a position to succeed in future years.

In addition, the company recently became a Dividend Aristocrat and offers an above-market yield. This could make the stock an attractive option for income investors.

That being said, we find that shares of United Technologies only offer a mid-digit total return at the moment. While we like the company’s growth prospects going forward as well as the long history of dividend growth, we rate this stock as a hold due to a fairly low rate of expected growth, as well as a fairly valued share price. That said, United Technologies would become a more attractive stock–and possibly a buy–on a meaningful pullback in the share price.

Disclaimer: Sure Dividend is published as an information service. It includes opinions as to buying, selling and holding various stocks and other securities. However, the publishers of Sure ...

more