Dividend Aristocrats In Focus: Amcor Plc

In order to become a Dividend Aristocrat, a company must possess a profitable business model and durable competitive advantages, along with the ability to raise dividends even during recessions. Consumer staples stocks such as Amcor plc (AMCR) have all the necessary qualities of a Dividend Aristocrat.

Amcor has increased its dividend for 25 years in a row. It has maintained its dividend growth streak thanks to a very strong brand portfolio.

Business Overview

Amcor plc that trades on the NYSE today was formed in June 2019 with the completion of the merger between two packaging companies, U.S.-based Bemis Co. Inc. and Australia-based Amcor Ltd. Amcor plc’s current headquarters is in Bristol, U.K. Amcor currently trades with a market capitalization above $17 billion.

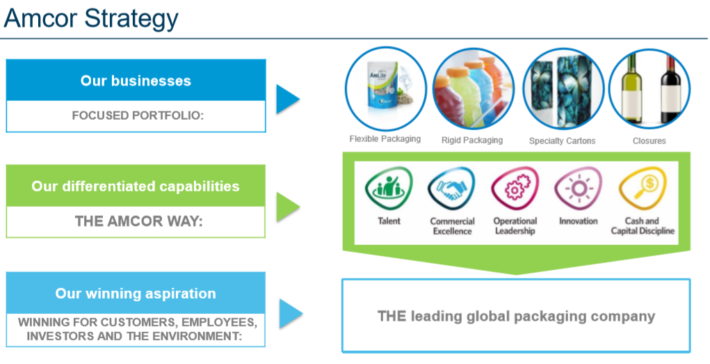

Amcor develops and manufactures a diverse array of packaging products for many consumer uses all over the world, including food and beverage, medical and medicinal, and home and personal care. It consists of two main business segments: Flexible Packaging and Rigid Packaging.

Source: Investor Presentation

Amcor reported its first quarter (fiscal 2020) earnings results on November 7th, 2019. The company announced that it generated GAAP net income of $66 million and GAAP earnings Per Share of 4.1 cents per share. Meanwhile, adjusted EBIT came in at $335 million, up 9.5% in constant currency terms year-over-year and adjusted net income of $218 million and adjusted earnings per share of 13.4 US cents both reflected robust 14.9% growth in constant currency terms.

The main drivers of growth in the flexibles business segment were sales growth across the segment combined with lower costs. Global healthcare and emerging markets experienced particularly strong growth alongside strong operating cost performance and benefits derived from legacy restructuring. There was, however, weak performance in the legacy Bemis Latin American business.

Meanwhile, beverage volume growth and favorable product mix drove growth in the rigid packaging segment. The North American market saw both volume and mix benefits, while the Latin American market only benefited from volume growth. Additionally, there were significant benefits derived from previously announced restructuring projects.

Simultaneously with its earnings release, the company announced a quarterly dividend of 11.5 cents per share and also released the news that it had repurchased 5.8 million shares in the quarter as part of management’s $500 million buy back program.

Integration of the recently acquired Bemis business was progressing well and remained on track to deliver $180 million of pre-tax cost synergies over the next three years. Finally, the company reaffirmed its fiscal 2020 expectations for adjusted earnings-per-share growth of 5% to 10% in constant currency terms.

Growth Prospects

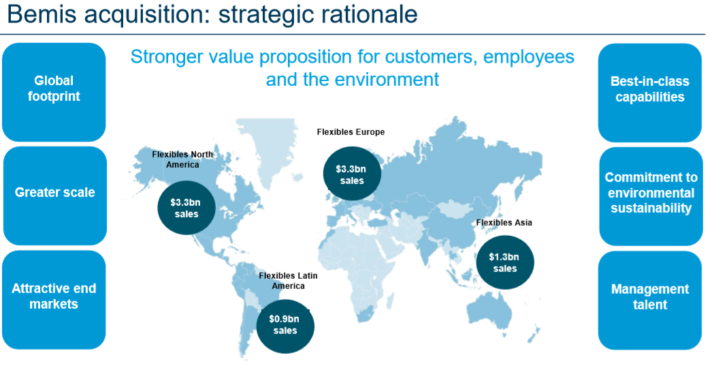

Amcor is counting on its Bemis acquisition to drive strong growth over the next half-decade. The main factors that will drive this growth acceleration are its global footprint opening up new attractive end markets and customers for the company’s products, and greater economies of scale driving efficiencies and higher margins.

Source: Investor Presentation

The company is also in the midst of an aggressive share buyback program that should boost per share growth numbers. Furthermore, its balance sheet is quite strong with the leverage ratio at just 2.7x, giving it flexibility to finance its dividend, share repurchases, and remain opportunistic on future growth opportunities.

We believe that all of these factors should combine to generate robust 8% annualized earnings per share growth over the next half-decade.

Competitive Advantages & Recession Performance

Amcor’s competitive advantages are fueled by its industry leadership position. Although Amcor’s headquarters are in Great Britain, its largest markets are in the Americas. That means Amcor should be relatively safe from potential future declines to the pound (or to the Australian dollar, for that matter).

In addition, Amcor’s products are used every day around the world. People around the world will continue to need packaging. Amcor’s emphasis on recyclable and reusable products should appeal to more conscious end-users, while the merger with Bemis brings it huge prospects in developing markets.

Plus, with the merger into one gigantic manufacturing entity, Amcor has increased ability to negotiate better costs from its suppliers. This should make Amcor an unstoppable force in the packaging industry.

Amcor is also fairly resistant to recessions, as it was able to continue growing its annual dividend through the Great Recession. As Amcor was not a publicly-traded company during the Great Recession, its earnings-per-share performance during the downturn is not available.

We do know that since the company was recently added to the Dividend Aristocrats list, the Great Recession was not nearly enough to threaten the dividend. This is a rare accomplishment that demonstrates the company’s defensive business model.

It is reasonable to assume Amcor’s earnings-per-share would decline during a recession, as the company’s global business model is reliant on economic growth. But it should continue paying (and raising) its dividend each year for the foreseeable future.

Valuation & Expected Returns

We expect Amcor to generate earnings-per-share of $0.50 for 2020. Based on this, and a current share price of ~$10.45, shares of Amcor are currently trading at a price to earnings ratio of 21.

This is a high multiple, even taking into consideration the strength of Amcor’s business. Even using a conservative multiple, we think that a recession-resistant Dividend Aristocrat with mid-to-high single-digit growth prospects such as Amcor should trade for 16 times earnings.

If shares were to revert to 16 times earnings, this implies the potential for a 5.3% annualized valuation headwind over the next five years. On this basis, the valuation appears stretched, even by Amcor’s lofty standards.

A strong five-year expected earnings-per-share growth rate (8%) and dividend yield (2.2%) will help boost shareholder returns, but a reduction in the security’s valuation to a more “normalized” level would offset most of the returns from the dividend payout. Overall, we expect total annual returns of approximately 4.9% through 2025.

Final Thoughts

Each year, we individually review every Dividend Aristocrat. There were 7 additions to the list for 2020, bringing the total to 64. The 2020 Dividend Aristocrats In Focus series concludes with Amcor.

Amcor is uniquely positioned for strong growth in the coming years thanks to its recent acquisition that has opened up several new attractive end markets and given the company access to unlocking valuable synergies. Furthermore, the company has the balance sheet to fund an aggressive $500 million share repurchase program which should boost per-share metrics moving forward.

As a result, even though shares look a tad stretched relative to our fair value multiple estimate, we still think that shares offer decent value here. With expectations of ~5% annualized total returns over the next half-decade, we view Amcor as a hold right now.

That said, it might be worth a look for dividend growth investors with a more conservative outlook, as its 2.2% yield is above average for the S&P 500 and its strong growth track record and recession-resistant business model make it an attractive long term holding. Finally, with its robust growth outlook, it will likely continue growing its dividend for the foreseeable future.

Disclaimer: Sure Dividend is published as an information service. It includes opinions as to buying, selling and holding various stocks and other securities. However, the publishers of Sure ...

more