Dividend Aristocrats In Focus: Albemarle Corporation

There were 7 additions to the Dividend Aristocrats for 2020. After increasing its dividend by 9.7% last year, Albemarle Corporation (ALB) joins this exclusive club.

Albemarle is reaping strong growth from continued demand for lithium. It is poised to continue growing for many years, as demand for lithium is only set to rise in the years ahead.

While we view Albemarle stock as slightly overvalued, it is a suitable holding for dividend growth investors, provided investors accept the volatile nature of the lithium industry.

Business Overview

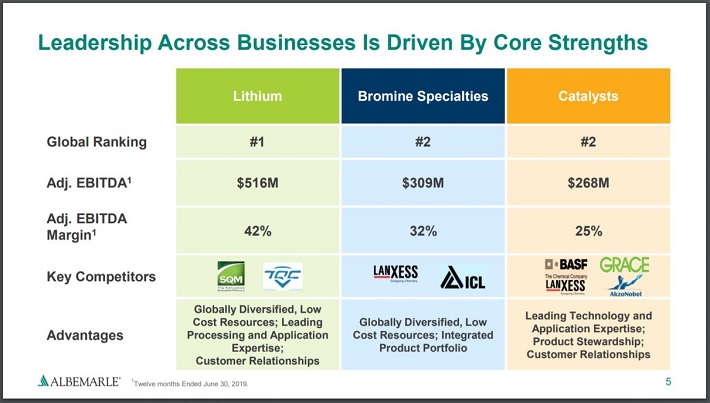

Albemarle is the world’s largest producer of lithium and the second-largest producer of bromine. The company relies on these two products for approximately two-thirds of sales.

Albemarle produces lithium from the company’s salt brine deposits in the U.S. and Chile, where the costs of producing lithium are very low.

Albemarle specializes in producing specialty chemicals. The company is a worldwide leader in each of its businesses.

(Click on image to enlarge)

Source: Investor Presentation, slide 5

Albemarle is composed of three segments:

- Lithium & Advanced Materials (49% of sales)

- Bromine Specialties (21% of sales)

- Catalysts (21% of sales)

- Other (9% of sales)

Lithium is used in electric cars, batteries, pharmaceuticals, and airplanes among other applications. Bromine is used in electronics, construction and automotive industries. Lithium continues to drive the company’s growth.

Albemarle reported third-quarter earnings results on 11/6/2019. The company earned $1.53 per share during the quarter, which was a 17% increase year-over-year and beat estimates buy $0.03. Revenue improved 13% to $880 million, though this was slightly below estimates. Currency reduced results by approximately 1%. Adjusted earnings-per-share increased 17% year-over-year.

Growth Prospects

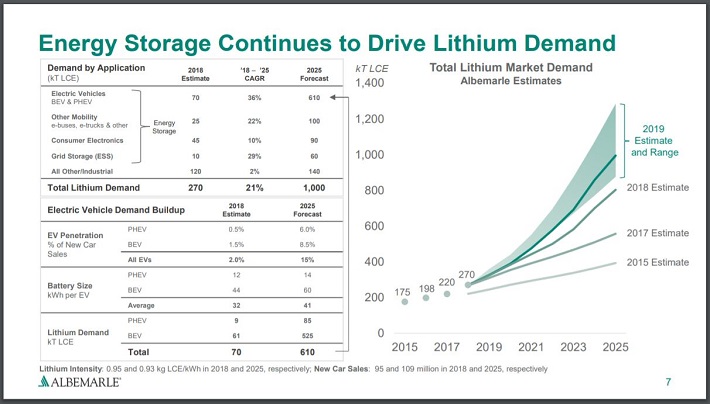

Albemarle’s stands to benefit from the increased sales of electric vehicles as the company’s lithium is used to provide the batteries. Lithium is expected to be a growth segment over the next five years, due to increasing demand for a wide range of applications including electric vehicles and consumer electronics.

(Click on image to enlarge)

Source: Investor Presentation, slide 7

Energy storage is expected to spike in the coming years as more consumers purchase electric vehicles. Electric vehicles are projected to account for 15% of all new car sales by 2025, up from just 2% in 2018. Battery size is also expected to grow.

With this growth will come a significant increase in demand for lithium. Fortunately, Albemarle’s mines in Chile offer an inexpensive source of lithium. Demand is already robust for the lithium.

Albemarle saw strong growth in the most recent quarter as sales for lithium were up 22% to $330 million year-over-year due to increased volumes and a 1% improvement in price. Much of this volume growth was due to increased sales for electric vehicles. Results would have been even better if not for a shipment delay related to a typhoon in the Sea of Japan.

Sales for Bromine Specialties grew more than 10% to $256 million due to a combination of higher prices and volumes. Catalysts improved 4% to $261 million as favorable pricing was partially offset by lower volumes. Sales for the Other segment improved 38% to $32 million on higher volumes for fine chemistry services.

Albemarle has compounded earnings-per-share at a rate of almost 13% over the last decade, but much of this growth occurred at the beginning of the decade. Earnings-per-share have also been somewhat unpredictable during this time. The company is expected to earn $6.12 per share for 2019.

Competitive Advantages & Recession Performance

Despite being among global leaders in multiple businesses, Albemarle isn’t content to rest on its previous success. The company has been active in acquiring businesses that strengthen its market share.

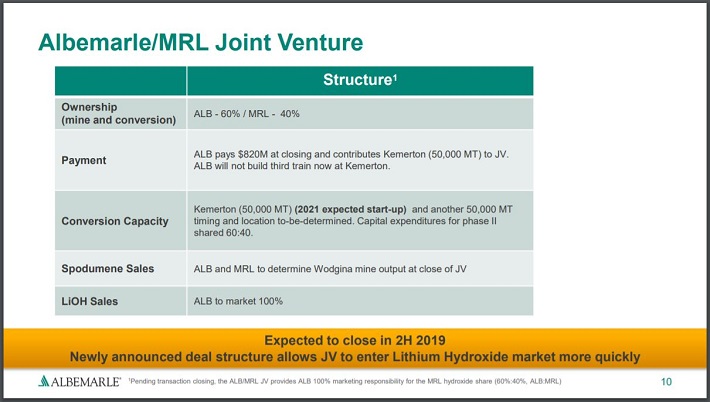

For example, Albemarle announced at the end of October of 2019 that it would be entering into a joint venture with Mineral Resources Limited (ASX: MIN), an Australian mining company.

(Click on image to enlarge)

Source: Investor Presentation, slide 10

Under terms of the agreement, Albemarle will invest $3.1 billion to acquire a 60% interest in Mineral Resources Limited’s Wodgina mine in Western Australia. In return, Albemarle will transfer 40% share of two lithium hydroxide conversion trains to Mineral Resources Limited.

The two companies will also construct two mines in the area over time. Mineral Resources Limited will manage these facilities while Albemarle will market 100% of the output from the mines.

The decision to add strategic assets to areas of strength in its business is a prudent move given that the company is not recession-proof. Listed below are the company’s earnings-per-share during and after the last recession:

- 2007 earnings-per-share of $2.41

- 2008 earnings-per-share of $2.40(0.4% decrease)

- 2009 earnings-per-share of $1.94 (19% increase)

- 2010 earnings-per-share of $3.51 (45% increase)

The specialty chemical business is heavily reliant on demand from customers. Lower demand results in lower pricing, which negatively impacts Albemarle’s performance. It is likely that the company would face a similar type of slow down during the next recession as well as demand for products dissipates.

Albemarle’s business has seen varied performance even when not facing a worldwide slow-down. Three times in the last decade (2012, 2014, 2017) the company has seen an earnings-per-share decline at least 27% from the previous year. Investors interested in investing in Albemarle should understand that ownership of the stock comes with risks, due to the volatile nature of its industry.

Valuation & Expected Returns

Albemarle’s stock currently trades with a price of ~$80. Using our expected earnings-per-share of $6.12 for the year, shares have a price-to-earnings ratio of 13.1. The stock has a 10-year average price-to-earnings ratio of 18.3, but this includes several years where the valuation was extremely high as earnings-per-share suffered drastic declines.

We feel that a target multiple of 12x earnings is more appropriate for shares of Albemarle as the company is exposed to recessions and industry downturns. The uneven nature of earnings-per-share warrants a slightly lower valuation multiple, in our view.

If shares were to revert to the target valuation of 12x by 2025, total annual returns would be reduced by 1.8% per year over this period of time.

That said, Albemarle’s total returns will also include dividends and earnings growth. Albemarle has been rather aggressive in raising its dividend, with a 10% compound annual growth rate over the last decade. The most recent increase is nearly in-line with the long-term average growth rate.

Just as important as dividend growth is dividend safety. Albemarle is expected to payout just 24% of projected earnings-per-share in the form of dividends. This is slightly below the 10-year average payout ratio of 28%. This makes it likely that the company would be in a position to continue to increase its dividend even in a prolonged economic downturn.

Shares currently yield 1.9%, about on par with the average yield of the S&P 500 Index. Albemarle’s total return will consist of the following:

- 8% earnings-per-share growth

- 1.8% multiple reversion

- 1.9% dividend yield

In total, Albemarle is expected to offer a total annual return of 8.1% over the next five years.

Final Thoughts

Reaching a Dividend Aristocrat status is no small feat. Less than 13% of the entire S&P 500 has managed to grow dividends for at least 25 years in a row. Albemarle was one of just a few companies to join this exclusive group in 2019.

Albemarle is the dominant player in its sector and has taken steps to improve upon its positioning. The company benefits from low-cost mines and its leadership position in multiple categories. The company is far from recession-proof and has experienced some earnings declines over the last decade, but this makes the company’s dividend growth track record even more impressive. Shares may yield less than 2% today, although the dividend is growing at a high rate.

Projected returns are slightly below the usual 10% threshold that earn stocks a buy recommendation from Sure Dividend. The stock is a solid holding for dividend growth investors, particularly those looking for exposure to the lithium industry, and would be an even stronger buy if the stock declines below fair value.

Disclaimer: Sure Dividend is published as an information service. It includes opinions as to buying, selling and holding various stocks and other securities. However, the publishers of Sure ...

more