Disney+ Launches: Netflix Killer? Maybe Not

Tuesday, November 12, was a momentous day for consumers. That’s when Disney launched its Disney+ streaming service.

This is a game-changer. I’m not exaggerating when I say this could be on the same scale as when Henry Ford started paying his workers $5 for an eight-hour workday.

For $169.99 per year or $6.99 per month, subscribers can have streaming access to the gigantic Disney warehouse. Mind you, that’s not just Mickey and Minnie. It’s also Star Wars. It’s also Marvel. It’s also Fox and much, much more—and it’s all for less than 20 cents per day.

But my point is that this is more than just a lot of content. Rather, the cord-cutting revolution has become the streaming wars, and we’ve only started. The days of channel surfing are gone. I don’t know what will happen to basic cable.

Fortune claims viewers are “ditching cable for streaming faster than anyone expected.” The Financial Times says we’re living in the “golden age” of television. I think that’s right.

Let’s consider some numbers. It’s reported that over 147 million Americans will watch Netflix this month. The streaming TV industry is set to double in five years to $124.5 billion. This year alone, Netflix, Amazon, Disney, Hulu, and dozens of others poured over $93 billion into streaming.

With Disney entering the streaming space in such a big way, all the other players will have to respond. In fact, they’ve already started. There’s PlutoTV, Vudu, Philo, DirecTV Now, AT&T Now, PlayStation Vue, Xumo, KlowdTV… even AMC theaters has an app.

The old-timers are joining in. CBS has its own service called CBS All-Access with original programming found nowhere else. NBC announced their new service, Peacock, which is set for kickoff in 2020. Netflix isn’t taking this lightly. Last month, the company admitted to its shareholders that all these new services could harm subscriber growth.

The point I try to get across to investors is that the Streaming Wars isn’t about some new gimmick that companies have developed. Instead, it fundamentally alters the relationship between viewers and content providers. The wall of distribution has severely melted away.

When I was a kid, there were three networks. We had so little choice. Imagine if you had to make dinner for everyone in America. Obviously, the dinner would be pretty bland chicken and potatoes. When you try to please everyone, you wind up pleasing no one, and pretty soon, you’re watching the Dukes of Hazzard on your mom’s old Zenith.

Now, the walls have broken down.

Let’s Take a Closer Look at Three of the Big Players in the Streaming Wars

There’s so much going on right now in the Streaming Wars, so let’s take a step back and look at four of the key players.

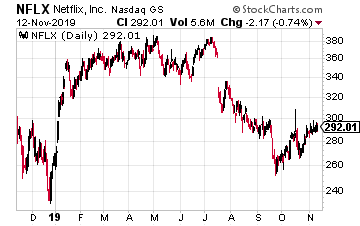

At the center of the streaming universe is Netflix (NFLX). The company is nearing 150 million paid subscribers. You can get Netflix just about anywhere on the planet except for China and North Korea and a few other places.

Netflix started out renting DVDs, and now it’s all about streaming. Not only that, but Netflix also produces its own content like House of Cards. Since its IPO in 2002, shares of Netflix are up more than 25,000%.

But Netflix is vulnerable, simply because everyone has their sights set on them. Still, I would never count them out.

According to Cisco (CSCO), internet traffic was 100 Gigabytes per DAY in 1992, 2,000 GB per SECOND in 2007, 46,600 GB per SECOND in 2017, and is projected to be 150,700 GB per SECOND in 2022.

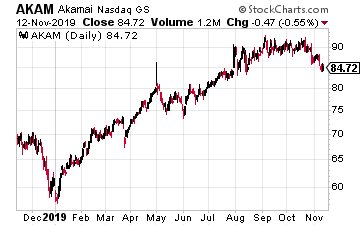

With growth rates like that, I don’t believe we’ll go wrong with a company responsible for delivering 20-30% of all internet content. I’m talking about Akamai Technologies (AKAM) and their Content Delivery Network or CDN.

With servers and delivery technology literally located in almost every country in the world, Akamai is responsible for providing a fast and reliable internet experience to users. And continually growing demand has meant continually growing earnings. Over the past year, the company grew earnings by almost 24%.

Providing a one-two punch of content delivery and security services, Akamai has effectively built what Warren Buffet would call a “moat” around its business.

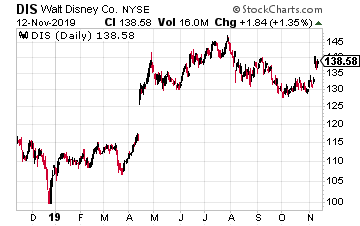

Lastly, I’m going to end where we began, with Walt Disney (DIS). Charlie Munger, Warren Buffett’s partner, once described Disney as like an oil company that can put its oil back in the ground once it’s done so it can drill it out again.

His point is that Disney has so much content that it can reintroduce it generation after generation. That’s why streaming is so important to the Mouse House.

For the last several years, Disney has pursued a strategy of buying great entertainment assets. In 2003, Disney bought Pixar. Three years later, it added Marvel Entertainment. Three years after that, Disney wrote a check for $4 billion to buy Lucasfilm and now Mickey Mouse owns Star Wars.

Then Disney got aggressive. In 2017, the company struck a major deal with Fox. Disney bought several of Fox’s assets like the 20th Century Fox film and TV studio, plus cable channels like FX. This was all part of the plan.

It’s staggering to think how much content Disney owns. Everything from Yoda to Spider-Man to Bart Simpson. The company can reintroduce Star Wars or Frozen or The Lion King to each generation. Now you see what Charlie Munger meant.

Last week, Disney released a great earnings report. The company made $1.07 per share, which topped Wall Street’s consensus by 12 cents per share. I’ve seen the future of entertainment, and it has mouse ears.

Disclosure: None.