Disappointing Selling Pressure

Some pent-up buying built over the weekend couldn't be sustained over the course of today and instead markets finished near their lows. It was a disappointing finish to the day and a poor start for the week after a positive Friday set up.

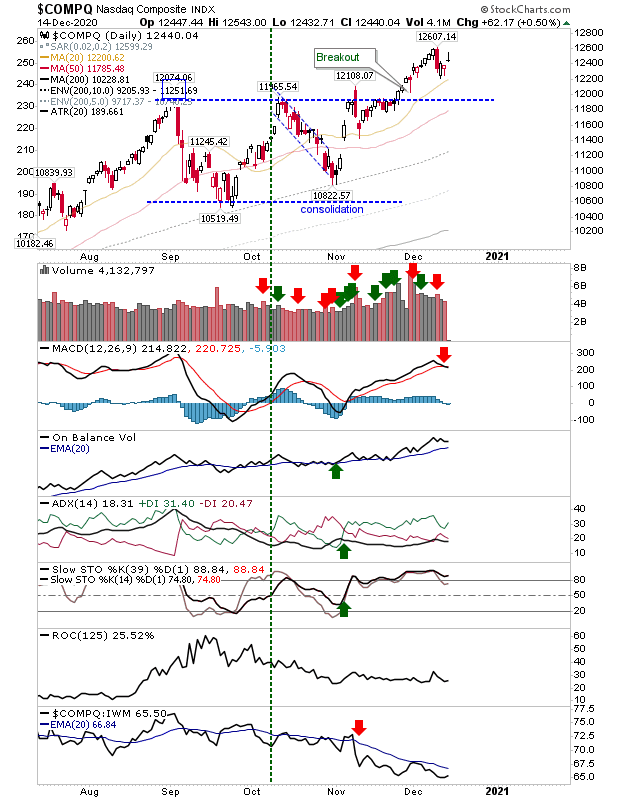

The Nasdaq gapped higher and did at least hold on to its gap by the close. However, it wasn't enough to stop a 'sell' in the MACD trigger.

The S&P finished with a bearish engulfing pattern, although volume was lighter - so no distribution, which takes some of the sting out of the selling. The index had already registered 'sell' triggers for the MACD and On-Balance-Volume, but there was an acceleration in the relative underperformance of this index to the Russell 2000.

The Russell 2000 finished with a bearish black candlestick at a rally peak. It's still holding support but it's looking vulnerable after today. Technicals are net bullish, but the MACD is close to a new 'sell' trigger.

We have gone from an optimistic close from last week to a pessimistic start to this week. Momentum is with bulls, but this has been a powerful rally running since the end of October. A period of sideways action would be welcome in consolidating breakouts, for the Russell 2000 in particular.

Disclaimer: Investors should not act on any information in this article without obtaining specific advice from their financial advisors and should not rely on information herein as the primary basis ...

more