Didi Denies Report About Potentially Going Private

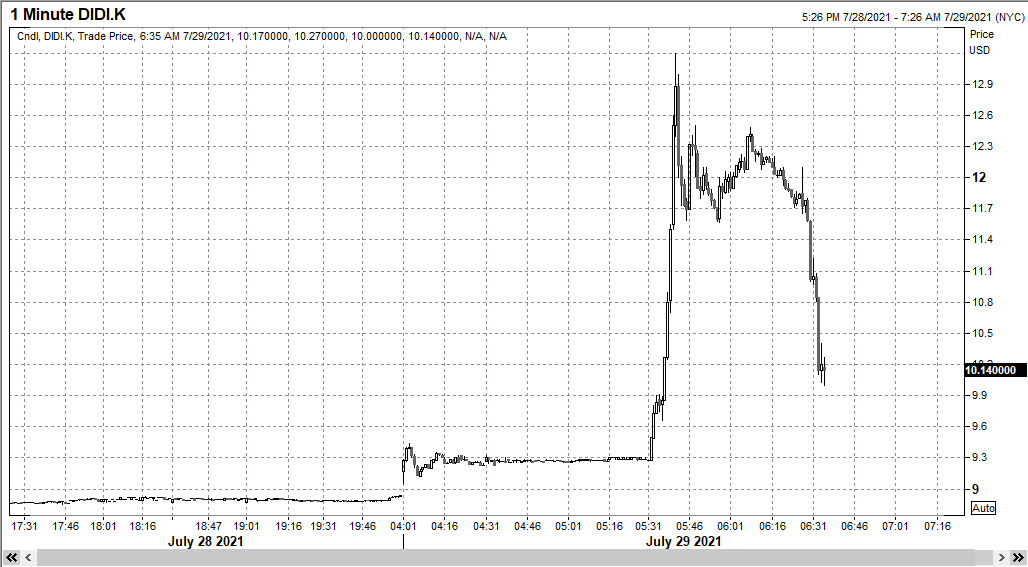

Update (0633ET): Didi shares are giving back most of their stratospheric premarket gains now that the company has publicly denied reports that it's still considering plans to go private.

Shares were recently down 25% off the intraday high of $13.20.

* * *

Thursday is shaping up to be another day of insane newsflow out of China.

Hong Kong and US-listed Chinese stocks rallied overnight on news that China's top securities regulator had told a group of American bankers that Beijing had decided against barring Chinese firms from listing in the US using the Variable Interest Entity structure - a legal workaround used by Chinese firms to facilitate US listings - adding only that the framework would need to be "adjusted" to satisfy national security concerns on a case by case basis.

According to Bloomberg, which broke the story, Fang Xinghai made the comment during a virtual meeting with major investment banks on Wednesday following days of brutal selling in Chinese stocks.

As traders in the US started waking up to this news, the Wall Street Journal followed up with another, even more explosive, report. Despite the recent change of heart by leaders in Beijing, the paper reported that Didi is considering going private one month after its IPO "in order to placage authorities in China and compensate investors for losses incurred since the company listed in the US."

A tender offer for its publicly traded shares "is one of the preliminary options being considered" as the firm continues to hold discussions with its underwriters and backers about strategies for reversing some of the damage done by the IPO. The firm famously raised more than $4 billion in its IPO, the biggest stock sale by a Chinese firm since Alibaba's 2014 blockbuster listing.

Going private would be a boon for shareholders who held on despite the immense volatility in Didi's shares in the weeks since its IPO. It might also stymie law firms that are already filing class-action lawsuits against the company, its underwriters, and its board. The lawsuits mostly allege that the company made false and misleading statements, and didn't adequately inform investors about the political risks involved with the deal.

Didi reportedly started contemplating its go-private plan in mid-JDuly, during the worst of the regulatory pressures from Chinese regulators, who had just launched a data security investigation into the firm, barring its apps from Chinese app stores. Regulators are supportive of the plan "in principle", WSJ added, though it noted that "SoftBank is unlikely to help fund the deal" (though Didi is also reportedly considering bringing in state-backed investors).

Which is ironic, because as Didi shares surge in premarket trading, it looks like there's one major loser in all of this: SoftBank, which decided to finally scalp one-third of its position in Uber, which it had backed from a startup, to try and stanch the bleeding and cover its Didi-related losses.

Disclaimer: Copyright ©2009-2021 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more