Despite What Everyone Is Saying, Breadth Has Done Better Than Price

With all the digital ink being spilled over the "problems" with breadth not confirming the V-shaped recovery, we thought we would show how wrong that analysis is.

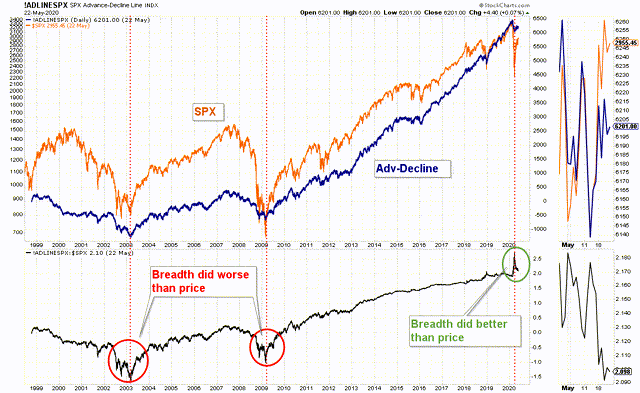

When we looked at the advance-decline line in ratio to the SPX, price we saw that in both the 2000-02 and 2008 bear markets the ratio dropped significantly, which means that the advance-decline line did worse than the SPX price, but in the virus-induced pullback the ratio increased, which means that the advance-decline line did better than the SPX price; positive breadth even as the price collapsed.

This confirms the veracity of the quick recovery in the SPX (chart below).

(Click on image to enlarge)

Comments

Please wait...

Comment posted successfully.

No Thumbs up yet!