Despite The Buying, Breakdowns Remain

Last week closed with sellers in control and this pessimism was reflected in the buying of the last two days.

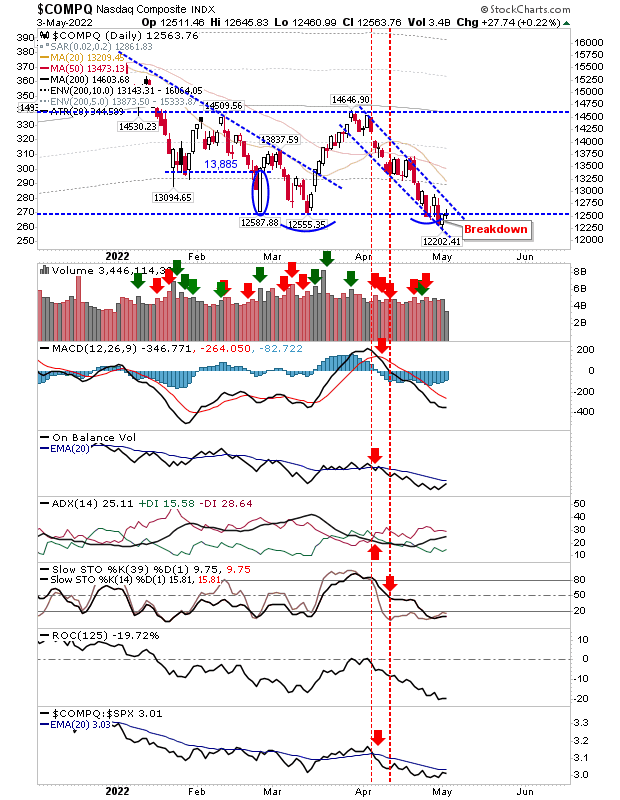

The Nasdaq had undercut March lows and had managed a day of accumulated buying yesterday, but today's neutral doji marked doubts on behalf of buyers. Technicals are net bearish, but there is a slowly improving relative performance for the index which may be reflected in the Nasdaq over the coming days.

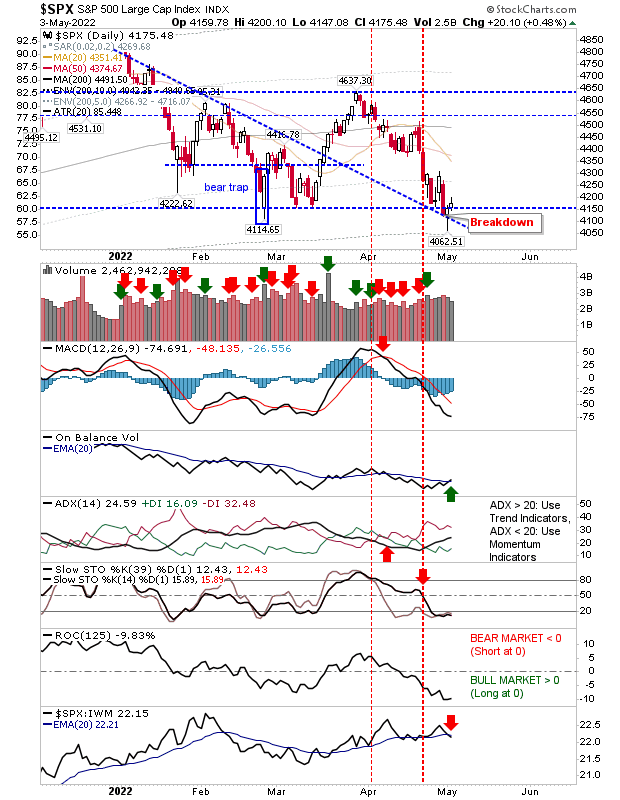

The S&P was able to recover support (barely), but I would hardly count it as a 'bear trap' yet. On a positive front, there was bullish 'buy' trigger in On-Balance-Volume. If this is a bottom - of sorts - then we need to see a confirmed move above 4,300, otherwise, price action is just noise.

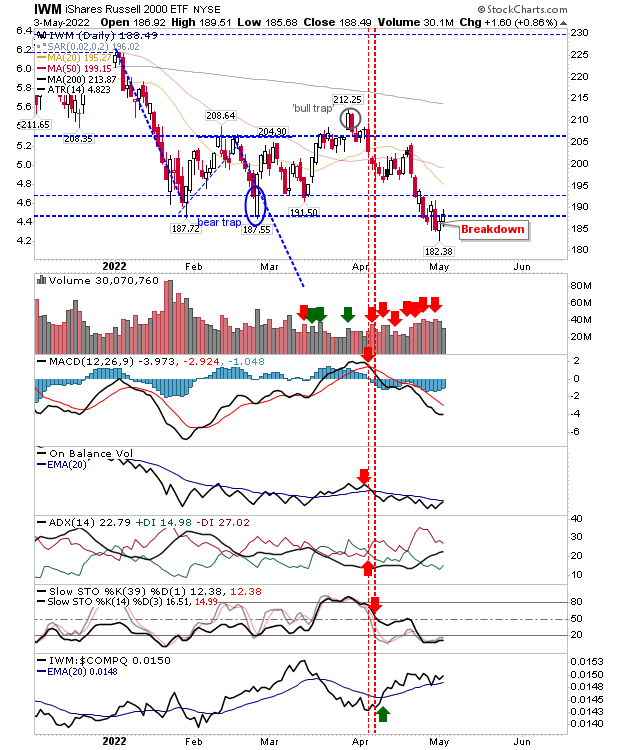

The Russell 2000 (IWM) moved deeper beyond support, requiring a larger gain to return itself above support. The index is outperforming peer indices during the course of the April downleg, but it needs to do more to confirm a return above support and mark a 'bear trap'.

I'm still looking at the measured move target lower as the preferred move here, although the last couple of days give buyers a chance to build a decent long trade. My protective stops for the monitored positions have not been hit yet, but buyers really need to step up far more than they have over the past couple of days.

Disclaimer: Investors should not act on any information in this article without obtaining specific advice from their financial advisors and should not rely on information herein as the primary ...

more