Despite Stellar Trading Results Morgan Stanley Hit By Loss Provisions; Warning Of 30% Drop In April Trading Volume

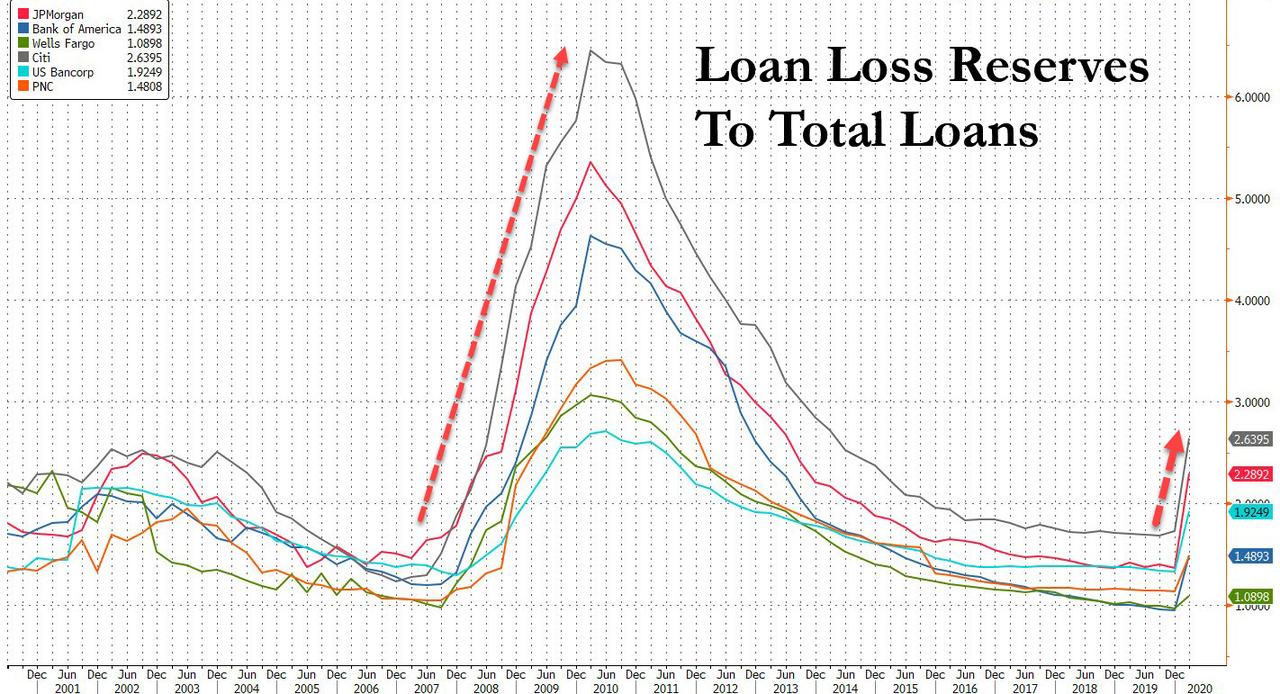

While corporate America's income statement has been hit hard by the plunge in revenue and cash flow, its balance sheet remains resilient for now, although not for long with the pain expected to come over time as cash and liquidity gets depleted. For the US banking system, it's been the other way around, with balance sheets emerging as the source of pain as banks scramble to predict the future and estimate how many billions in loans will default - so far the big 4 banks have taken $24BN in loss reserves - even as their income statements remain solid and in fact - largely thanks to the furious trading in March - many banks posted near-record sale and trading numbers.

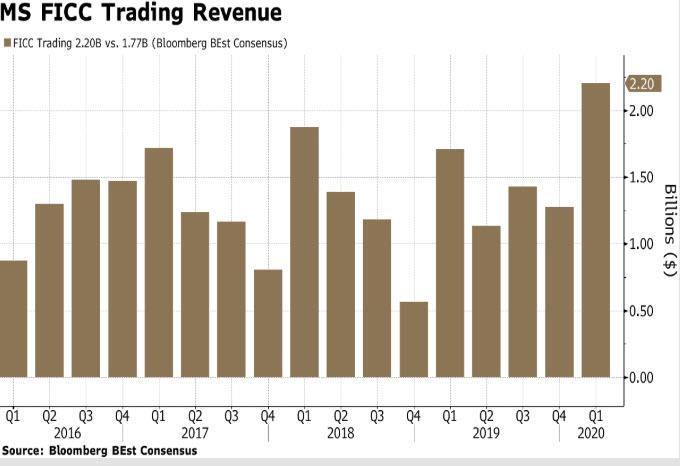

Morgan Stanley was one of them, with the bank rounding out Wall Street’s banner week for trading desks with a 24% first-quarter revenue surge, pushing the industry’s tally to the highest in eight years. The firm, which sports the world’s biggest stock-trading shop, said that business posted a 20% jump in the first quarter, with fixed-income revenue surging above $2 billion for the first time since 2012.

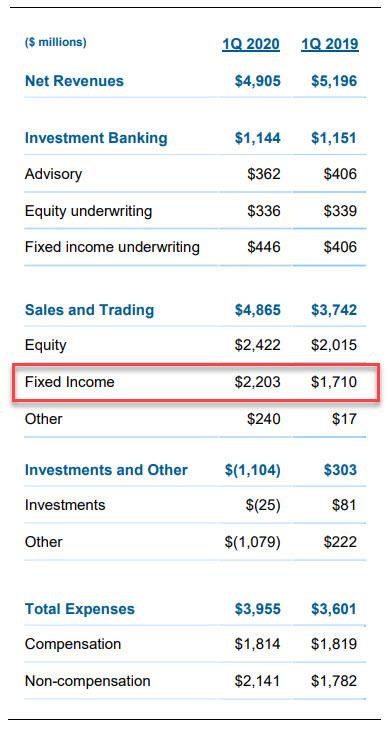

Some more details on the bank's sales and trading prowess, which jumped by 30% from a year ago:

- Equity sales and trading revenue 2.42BN (exp. 2.23bln, prev. 2.02bln Y/Y), driven primarily by the Americas and Asia.

- FICC sales and trading revenue 2.2BN (exp. 1.71bln, prev. 1.71bln Y/Y) "partially offset by declines in credit products, notably in securitized products and municipal securities, which were negatively impacted by market dislocation."

The bank’s sales and trading group was also helped by gains on economic hedges that it put in place as part of its corporate lending activity.

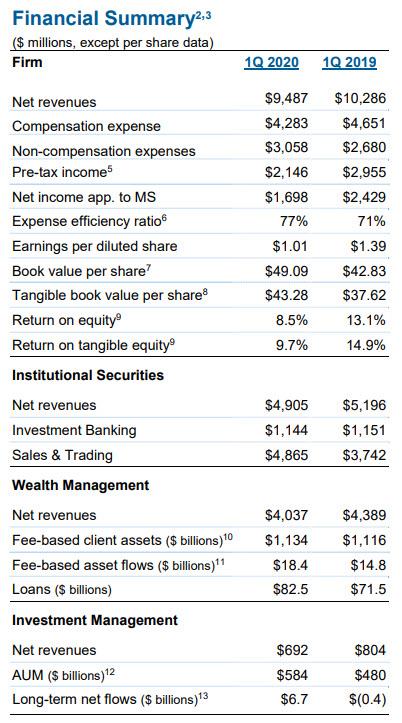

Meanwhile, investment banking revenue decline by 1% to $1.144BN from $1.15BN as advisory revenues fell to 362MM from 406MM driven by lower completed M&A activity on a decline in volumes, particularly in large transactions. Fixed Income underwriting rose to 446MM from 406MM, "clients accessed the market to benefit from the lower rate environment and to raise additional liquidity in March." At the same time, equity underwriting came in better than analysts expected, at $336 million, topping the $303 million average estimate, although the firm warned there was a “steep decline” in global equity volumes in the second half of the quarter. Other revenue -1.1bln (prev. +222mln Y/Y), "reflecting mark-to-market losses on corporate loans held for sale due to the widening of credit spreads and an increase in the allowance for credit losses for loans held for investment"

And yet, just like the rest of its peers, the bank was hit by the surge in market volatility as firmwide revenue dropped 8%, driven by more than $1 billion of provisions and writedowns on loans and the markdown of an energy-related investment. The result was a miss in both the top and bottom line, with revenue of $9.487BN missing exp. of $9.73BN, and EPS of $1.01, also below the exp $1.14, even as the bank said it had "not experienced any significant loss of operational capability as the company implemented pandemic related responses."

"Over the past two months, we have witnessed more market volatility, uncertainty, and anxiety as a result of the devastating COVID-19 than at any time since the financial crisis,” Chief Executive Officer James Gorman said in a statement Thursday. And for him it was personal: Gorman, 61, said last week that he tested positive for the coronavirus in March and had informed the board. He was never hospitalized and continued to run the bank while quarantined. Morgan Stanley didn’t disclose the diagnosis until the CEO had recovered and been cleared by his doctors.

There was more bad news: the bank also said the pandemic and its effect on the economy may “adversely impact our future operating results and the attainment of our financial targets.” During the earnings call, CFO Pruzan says trading volumes in April are down as much as 30%. Morgan Stanley’s stock did not like the news and was down 1.1% to $37.98 at 7:28 a.m. in early New York trading.

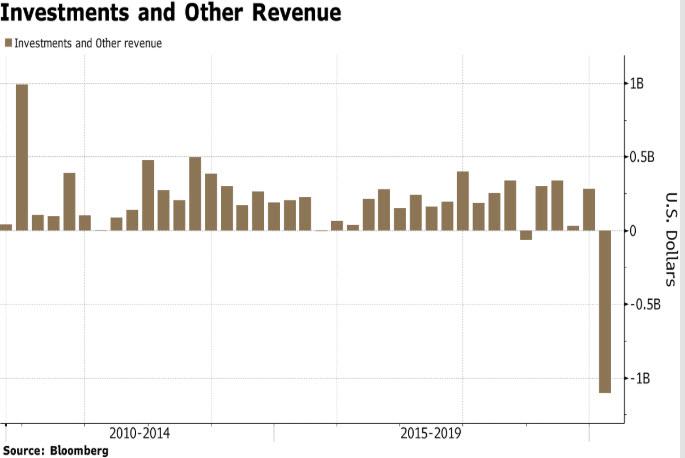

Curiously, the bank recorded a $1.079 billion loss in its “investments and other” unit, blaming that on a decline in revenue on investments primarily driven by a markdown on an "energy-related investment."

The bank also saw revenue decline due to some mark-to-market losses on corporate loans held for sale due to the widening of credit spreads and an increase in the allowance for credit losses on loans it holds for investment. Those declines, the bank says, were due to the deterioration in credit that began in March.

The question now is how long will the boost from the March volatility surge persist: as Bloomberg notes, the outbreak of the coronavirus sparked wild price swings in stock and bond markets, a boon for Wall Street trading desks that became an island of prosperity as the pandemic attacked other businesses. The top five trading firms generated a combined $27 billion in revenue, rebounding from years of low volatility that kept trading operations underperforming.

Unfortunately, that surge will hardly be enough to offset the tens of billions in loan losses that are coming as millions of Americans default on their loans.

The gains at Morgan Stanley showed its traders can still be counted on to help boost results even as the firm shifts more of its focus and resources to managing money. That operation had an 8% drop in revenue. Gorman has made expanding in wealth management his top priority in the years following the financial crisis. In February, the firm unveiled plans to purchase E*Trade Financial Corp. as Gorman turned to acquisitions to speed up Morgan Stanley’s makeover. It was the industry’s biggest takeover since the 2008 financial crisis, but the timing was particularly unlucky: The day of the announcement marked the start of a historic slide in the S&P 500 index that at one point erased a third of its value.

Disclaimer: Copyright ©2009-2020 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more