Despite S&P Rise There Is Still Widespread Pessimism

“Davidson” submits:

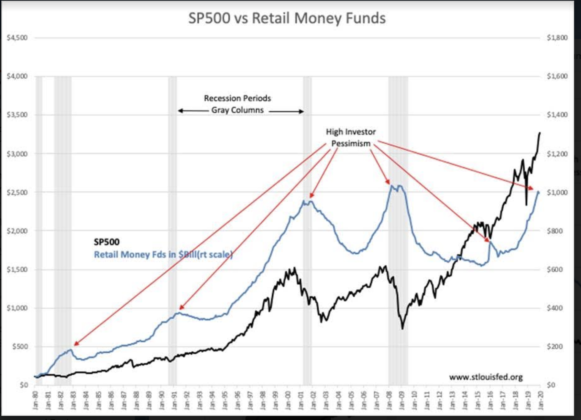

Investors have a history seeking safety in Money Funds when pessimistic. The history of the SP500 v Retail Money Funds show a very strong correlation between major lows in the SP500, recession lows and peaks in Retail Money Funds (RMF) asset levels. A detailed analysis shows that the actual peaks in pessimism as implied by peaks in RMF is often close to the end of the recession and represents the final investor capitulation leading to the next upcycle of which so many speak. This chart format indicates that a recessionary mentality exists in today’s market.

In my opinion, there remain many sectors that are grossly undervalued and priced at previous recessionary metrics. Many companies are priced at Pr/Sales ratios representing 10yr lows as they continue to record sales. These issues have the highest levels of insider accumulation.

The SP500 has soared to new highs on the Momentum-Investor-driven trading of only 5 issues. This type of activity skews the perception of any market index especially when names like Tesla (TSLA) which has doubled in recent months but been Net Income negative since inception. The forward 12mo earnings are minuscule. Momentum Investing is what it is.

(Click on image to enlarge)

Markets are made by both Value and Momentum Investors. One needs to separate out the value situations from the “Tulip Bulb Mania” situations and invest accordingly. Many investors have been frightened out of the equity markets due to FAANG type issues which make little investment common sense. This shows in the $1 Trillion of capital now sitting in RMF.

Markets do not peak with pessimism! They bottom with pessimism. Investors should be adding capital to investment portfolios in underpriced companies doing well in the current economy.

Disclosure: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or ...

more