Deriving Square's Growth Potential By Comparing It With Customer Banking

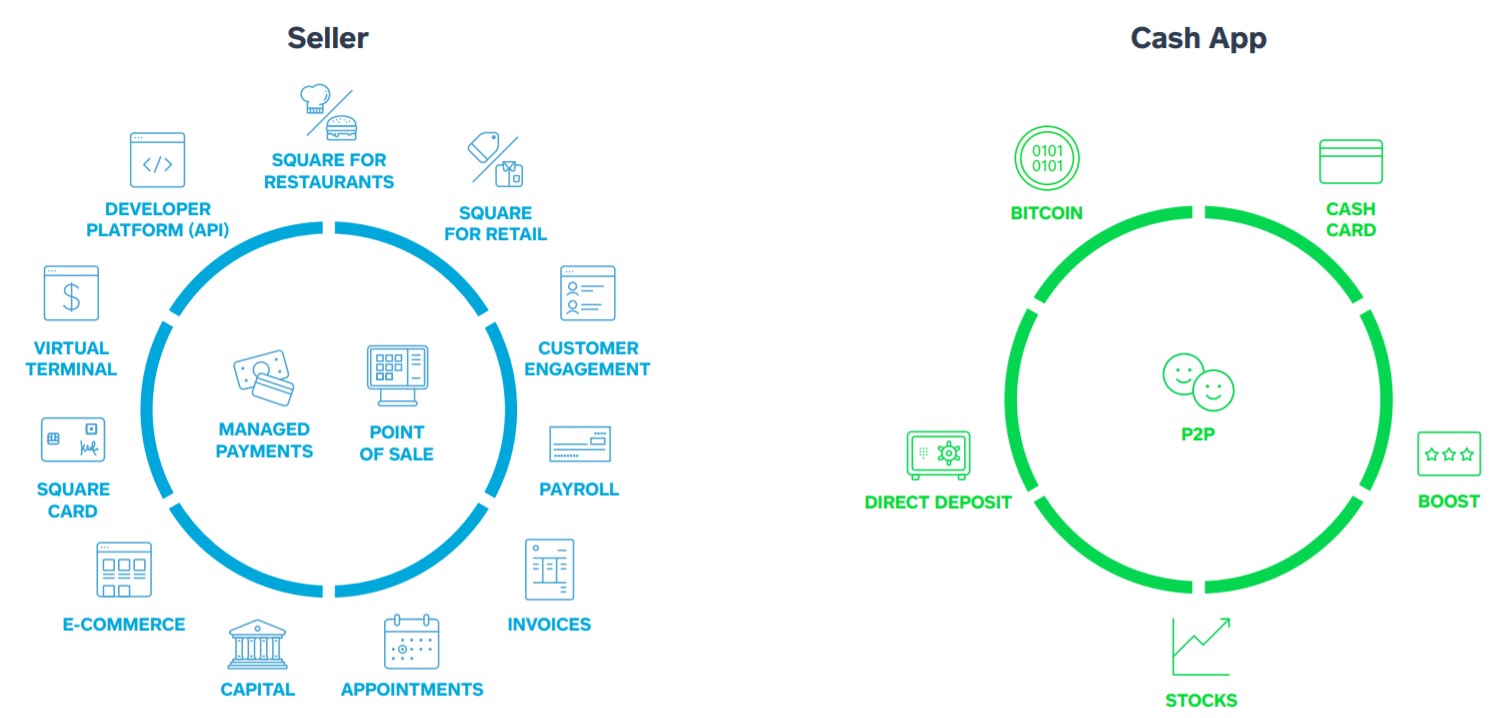

Square's Business Model

Source: Square Investor Update March 2020

Square (SQ) is divided into the B2B section of the company, which offers services and products for small businesses and its consumer segment. The company has become known for simplifying payment processing and has been adding many related services. Some include handling payrolls, planning of appointments, and billing. Also, Square Capital offers loans to small firms, which are tailored to the individual customer based on the data collected.

However, the more exciting part of Square is the consumer segment, which currently makes up only 14% of Square's revenue. Square launched Cash App in 2013 to expand its business and to address consumers. The long-term vision is to digitalize the retail banking sector and to offer services in a more transparent and accessible way. An individual should no longer have to go to a bank but should be able to make all financial transactions online via Cash App.

Cash App currently includes functions to enable P2P transactions, investing in stocks and Bitcoin, direct deposits, and discounts through Boosts. Furthermore, there is the Cash Card, Square's debit card.

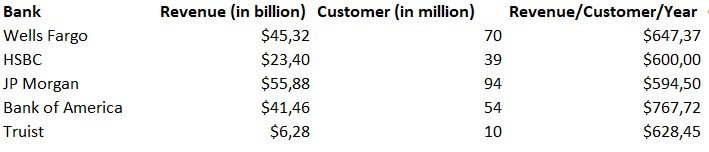

Banks as a benchmark for future growth potential

There are many approaches to value Square and calculate its growth potential. Due to the company's vision, Square can be compared to traditional banks. Most banks report sales of their consumer banking business, which includes revenues generated by small businesses. The consumer banking part of banks is, therefore, comparable to Square's business. To get a correct comparison, I subtract all revenues generated by the Bitcoin segment of Square. Unlike banks, Square makes a large percentage of its revenues through its Bitcoin business. Furthermore, it is still very questionable to what extent Bitcoin will prevail and whether this segment will continue to be in high demand. In my analysis, Bitcoin is consequently not considered and can be seen as a blind card.

By scrutinizing revenue per customer of banks, I would like to get a rough estimate of how far Square's revenues can grow and how they are positioned compared to banks. In this vein, I calculated revenue/customer for the consumer banking segment of traditional big banks. It will serve as a benchmark for future revenues of Square.

Source: Data from companies' financials and estimates of author

For most of the banks, the data was easily found in the respective 10K. For JP Morgan (JPM), I did a guesstimation because their customer base was not accessible. They published that they have 63 million households as customers. The average household in America is 2.52 people, with about 0.57 people per household under the age of 18. Therefore, one household accounts for approximately 1.95 customers. To be a bit more conservative, since not every member of a household is necessarily a customer of JP Morgan, I calculated with 1.5 persons per household. After rounding up, this results in 95 million customers. Subsequently, calculating Revenue/Customer for Wells Fargo (WFC), HSBC (HSBC), JP Morgan, Bank of America (BAC), and Truist (TFC), I took a revenue-weighted average and end up with $650 revenue/customer.

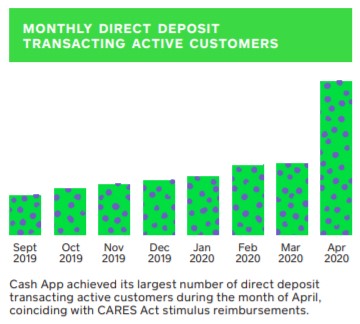

Source: Company financials

The ttm Revenue of Square is $4.337 billion, excluding Bitcoin. As of 2019, more than two million businesses were using Square, and Cash App had 24 million monthly active users. According to Ark Invest, this translates to approximately 38 million users. Revenue/customer of Square is, accordingly, $115, which reflects not even a quarter of the amount banks generate per customer. Square only reports its userbase in Q4, so it is hard to tell the current number. But keeping in mind that more customers lead to a lower Revenue/Customer ratio, I will calculate with 38 million users.

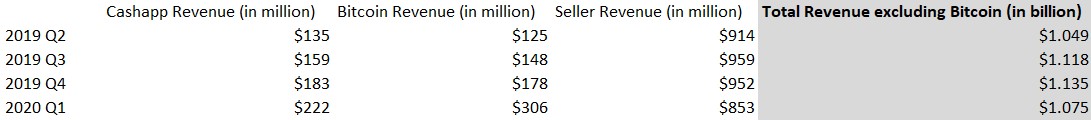

Increasing Publicity – Stimulus Checks & Google Trends

Source: Square Shareholder Letter Q1 2020

Through the Cares Act, many new potential customers have become aware of Cash App, and direct deposits have reached a new peak. There will likely be further stimulus payments to Americans, and many of these new customers will remain. However, the business model of Cash App is also very sticky. The more people use Cash App, the more detrimental it becomes for each individual to stop using Cash App. This strengthens expectations of friends and family to receive P2P payments in Cash App, which leads to a social pressure to use Square's P2P service.

Another segment, which proves to have a strong lock-in effect, is the seller segment of Square's. It has continuously been expanded by constantly offering new services, which aim to cover most of the small businesses' needs. A change of provider is inevitably associated with high costs, as this would mean a restructuring of the customers' businesses. Square's management follows a similar path with Cash App. The latest feature that has been introduced is payments within different currencies. Currently, this is only possible for dollars and pounds, other currencies will follow. During the last years, Square enabled its users to invest in stocks, even to buy fractional shares and to buy bitcoin, to name a couple of examples.

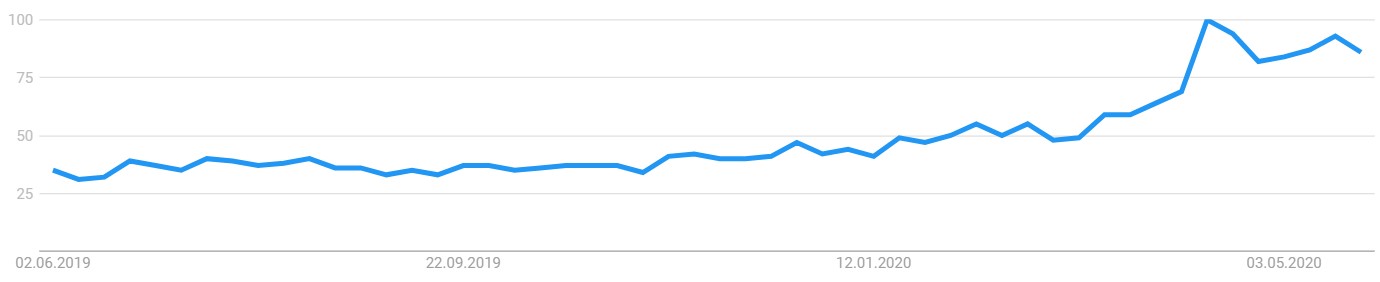

Source: Google Trends

The increase in Cash App's customers is also visible in Google Trends "Cash App". The peak of interest was when the Stimulus bill had been passed. Hence one can assume that the interest in Square's services continues to grow sharply.

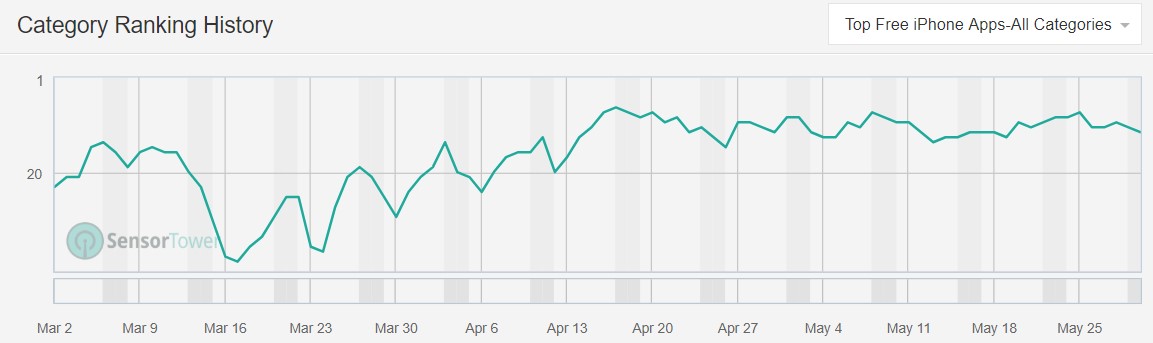

Source: Sensortower

According to Sensortower, Cash App has been in the top 20 free iPhone apps since the beginning of April. In addition to this, Cash App has been the top finance app on the app store since April the 17th. In April 2020 alone, Cash App was downloaded over 2 million times.

Concluding this data, it is clear that there is a growing demand for Cash App, which will lead to strong growth of its userbase during the upcoming years.

Growth Assumption

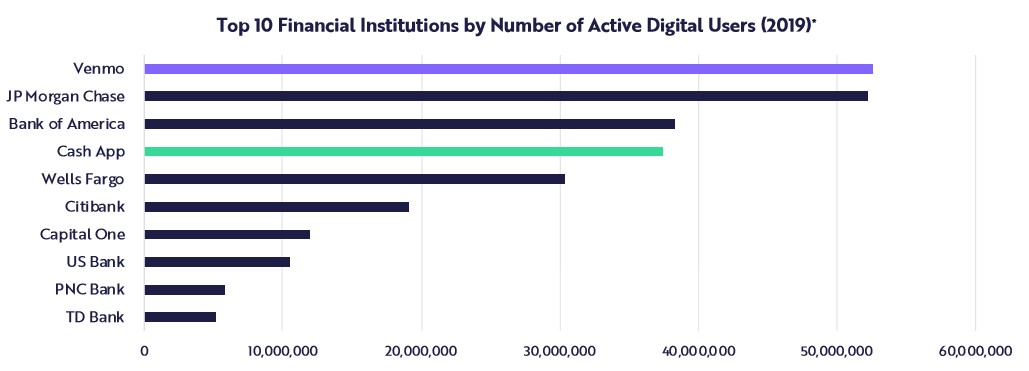

Source: Ark Invest Big Ideas 2020

Based on the revenue and customer growth analysis above, the final growth assumption can be derived. Square will expand its user base from 38 million to 80 million by the end of 2027. Venmo and JP Morgan already have over 50 million users. The American market is limited, but it is expected that Square will be expanding to other continents in the coming years. During that timeframe, I expect the Revenue/Customer to increase to $300/customer caused by new services and trough the creation of a financial ecosystem for consumers. It is resulting in a revenue of $24 billion, excluding bitcoin in 2027, leading to a CAGR of 24% over the next eight years.

By applying this assumption to the discounted cash flow method, I calculated a current value per share of $120. This price reflects approximately a 33% upside based on the current stock price of $90 as of June the 11th 2020.

Risks

Obviously, this upside comes along with risk. The adaption of P2P payments and contactless payments is increasing, and the P2P segment of Square is growing during these extraordinary times its small business segment is suffering. Due to Stay in Place orders, a lot of small businesses will file for bankruptcy. Square offers loans for small businesses through "Square Capital", some of which are now insolvent, and the risk of these loans has therefore risen sharply. However, this service is provided by third parties, and they bear the majority of the risk. Due to the loss of many small businesses, Square will also lose a part of its revenues. The next earnings report will be informative to assess whether the additional growth of Cash App can compensate for this loss of sales.

Nevertheless, the most significant risk is the competitors. Besides the traditional banks, Apple Pay and Paypal's Venmo are growing rapidly in userbase and revenue. The market might be big enough to be shared by many companies, but it will continue to be an uncertainty, the market has not decided yet who will be the clear winners.

Disclosure: I have no positions in any stocks mentioned, but may initiate a long position in SQ over the next 72 hours.

Really interesting article! Are consumer banks also a threat to enter the electronic payment market?

Hello Noah,

As shown in the chart "Top 10 Financial Institutions by Number of Active Digital Users (2019)", some banks are already in the electronic payment market. However, Cash App and Venmo, in particular, are taking market share, as their products are much more functional.

Isn't Venmo a competing product to PayPal? Yet doesn't PayPal own Venmo? Confused.

Hello Susan, Paypal does own Venmo. Venmo was bought buy Paypal in 2013. By buying Venmo Paypal was more or less able to cripple the competition and expand its own growth. But yes, you are right, overall the functionalities are pretty similar.

Impressive. Bullish on $SQ.