Denny's: Overvalued

Denny’s (DENN) is one of our favorite places to eat with the kids on a weekend morning, or after a long night out with friends. This is a diner-style restaurant, featuring a relatively low-cost menu which features breakfast all day. While the performance of the stock has been strong, we feel shares are a bit expensive here. It is out thesis that shares are presently overvalued. In this column, we will discuss recent performance, as well as offer our projections for 2018, relative to the valuation of the stock.

Price action and valuation

Take a look at the price of Denny’s stock in the last year:

(Click on image to enlarge)

Source: SEC filings

As you can see, shares have risen to a near 52-week high. At $15.10 per share, this puts the stock at 27 times trailing earnings, priced well above the sector average of 21, which suggests the name is baking in continued growth. To justify this price, we want to see strong revenue growth, continued mid-single digit comparable sales growth, and most importantly significant earnings per share growth. Let us discuss.

Sales growth slightly below expectations

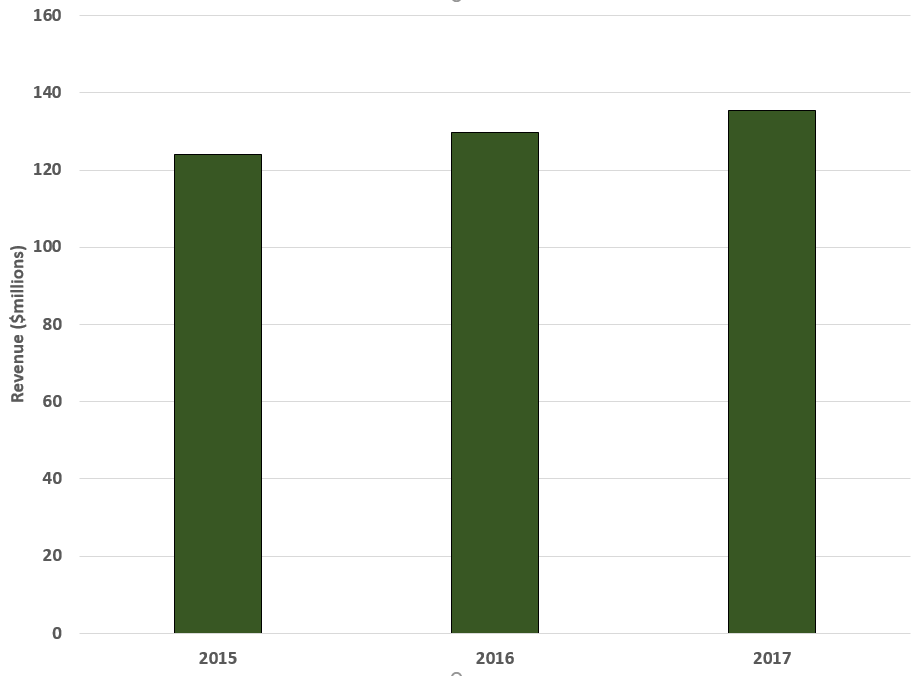

We saw total Q4 operating revenue grow a respectable 4.5% to $135.5 million, continuing a trend of rising sales:

Source: SEC filings

The main problem we have here is not so much the pace of sales growth, but the fact that it was $1.2 million below our target of $136.7 million. We were admittedly more bullish than the Street consensus of $135.8 million. In either event, sales were below expectations.

What went into these sales figures?

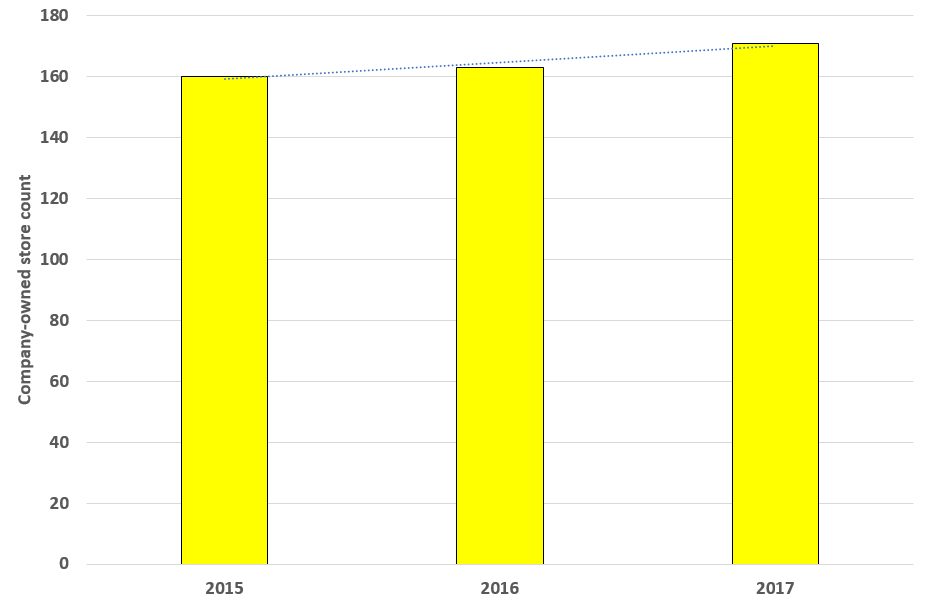

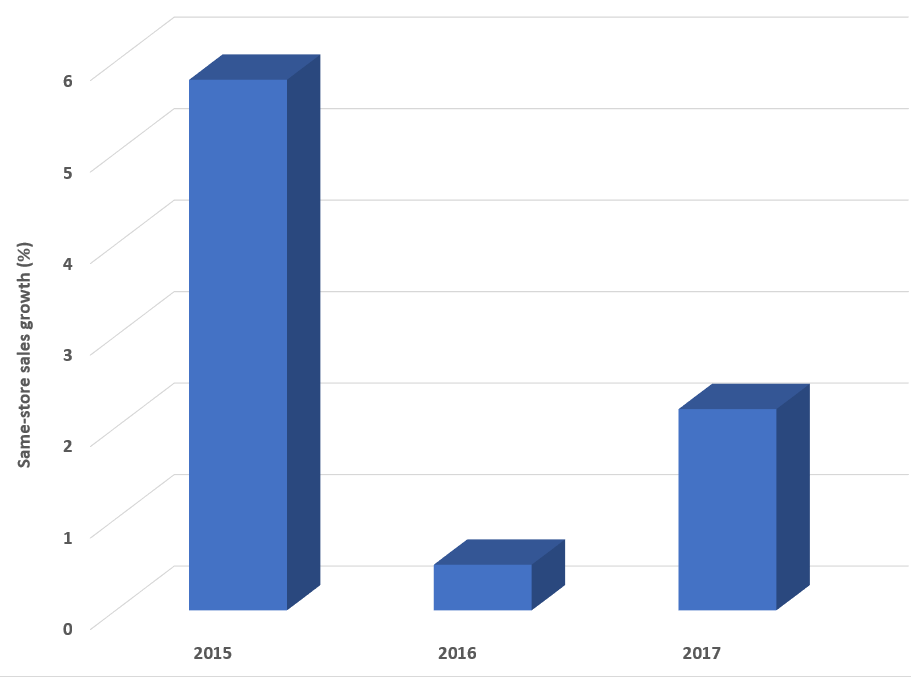

The 4.5% growth stemmed primarily from a strong performance in company-owned restaurant sales. Company-owned restaurant sales were up 6.0% to $100.3 million, primarily due to a greater number of company restaurants compared to the prior year quarter, and same-store sales growth in Q4:

(Click on image to enlarge)

Source: SEC filings

Source: SEC filings

Total revenues for company-owned stores met our expectations, despite same-store sales slightly below our target of 2.5%. While it is a turnaround from last year, we’d like this number higher. Where the top line came up short versus our expectations was in franchise and license revenue. This was up just 0.5% to $35.2 million compared to $35.0 million in the prior-year quarter. We were looking for $36.3 million. While we saw increases in royalty revenue and franchise fees from new restaurant openings, these were offset by lower occupancy revenues. While sales were up, we need to understand if expenses are rising as well.

Margins compress

Operating margin for company restaurants was down to $16.4 million, or 16.4% of company restaurant sales, compared to $16.6 million, or 17.5%, in the prior-year quarter. This was a result of significantly product costs and minimum wage hikes in the United States. Franchise margins were flat at $25.4 million, or 72.1% of franchise and license revenue.

While we were pleased to see that general and administrative expenses were down to $15.9 million compared to $17.3 million last year, there was more debt on the balance sheet this year. As such, interest expense was $4.3 million versus $3.3 million in the prior-year quarter. Debt rose $30.2 million from last year, coming in at $289.2 million of debt outstanding.

Earnings rose, but not enough

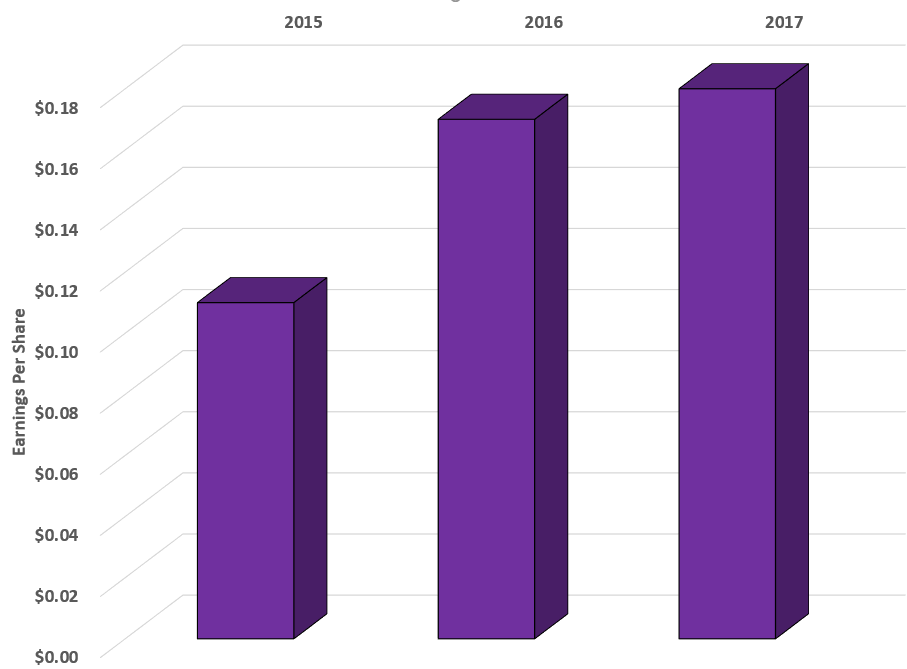

When we factor in the top line growth and the expenses that the company incurred, as well as income tax benefits, we saw as reported net income come in at $13.1 million, or $0.19 per diluted share, compared to $11.3 million, or $0.15 per diluted share, in the prior-year quarter. However, the more comparably adjusted net income per share grew just 7.0% to $0.18 compared to the prior year quarter:

Source: SEC filings

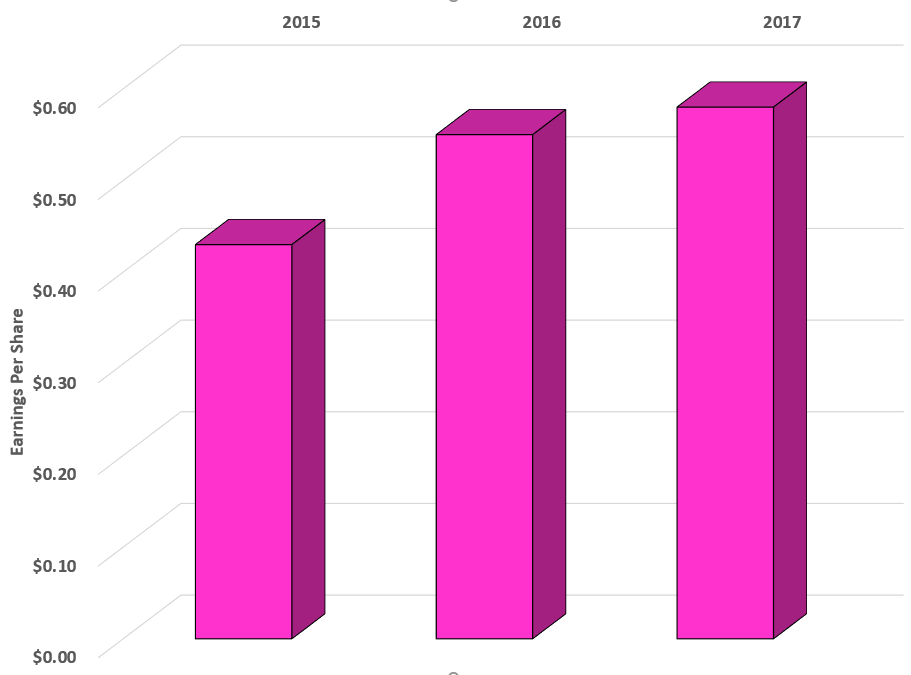

While this earnings growth is positive, it is below what we would like to see for a stock with this valuation. Perhaps a single quarter comparison is insufficient to make such a determination. Well year-over-year income for 2017 versus 2016 tells a similar story:

Source: SEC filings

As you can see, earnings per share grew just $0.03 from 2016. This is growth of less than 10%, and is far below what we would expect for a stock priced at 27 times earnings. Unless there is reason to believe that earnings will rise significantly in 2018, this performance does not justify the valuation.

Our 2018 outlook

As we saw, earnings growth was rather lackluster. To justify the valuation, we are looking for top-line growth, mid-single-digit Same-store sales growth, and of course double-digit earnings per share growth.

We do not foresee this happening in 2018. We are targeting a somewhat bullish 1.5% to 2.5% same-store sales growth figure, while management is guiding between 0% and 2%. That is a negative sign. We predict 50 new restaurant openings in 2018, which should help the top line.

We are projecting 2018 revenue between $627 and 640 million, driven by store count growth and our expected same-store sales growth. This is a positive, as it suggests double-digit sales growth. But management has surprised us with its margin forecasts. It sees company-owned restaurant operating margins between 16% and 17%, while franchise operating margins will be between 46% and 47%, far below the 72% we saw in 2017 and the 70% the year before. With this margin compression, we are predicting earnings per share of $0.62 to $0.65. This represents growth of just 6.8% to 12%. At the top end of our range, it still puts the stock at a pricey 23.2 times forward earnings based on the current share price of $15.10.

Our take

We love the company, but we think the stock is too expensive here. The growth projections do not justify the valuation on our estimation. We would avoid the stock here.

Quad 7 Capital has been a leading contributor with various financial outlets since early 2012. If you like the material and want to see more, scroll to the top of the article and hit ...

more