Demystifying The June 2020 Annual Dividend Rebalance

During the months of March to May this year, dividend concerns came to the fore as many companies, globally, announced cuts, cancellations, and postponements to their respective dividend programs. We examined the impact of these public announcements on the S&P DJI Dividend Indices, and our assessment then revealed that the extent to which indices were affected varied regionally. Companies within U.S. indices, for example, saw limited negative dividend action, while in Europe, it was a rather different picture.

Results from the June 2020 Annual Review

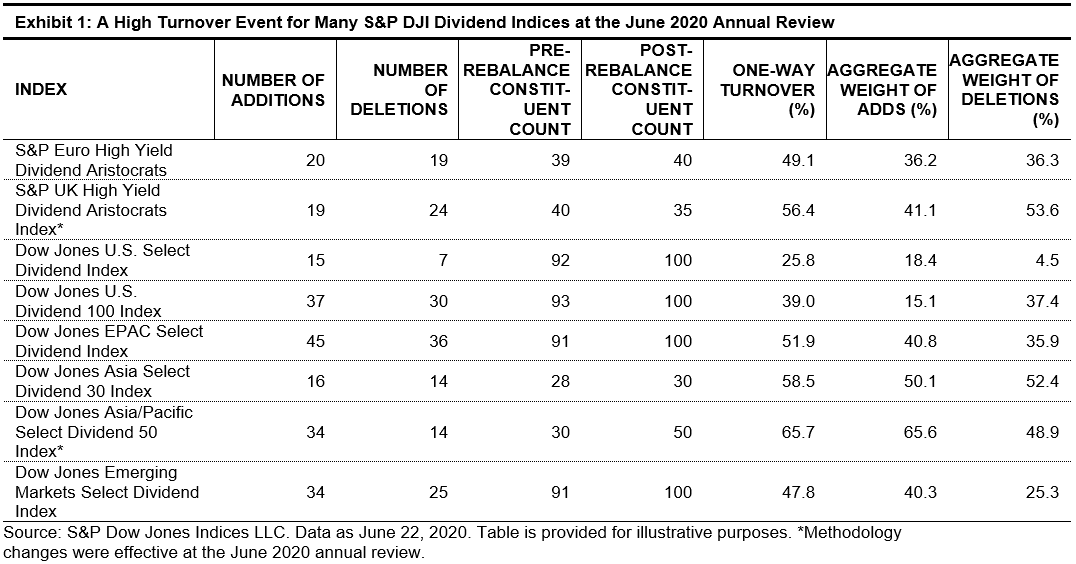

A number of indices, including the S&P Euro High Yield Dividend Aristocrats® (S&P Euro HYDA), S&P UK High Yield Dividend Aristocrats Index (S&P UK HYDA), and Dow Jones Select Dividend Indices,1 underwent annual reviews in June (effective as of the June 22, 2020, open). The rebalance produced significant changes (see Exhibit 1), which we highlight in this blog. Unsurprisingly, it was a high turnover event that led to meaningful sectors shifts for many of the indices. Additionally, a couple of indices also had methodology changes, resulting in a revised target number of constituents in those indices.

(Click on image to enlarge)

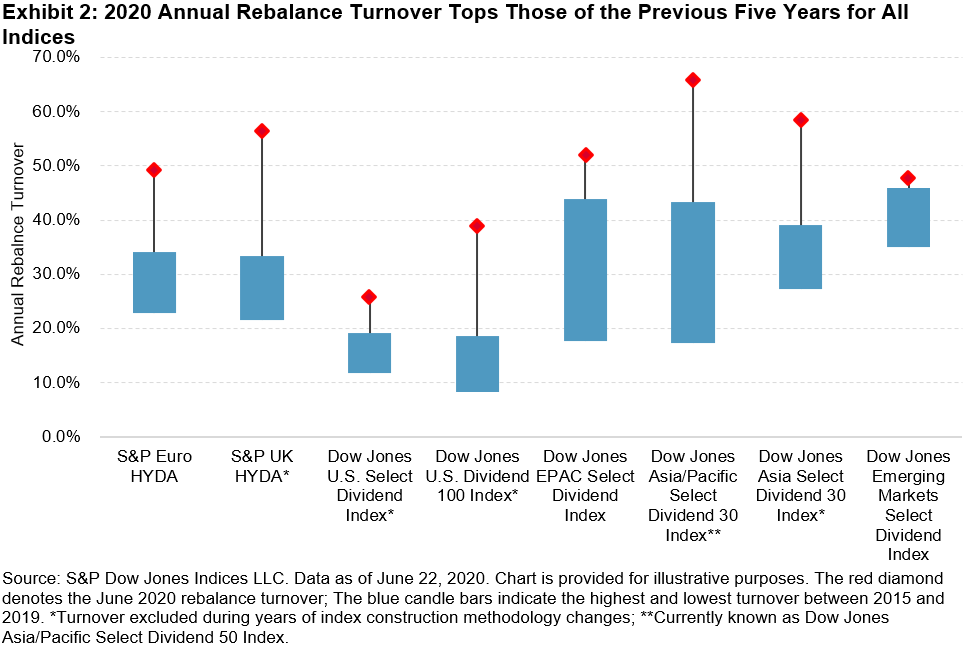

A Major Turnover Event by Historical Standards

Almost all the dividend indices experienced a one-way turnover of 35% or higher, with the exception of the Dow Jones U.S. Select Dividend Index. The turnover figures were considerably higher with historical context, as shown in Exhibit 2, where we investigated annual rebalances going back to 2015.2 Interestingly, however, the turnovers for the S&P Euro HYDA and S&P UK HYDA were lower compared with those of the Global Financial Crisis period (2008/2009, c.70%).

(Click on image to enlarge)

S&P UK HYDA and Dow Jones Asia/Pacific Select Dividend 50 Index Rule Changes

The UK HYDA and Dow Jones Asia/Pacific Select Dividend 50 Index, which were among the top three in turnover, instituted changes to their respective index construction methodologies, effective at this latest review. Brief highlights of the changes are as follows:3

- The S&P UK HYDA—Previous index rules targeted 40 stocks based on a rank of companies that had increased or maintained dividends for seven consecutive years. This was relaxed down to four consecutive years to ensure that a target of 40 stocks was met. Under the new rules, the constituent count may vary between 30 and 40, subject to the same dividend payment constraints as per previous rules. However, should the eligible number of stocks dip below 30, the number of consecutive years of dividend payments would be relaxed further to three years.

- The Dow Jones Asia/Pacific Select Dividend 50 Index (DJ APAC Select Div 50)—This index was previously called the Dow Jones Asia/Pacific Select Dividend 30 Index. As the name change suggests, the target number of constituents was increased from 30 to 50.

The significant increase in number of constituents for the DJ APAC Select Div 50 was the likely driver of high turnover at the June 2020 review. However, this was unlikely to be the case for the S&P UK HYDA, for which the scale of dividend cuts and cancellations within the index was the likely contributor.

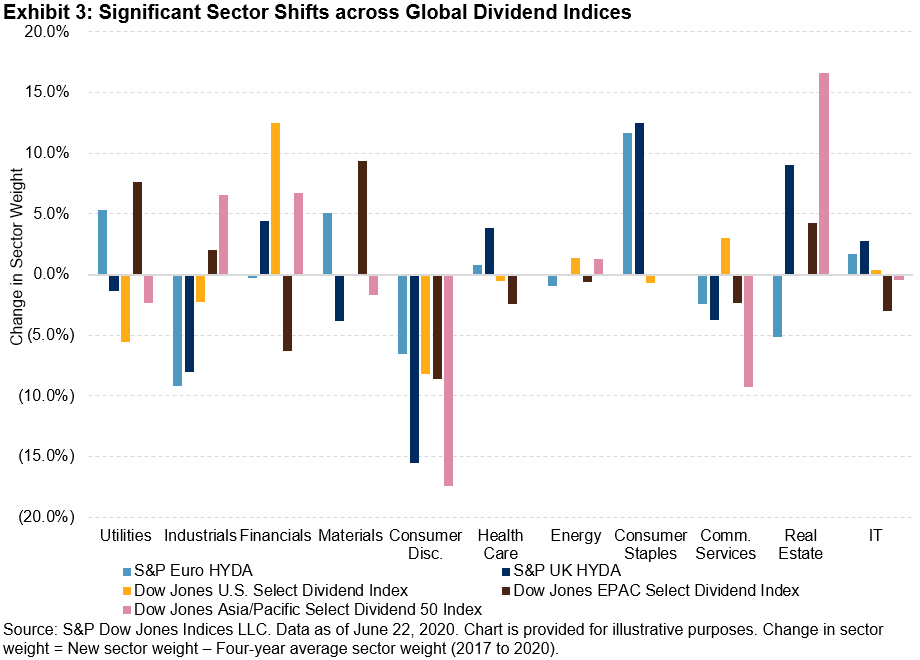

Dividend Strategies Rotated Out of Consumer Discretionary

The high turnover of the rebalance was accompanied by significant sector shifts, as shown in Exhibit 3. The rotation comes after four-plus years (since 20174) of relatively stable sector weights for many of the indices. While a material down-weight in Consumer Discretionary was a common theme, the beneficiaries were varied across the indices analyzed. Consumer Staples, for example, saw a considerable weight increase in the S&P Euro HYDA and S&P UK HYDA and Financials was the winner in the Dow Jones U.S. Select Dividend Index. Notably, of the eight indices listed in Exhibit 1, Financials is now the largest weight in six of them, rising from two, pre-rebalance.

(Click on image to enlarge)

1Postponed from its regular annual rebalance schedule in March every year.

2Index turnover was analyzed from 2015 onward, as many indices had been subject to methodology changes prior to 2014.

3For a methodology overview of the S&P Dividend Aristocrats and Dow Jones Select Dividend Indices, please refer to S&P DJI’s Dividend Indices: The Importance of Incorporating Quality Screens.

4The GICS® Real Estate sector was introduced in 2017.

Disclaimer: For more information on the risk-adjusted performance of actively managed funds compared with their benchmarks in 2018, read our latest more