Dave And Buster's Is A Buy

The first time we visited a location, and subsequently hosted a corporate event there, it quickly became clear to us that Dave & Buster's (PLAY) was a cash cow, and this was without looking into the financials of the company. In this article, we discuss the company’s ability to generate sales and maintain this cash cow status, despite the stock having tanked recently.

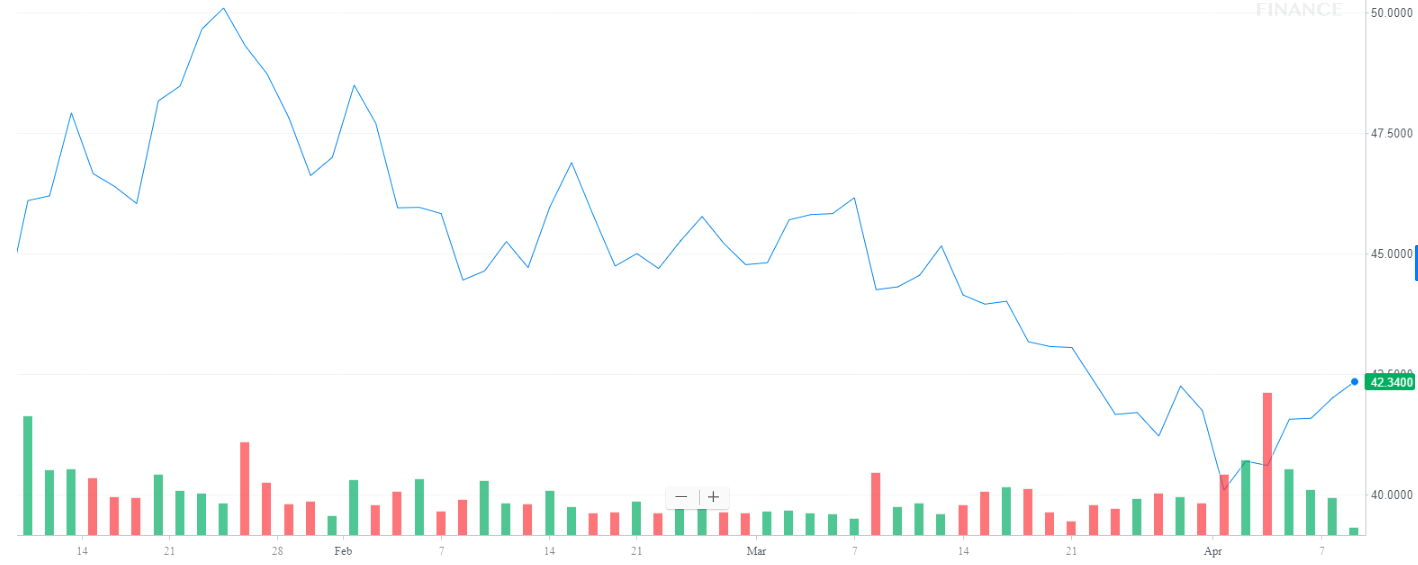

(Click on image to enlarge)

Source: Yahoo Finance

As you can see this action is setting up possibly for a BAD BEAT trade, and as such we added it to the BAD BEAT Investing portfolio. Let us discuss what we see in the name here. The first thing we need to ask is how does Dave & Buster's make its money? Well, it offers entertainment and it offers food and beverages. What we like here is that in genius fashion the company charges more credits for 'better' games. After a visit or two, you will quickly realize just how fast these credits could go. We also decided to eat there at our visits and the food was surprisingly high quality compared to what we had expected and was very reasonably priced.

To attract a diverse clientele, there was a full bar complete with over a dozen big screen TVs to offer sporting events and other entertainment. The company is working hard to continue to grow at a manageable pace, but we have had some concerns over the comparable same-store sales. Still, the stock has been hammered. To know whether Dave & Buster's can still be invested in here, we have to turn to the numbers. And the growth is still there, in many respects.

In the company's just reported Q4 2017, we saw a few records made. Total sales increased a respectable 14.9%, coming in at $304.9 million, up from $270.2 million in Q4 2016. This seems very strong, however, this top line print may have concerned some on the Street, as Dave and Buster’s missed consensus expectations by $0.6 million. Still, sales continue to propel higher at a reliable pace. The slight miss does not concern us, however, we must be aware of what is influencing the top line.

If we look deeper into the sales numbers, you will note that sales consist of revenues from gaming, and from food and beverage sales, as we alluded to above. Food and beverage revenues rose nicely, increasing 10.0% year-over-year to $138.6 million. This represented 45.5% of all sales.

Gaming attractions are still the stronger, higher margin money-maker for the business. The 'amusements and other' revenues increased 15.3% to $166.3 million year-over-year and represented 54.5% of total revenues in Q4 2017. The company constantly markets new games and takes out old ones. They offer to let you try new games for free, provided you spend at least $10 to charge up your game cards. So is it working?

Well, from a consumer standpoint, it is very expensive to bring a family for a night of food and gaming. In fact, it can easily run you a quick hundred dollars for a family of four. To ensure repeat business, the company replaces games frequently with new attractions, often in line with new movie releases, but also is focused on its menu offerings as well.

Keeping the menu offerings fresh is necessary. Let us be clear, we are not advocating that Dave and Buster’s focus on being a restaurant. Games should still be the attraction. However, Food and beverage needs to be a key focus as well. It should not be an afterthought, given almost half of all revenues are still generated on this side of the business. Understanding customer patterns can help the company shift to serving higher quality food and targeting the right clientele with higher margin alcoholic beverages. It has done this somewhat already as stores are already featuring happy hours and sporting promotions. But more work is needed as evidenced by comparable sales weakness.

While the growth trajectory in sales is encouraging, the one key indicator that we watch for in any entertainment and dining businesses is comparable store sales growth. Comparable store sales flipped from being positive to negative throughout 2017. They fell 5.9% in the fourth quarter, and this is a major reversal from last year’s 3.2% increase in comparable sales.

The same-store sales decline was mostly driven by a 6.4% decrease in walk-in sales. There was also a decrease in special events sales, like corporate events, of 2.9%. This was a surprising result. Now, we hate to blame the weather, but it was a harsh winter, and many stores were impacted by this. Of course, there remain concerns with mall traffic, so this needs to be considered as well.

Despite the short-term weakness, we have to consider that the tax cuts are going to put more money in consumers’ pockets. Further, the economy remains robust. Disposable income is at a decade high. We like what we see on that front. With the outlook for sales to grow double digits in 2018 and earnings to be flat-to-up, we believe shares are at an attractive entry point in our opinion at $40 a share. At the low end of guidance, the stock is trading at 16.3 times forward earnings. This is attractive, even if the company is guiding conservatively. We recommend a buy.

Disclosure: We are long PLAY.

Quad 7 Capital is a leading contributor with various financial outlets, and pioneer of the BAD BEAT Investing philosophy. If you like the material and want to see ...

more