Danaher Wins FDA Approval For Fast Covid-19 Test

This Has the Potential to Be a Game-Changer

Earlier this week, the Federal Reserve rolled out the big guns. The central bank said it would start buying an unlimited amount of bonds. This is a reprise of their QE Infinity policy.

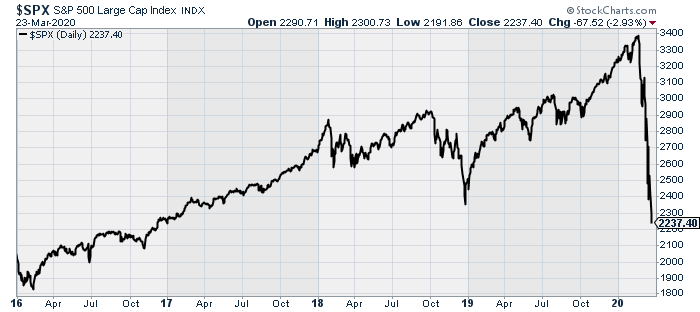

The hope was that this news would help quell the panic that has fallen over Wall Street. Instead, it flopped. While the S&P 500 futures rose briefly after the announcement, once trading start, stocks started to fall.

At one point on Monday, the S&P 500 was down close to 5%. The index has erased all of its gains since President Trump was inaugurated three years ago.

These are historical times on Wall Street. Monday was the first time in the New York Stock Exchange’s 228-year history that it was open, but the trading floor was closed. We’re in a new world. All of the trading was done electronically.

The New Rules

From February’s peak to March’s trough, the S&P 500 has lost close to 36%. If a bear market is a 20% drop, then a 36% loss is two bear market’s on top of each other. We went a full decade without a bear market, and now we’ve just had a double bear market.

The idea of this near-worldwide quarantine is to “flatten the curve.” Hopefully, that will buy us more time so hospitals can get more beds and ventilators as well as limit the surge in sick patients who would overwhelm hospital resources. We’ll also understand better ways to care for those that are infected with the virus. We just need time. In the meantime, the U.S. economy is being wrecked.

In normal times, there are all sorts of methods to measure valuation. You can look at a company’s dividend yield, or its price/earnings ratio. None of these methods are perfect, but they all serve a role.

But what about now? Previous earnings are nearly irrelevant. Dividends? That may not matter when so many companies are reducing or suspending their dividends.

However, we can rely on less conventional methods to find stocks. For example, we should pay more attention to companies with sound balance sheets. That suggests they have a greater ability to withstand a drop in the economy.

I would also pay more attention to companies with good reputations. When you don’t know what’s happening from one day to the next, you can be sure that smart, capable leaders are doing what’s best for the business and its employees.

The Bull Case for Danaher

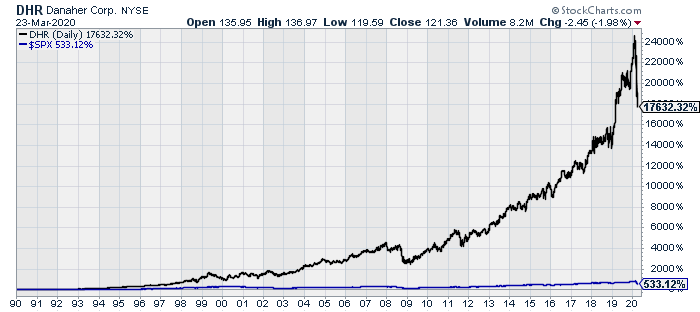

This is what leads me to highlight Danaher (DHR) this week. This is one of the strongest companies you’ll run across. For 50 years, it’s been run by the Rales brothers. Their specialty is finding and buying overlooked niche companies with strong cash flow.

It’s a simple formula, and it’s been incredibly successful for them and their shareholders. Over the last 30 years, Danaher has crushed the rest of the market.

In 2016, Danaher bought Cepheid for $4 billion. This week, the FDA announced emergency approval of Cepheid’s Covid-19 test. The current test has to be sent off to the lab and takes four days to get results. With Cepheid’s test, you can get the results in just 45 minutes, and the test can be done on-site. This is a huge development. Cepheid hopes to roll it out as soon as possible.

Now Cepheid has to ramp up production to meet a very high need. What’s interesting is that thanks to Danaher, Cepheid’s manufacturing capabilities have significantly improved. Danaher also owns Integrated DNA Technologies, which can help spread the adoption of the Cepheid test.

Danaher is normally a very sound stock, but with the share price down by 25%, it makes for a good value. Combined with a concrete advancement in the battle against coronavirus, Danaher is an excellent buy here.

Disclosure: None.