Cybersecurity Stocks Will Dominate As Coronavirus Spreads

Coronavirus is dominating the headlines right now for good reason. In addition to the unfortunate human impact of the virus, it has already and will continue to have an impact on business around the globe.

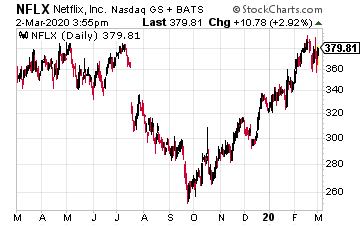

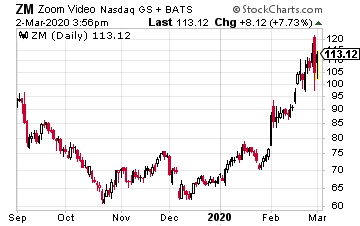

I’ve seen a few mainstream ideas for investing in stocks that will be helped by potential virus impacts, such as Netflix (NFLX) and Zoom (ZM). Both plays on people staying home to avoid the virus.

That’s probably not a bad investing theme. But, I think one better is a theme that benefits whether the virus gets worse, or we find a vaccination tomorrow. And I believe that theme is cybersecurity.

Let’s think about this for a minute. We have elections coming up later this year, which will happen regardless of coronavirus, and already Russia has been accused of interfering. Cybersecurity will increasingly be top of mind as the elections get closer.

Then, we have the theme that pundits are using to push Netflix and Zoom. People are staying home and being on their computers, phones, and the internet more. More traffic on the internet means more demand for cybersecurity.

Let’s take a look at three cybersecurity stocks I think are worth taking a look at here.

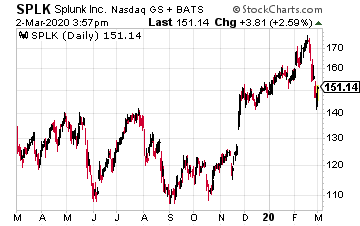

Splunk (SPLK) is both a cybersecurity provider, as well as a business analytics company. While helping customers organize and analyze their data, the company deploys a classic business technique that consultants have been using for decades.

“Since I’m here helping you with your data and IT functions, maybe I could also help you with your cybersecurity.”

In its latest quarter, the company grew software revenue 40% year-over-year, to $454 million. And, grew total revenue by 30%. Splunk also added 440 new enterprise customers in the quarter.

The company has been on a buying spree the past year and appears close to the successful integration of several companies and a move to profitability. They raised guidance in the latest quarter to $2.35 billion in revenue for 2020.

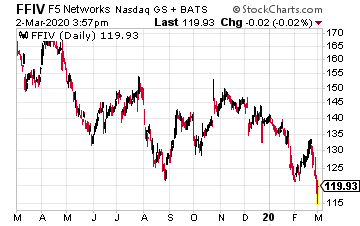

F5 Networks (FFIV) is known as the applications company. In its latest quarterly report last month, the company reported 50% growth in its software business.

This number is important because F5 is managing the move from a primarily hardware-based business to a software-based business, with a focus on the cloud. They accelerated this move with the purchase of Shape Security for $1 billion in December.

The company’s profitable hardware security solution, the application delivery controller (ADC), sits in a prime location, between users and cloud applications. I believe investors could piggyback on the momentum, and earnings, this opportunity of shifting from hardware to software presents.

F5 currently has a PE ratio of just over 19 and appears undervalued if the software growth continues to accelerate.

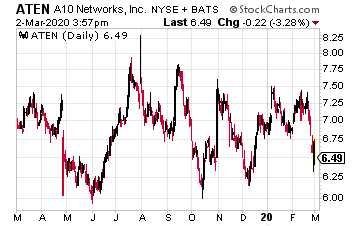

A10 Networks (ATEN) has a major focus on securing the coming 5G network. A10 uses machine learning and artificial intelligence (AI) to address evolving and shifting network threats.

With that focus on 5G, A10 markets what it calls “hyperscale”, which is the ability to secure not only the amount of data flowing through a network but the increasing number of singular connections to the network. This is especially important with the rise of the Internet of Things (IoT) and autonomous vehicles (AV).

In its latest quarterly earnings report, released early in February, the company increased quarter-over-quarter revenue 14% to $60.3 million. A10 also increased earnings from $4 million in Q3 to $10 million in Q4.

A10 is a play on cybersecurity threats to new technology, which is currently being deployed for 5G and IoT. I believe the company has a great opportunity to expand its business by addressing these quickly growing markets.

Disclosure: None.