Cruise Line Stocks To Buy: Royal Caribbean, Carnival Or Norwegian?

Cruise line operators tend to see immense earnings-per-share growth during times of strong economic growth and as a result, their stocks can do very well during such periods.

High levels of growth affords these companies the ability to return cash to shareholders via dividends, making the group of stocks potentially enticing for dividend investors as well.

Two of the three major cruise line operators–Royal Caribbean Cruise Lines (RCL) and Carnival Cruise Lines (CCL) – pay dividends to shareholders. You can see our entire list of 674 dividend-paying consumer cyclical stocks here.

While the third major cruise line operator, Norwegian Cruise Line Holdings (NCLH), does not pay a dividend, we expect all three stocks to generate positive returns for shareholders each year.

Valuations in the sector have largely come down of late, meaning the cruise line operators offer value at current prices as well, in addition to driving up current dividend yields for certain names.

In this article, we’ll take a look at the three cruise line stocks we have in our coverage universe and rank them according to their total return potential.

More information can be found in the Sure Analysis Research Database, which ranks stocks based upon the combination of their dividend yield, earnings-per-share growth potential and valuation to compute total returns. The stocks are listed in order below, with #1 being the most attractive for investors today.

Cruise Line Stock #3 – Royal Caribbean Cruise Lines

Royal Caribbean Cruises was founded in 1969 and since that time, has grown into six different brands that have 40 cruise ships in service. RCL is the second largest cruise operator in the world and services six different continents. The company produces $9.4B in annual revenue and the stock has a $22B market cap.

The company’s recently reported Q1 earnings report showed just a 1% increase in revenue but growth in adjusted earnings-per-share was 10%. RCL’s run of record earnings continued as it sees strong bookings, which is also positively impacting pricing. This is an industry trend that RCL is taking full advantage of as more and more consumers choose cruises for their vacations. Gross yields were up 3.1% in Q1 and net yields were even better, rising 4.5%.

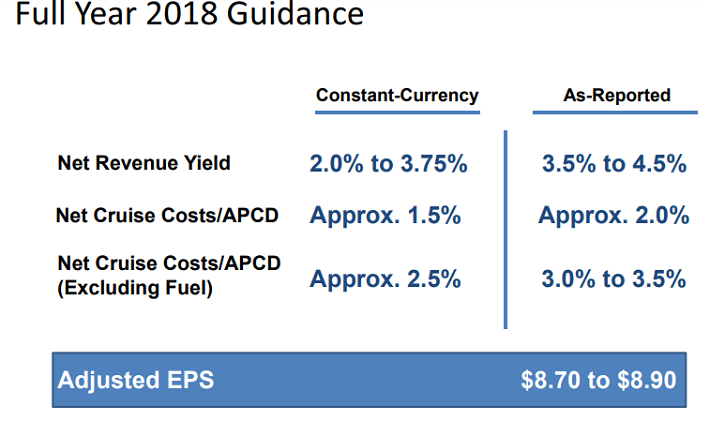

Source: Q1 earnings presentation, page 3

Guidance for the year, as we can see above, was very strong. Management is forecasting further strength in booking volume and pricing, giving RCL nearly $9 in earnings-per-share for 2018. Overall, RCL’s mixed Q1 results were largely ignored by investors in favor of the strong outlook that we see above.

RCL’s earnings-per-share has more than quadrupled since 2012, a very impressive feat indeed for any company. There is a significant risk associated with cruise line operators when recessions strike and RCL certainly isn’t immune to that threat, but we see the industry – and RCL – as having a bright outlook for the foreseeable future.

We are forecasting 8.1% earnings-per-share growth for RCL moving forward as it has meaningful tailwinds that should outweigh potential headwinds. Fuel costs and currency exposure are common risks for cruise line operators and RCL carries those risks. RCL hedges 50% of its fuel costs so volatility will be lower from that factor, but currency swings can impact results positively or negatively at any given time depending upon where the US Dollar trades.

Apart from that, we think RCL is positioned for strong growth ahead as it has 12 new ships coming into service in the next several years. This will afford RCL not only increased capacity but the higher yields that new ships bring as well. New ships are more efficient to operate than older ones and customers will pay more per room, meaning margins should rise over time in addition to rising revenue.

The dividend has grown at very high rates in recent years and while we cannot expect the same rates of growth going forward, we do see the payout at nearly $4 in five years, keeping RCL’s payout ratio around 30% of earnings. This gives RCL an element of dividend growth in addition to its robust earnings-per-share growth potential.

RCL’s price-to-earnings ratio has fallen significantly recently, along with the rest of the group. This has resulted in the stock being undervalued at present, providing what we believe is an opportunity for longer term investors. The current price-to-earnings ratio of 11.9 compares quite favorably to our fair value estimate of 15.5 times earnings. That should produce a robust 5.4% tailwind to annual total returns due to the rising valuation.

We think the share price will appreciate more rapidly than the dividend payment and thus, the yield should fall from the current 2.3% to 1.9% over time. However, RCL still offers investors the chance for some meaningful dividend growth and earnings-per-share growth to boot.

Overall, RCL looks well positioned for strong total returns in the coming years despite it coming in third in our rankings. We are forecasting total annual returns of 15.8%, consisting of the current 2.3% yield, 8.1% earnings-per-share growth and a 5.4% tailwind from a rising price-to-earnings ratio. Given these factors, we think RCL is suitable for most investors, including those seeking a strong rate of growth, dividend growth and value.

Cruise Line Stock #2 – Carnival Cruise Lines

Carnival Cruise Lines was founded in 1972 when it began as a small cruise ship operator. The company has been publicly traded since 1987, starting what has become a long tradition of using shareholder capital to acquire other cruise lines. Today, it has 11 different brands that generate $19 billion in annual revenue and the stock has a $41 billion market cap.

The company’s very recent Q2 earnings report was poorly received by investors as its actual results were overshadowed by a small trim of guidance for this year. CCL reduced its earnings-per-share guidance by about 10 cents for this year at a time when the other cruise line operators are boosting guidance and the stock fell sharply for that reason. CCL specifically cited fuel costs and currency exchange risk as principal factors in its guidance reduction but investors would do well to remember that this implies its booking and pricing will remain strong. Thus, the fundamental growth story should largely be intact.

CCL did lift its net revenue yield forecast to 3% from 2.5% for the rest of the year, but that, too, fell short of expectations. However, given that the industry outlook is so strong for both booking volume and pricing, we still think CCL has significant growth in front of it.

To that end, we are forecasting 8.5% in annual earnings-per-share growth for the next five years. CCL will be able to achieve such growth via a combination of continued higher booking volumes and pricing, as well as margin expansion. We continue to see the industry produce records for booking volumes and which is leading to higher pricing, and while CCL doesn’t look quite as strong as it competitors at the moment, it still raised its yield forecast, implying further strengthening ahead. In addition to that, CCL continues to buy back stock, which will provide a small tailwind to earnings-per-share growth as the float is gradually reduced.

Principal risks include the forex and fuel risks we already mentioned as well as potential overcapacity in the industry as a whole. However, management doesn’t see overcapacity as an imminent issue and neither do we. Forex and fuel costs are always risks for cruise line operators so that isn’t unique to today, but it certainly bears watching for shareholders. Overall, however, we think CCL still has a very bright future in front of it.

CCL’s dividend has grown at very high rates since 2014 as the company’s improving profitability has allowed it to increase cash returns to shareholders. This kind of growth in the dividend isn’t realistic to continue moving forward but we do think the payout will rise to about $3 per share by 2023, affording investors double digit annual growth in the dividend.

CCL’s price-to-earnings ratio has been reasonably stable in recent years and today, it stands at 13 due to the selloff related to the second quarter earnings report. That stands very favorably against what we see as fair value of 16 times earnings, implying a meaningful 4.2% tailwind to total annual returns as the price-to-earnings ratio increases over time.

We think the yield will come down from today’s level over time as the valuation rises but CCL should continue to provide investors with a yield around 3% for the foreseeable future, making it a strong choice for those seeking income.

Overall, CCL looks attractive here for a variety of investors as we see 16.1% total annual returns moving forward. CCL should achieve these returns via a combination of the current 3.4% yield, a 4.2% annual tailwind from a rising price-to-earnings ratio and 8.5% earnings-per-share growth. The recent selloff has boosted the current yield of the stock as well as the value it represents given the lower price-to-earnings ratio. Combined with a strong growth outlook, we think CCL looks attractive here.

Cruise Line Stock #1 – Norwegian Cruise Line Holdings

Norwegian Cruise Line Holdings was founded more than 50 years ago as an alternative to the more structured cruises that were offered on other carriers. The company’s “freestyle” cruising has resonated well with consumers and today, it operates 16 ships that generate more than $6 billion in annual revenue. After going public in 2013, NCLH’s market cap has grown to $11 billion today.

The company’s recently reported Q1 earnings showed tremendous results as earnings-per-share were up 67% on a reported basis and 50% on an adjusted basis. Strength came from top line growth of 12.4% as booking volumes remained very high, which also led to better pricing. The company’s newest flagship vessel, the Norwegian Joy, also came into service, adding more capacity to its line. Margins rose in Q1 as well as operating expenses rose at a slower rate than revenue and importantly, operating expenses only rose as a result of increased capacity. The margin growth we saw in Q1, therefore, should be repeatable as we move throughout 2018.

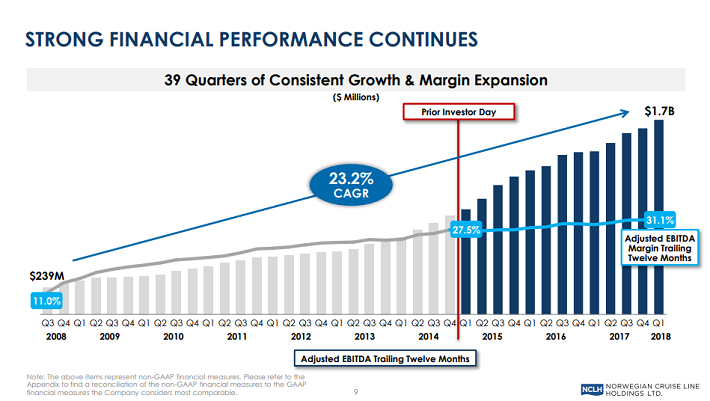

Source: Investor Day presentation, page 9

This slide from a recent investor day presentation shows just how good NCLH has been in the past decade. Its adjusted EBITDA margins have almost tripled from 11% of revenue to 31% in the past ten years, producing 23% in annual growth in EBITDA on a dollar basis. While we cannot reasonably forecast such growth to continue, we still think NCLH has some tailwinds for earnings growth that make its outlook particularly bright. And given its track record, there is no reason to doubt this growth will come to fruition.

We see 8% earnings-per-share growth annually moving forward as NCLH should continue to grow its capacity, but we should also continue to see margin expansion, as evidenced above. The company’s recent addition of the Norwegian Joy will significantly boost capacity and yield until it becomes part of the comparable base early next year, boosting revenue and yield as the new ship operates more efficiently than the older parts of the fleet. Fuel costs and forex are, of course, concerns for NCLH but given the strong booking volume and pricing we’re seeing, high single digit earnings-per-share growth is very achievable.

Finally, the company recently announced a $1 billion share repurchase program, which is good for about 9% of the float over the next three years. Unfortunately, NCLH doesn’t pay a dividend and we do not expect that to change in the near future as share repurchases are the clear priority when it comes to capital returns.

NCLH’s price-to-earnings ratio has varied quite a bit since it came public a few years ago but today, we see the stock as offering new investors significant value. Shares trade for just 10.2 times this year’s earnings, comparing extremely favorably against what we see as fair value at 16 times earnings. That implies a strong 9.4% tailwind for annual total returns from a rising price-to-earnings over time.

Overall, we see NCLH as the cruise line stock that offers the strongest potential total annual returns moving forward. We forecast 17.4% annual total returns, consisting of 8% earnings-per-share growth as well as a 9.4% tailwind from a rising valuation. This stock is not appropriate for income investors as it doesn’t pay a dividend, but it is quite suitable for those seeking value and growth. Indeed, we see NCLH as the best pick for total returns among the cruise line operators in our Sure Analysis Research Database.

Disclosure: Sure Dividend is published as an information service. It includes opinions as to buying, selling and holding various stocks and other securities.

However, the publishers of Sure ...

more