CrowdStrike: Massive Growth Opportunities Ahead

CrowdStrike (CRWD) is a highly innovative player in endpoint security. The company is growing at full speed, and it has a lot of room for further expansion going forward. The stock is expensive, yes, but not necessarily overvalued if management keeps executing well.

A High Growth Leader In Endpoint Security

CrowdStrike is a growth leader in endpoint protection, meaning that the company provides protection for smartphones, computers, servers, and other devices. The demand for this kind of protection is obviously increasing due to workloads moving to the cloud and growing connectivity needs all over the world.

The company's Falcon platform is cloud-native, which provides enormous advantages. CrowdStrike's solutions are notoriously easy to implement, more importantly, the company uses Artificial Intelligence to learn from the data it collects, permanently improving the effectiveness of the platform to provide the best solutions in an always evolving environment.

When a client gets attacked, CrowdStrike gathers information from that attack and learns from it, generating better solutions for all of CrowdStrike clients based on one single event experienced by one client.

Customers are generally reluctant to changing cybersecurity providers since this can be risky and complicated. In this particular case, CrowdStrike also benefits from the network effect, meaning that the platform becomes more effective as it learns from the data that it owns, and this provides an additional layer of competitive strength.

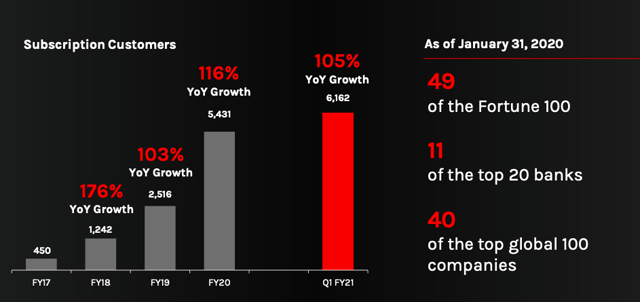

This innovative business model has been remarkably successful over the past several years, and CrowdStrike has delivered vigorous growth for shareholders over time.

Source: CrowdStrike

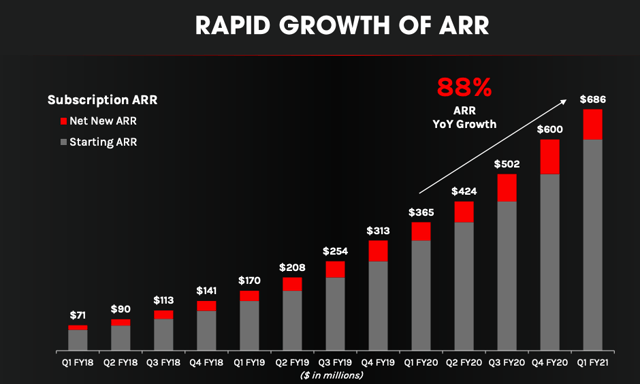

The numbers for the first quarter of the fiscal year 2021 show that the business is firing on all cylinders. Total revenue reached $178.1 million, an increase of 85%. Subscription revenue was $162.2 million, growing by 89%. Annual Recurring Revenue increased by 88% year-over-year.

Source: CrowdStrike

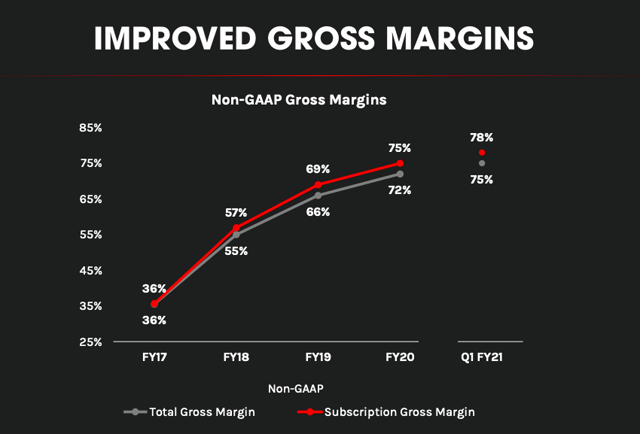

The company is still losing money at the GAAP level, but it produced positive operating cash flow and free cash flow of $98.6 million and $87 million respectively last quarter. The main profitability trends are clearly moving in the right direction, and management is targeting an operating profit margin of 20% of revenue over the long term.

Source: CrowdStrike

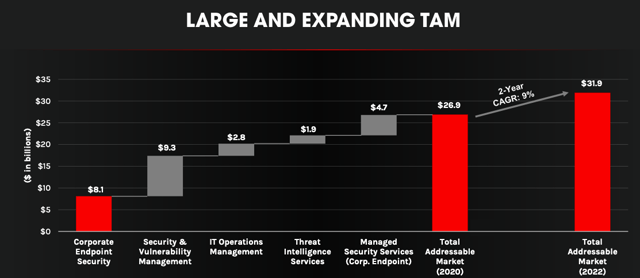

The company's total addressable market is worth around $31.9 billion by 2022 according to management estimates. The company is expected to make $770.64 million in revenue this year, so it still has enormous room for expansion.

Source: CrowdStrike

Solid Management Team

CrowdStrike operates in a very dynamic and always changing environment, the company will face growing competition in the years ahead, and new opportunities for growth will emerge. In these kinds of companies, betting on the right management team is of utmost importance, because a high-growth business cannot successfully operate in auto-pilot mode.

The company's CEO, George Kurtz, is one of the co-founders, and he has been with CrowdStrike since the beginning. Before he started CrowdStrike, Mr. Kurtz worked at McAfee, where he held positions as Worldwide Chief Technology Officer and GM. Academic research shows that companies led by their founders tend to outperform over time, and a founder's mentality is particularly important in these kinds of highly innovative businesses.

CrowdStrike has a dual share class structure, with class A common stock having one vote per share and Class B common stock entitled to 10 votes per share. As of January of 2020, the company's executive officers, directors, and major stockholders concentrate in aggregate, 82% of the voting power. This high degree of concentration in voting power can be seen as a relevant risk factor for small shareholders, but it is not a red flag in my opinion. At the end of the day, if you don't trust the management team you should not invest in the company, and voting power concentration should be of second nature.

Overall, CrowdStrike has a solid management team with a strong technical background and well-aligned incentives. The company is aggressively investing for growth in areas such as R&D and marketing, so it will be crucial to assess management's ability to translate those investments into consistently growing cash flows for shareholders in the years ahead.

Timing And Valuation

It is important to understand the difference between being "expensive" and being "overvalued". A Lamborghini is obviously an expensive car, meaning that it has a relatively high price tag in comparison to other vehicles in the market. But in order to say if the Lamborghini is undervalued or overvalued you need to compare the price versus the quality of the car.

The fact that a particular stock is trading at a high valuation in comparison to current revenue or earnings is basically indicating that the market expects rapid growth in the future. Even if the ratios are elevated and the stock looks expensive, it can ultimately be undervalued if the company can exceed those demanding expectations.

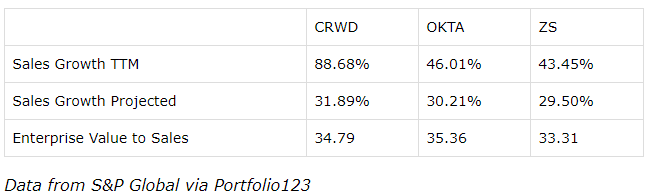

The table below shows sales growth on a trailing twelve months basis, projected sales growth, and enterprise value to sales for CrowdStrike versus other successful companies in the sector such as Okta (OKTA) and Zscaler (ZS).

(Click on image to enlarge)

CrowdStrike is valued roughly in line with other high growth stocks in the sector. Granted, someone could argue that the whole sector is overvalued, so comparisons wouldn't add much value in this scenario.

However, a much more interesting approach to the question of valuation is trying to assess if CrowdStrike can meet or ideally exceed growth expectations in the future. If the company can in fact exceed expectations, this can indicate that the stock is essentially undervalued, even when valuation looks rather expensive in comparison to the broad market.

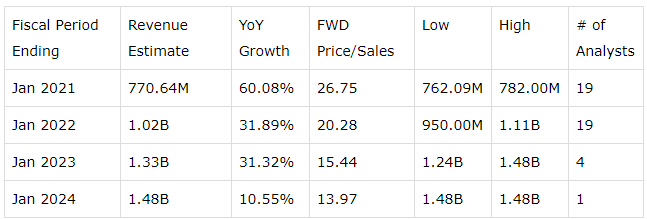

The table shows revenue estimates for CrowdStrike in the next several years. As we can see, Wall Street is expecting a substantial deceleration in growth in the near term. This is a sensible assumption to make, because growth naturally tends to decelerate as a company gains size over time.

However, when considering CrowdStrike's abundant growth opportunities, it is not unreasonable to say that the company has enough strength to exceed Wall Street's growth expectations if management executes well.

(Click on image to enlarge)

Source: Seeking Alpha

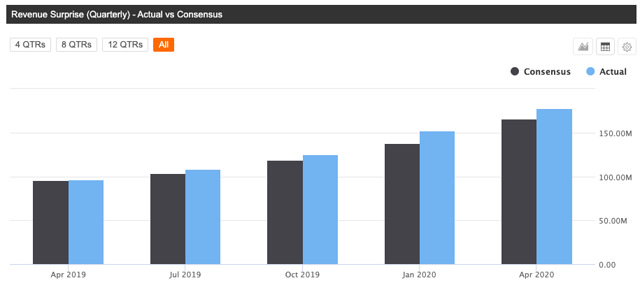

To the extent that past history is any valid guide for the future, it is important to note that CrowdStrike has exceeded revenue expectations in each of the past five quarters since being a public company. The company's track record in the market is admittedly short, but it is also flawless.

Source: Seeking Alpha

Past performance does not guarantee future returns, and the fact that CrowdStrike has exceeded expectations in the past does not guarantee that it will continue doing so in the future. Nevertheless, it is good to see that management tends to consistently outperform expectations because winners tend to keep on winning more often than not.

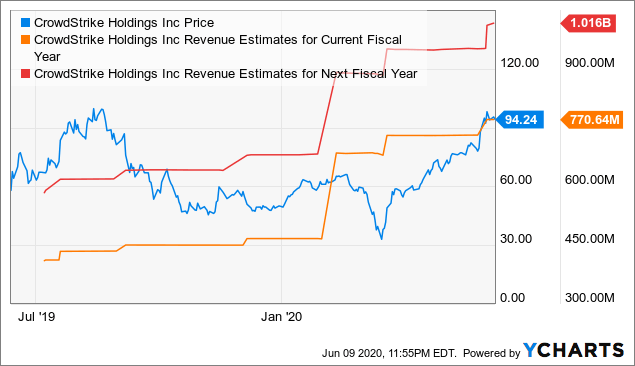

Looking at revenue estimates, we can see how revenue expectations for CrowdStrike in both the current year and next fiscal year have been increasing in the past several months. The stock price is reflecting a particular set of expectations about the future, if those expectations are increasing, the stock price needs to increase too in order for the valuation to remain constant.

Data by YCharts

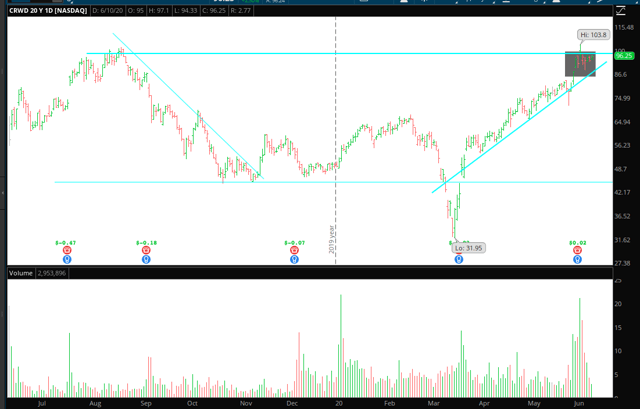

Looking at the price action, CrowdStrike is in a strong short-term uptrend since March, and the stock is approaching the much important level of $100 per share. A sustained move above this level could open the door to further gains over the middle term.

Source: TOS

The obvious trade would be buying CrowdStrike on a confirmed move above $100. However, price moves can get quite explosive when stocks break away above these kinds of important levels. For investors with a middle to long term time horizon, it can make sense to start building a position before the stock breaks away to all-time highs.

Since CrowdStrike is not cheap at all, starting with a small position and keeping some cash on the side to potentially buy more at lower prices can be a smart move from a risk-management perspective.

Disclosure: I am/we are long CRWD.

Disclaimer: I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship ...

more