Cresco Labs' Q3 Financials Report Record Levels Of Revenue, Profitability & Cash Flow

Cresco Labs Inc. (CRLBF), a constituent in the munKNEE Pure-Play Pot Stock Index, announced its Q3, 2020 financial and operating results on Tuesday for the period ended September 30, 2020, which confirmed its position as the largest wholesaler of branded products in the industry.

Q3 Financial Highlights

(All results are presented in USD and compared to the previous quarter.)

- Revenue: increased 63% to $153.3M

- Wholesale: +64.1% to $90.5M

- Retail: +60.0% to $62.8M

- Gross Profit: increased 21.7% to $84.6M

- Gross Profit as % of Revenue: increased to 53% from 47%

- Net Profit (Loss): increased by 360.5% to $(9.3)M

- Adj. EBITDA: increased 182% to $46.4M

- Net Income: increased to $4.9M from $(4.7)M

- Cash Equiv. on Hand: $57.7M

Management Commentary

Charles Bachtell, Co-founder, and CEO said:

- “...We remain the number one operator in the industry focused on, and delivering results in, the wholesale distribution of branded products,,.

- The investments we made to support growth are paying off, and as a result, our profitability has grown dollar for dollar with gross profit...

- This is a unique story of strategic breadth, depth, and execution. As we look toward our next phase of growth, it’s rinse and repeat – the playbook will be applied to more states and, again, we will achieve meaningful, material market positions.”

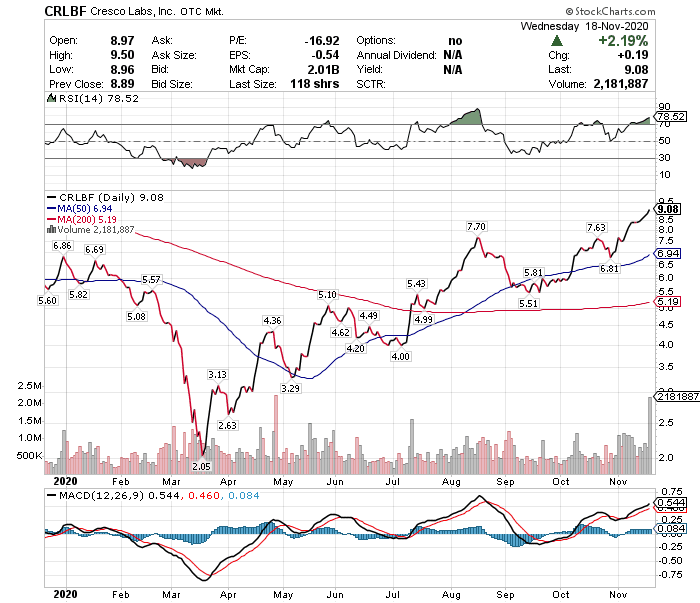

Stock Performance

The Cresco Labs stock price has tripled (331%) from its 2020 low in mid-March and is UP 26% so far in November as illustrated in the chart below:

Visit munKNEE.com and register to receive our free Market Intelligence Report newsletter (sample more