CPRI Stock Forecast: Holdings Luxury Brands Are Doing Well In The Market

Highlights:

- In the Q1 Fiscal 2022 Revenue increased 178%, with better than anticipated results across all three luxury houses.

- For Capri Holdings Fiscal Year 2022, the Company expects total revenue growth of approximately 31%.

- The market is expected to grow annually by 4.81% (CAGR 2021-2025).

Overview

Capri Holdings Limited (NYSE: CPRI) is a multinational fashion holding that owns the Michael Kors, Versace, and Jimmy Choo brands. Capri sells, distributes, and markets high-quality accessories and apparel worldwide. Michael Kors, Capri’s largest and original brand, sells men’s and women’s clothing, accessories, watches, jewelry, footwear, and fragrances in over 800 brand stores, third-party retailers, and e-commerce. Milan-based Versace (acquired in 2018) produces luxury Italian ready-to-wear apparel and accessories, as well as haute couture products under the Atelier Versace brand. Jimmy Choo (acquired in 2017) is best known for its luxurious women’s shoes, bags, accessories, and perfumes. Since 2003, John Idol has been the CEO of the company.

Business Optimization in the Turbulent Time

Covid in 2020 has become a big problem for the whole world. Its rapid spread led to widespread lockdowns, which affected many businesses, in particular retail. In 2019, before the pandemic has loomed on the horizon, the personal luxury goods market grew at a 5% rate same as over the past 20 years. Then, in 2020, due to the impact of the COVID-19 crisis, the personal luxury goods market declined 23%. As the world has begun to adapt to the pandemic, Statista predicts luxury fashion revenue of $ 106.85 billion in 2021. The market is expected to grow at 4.81% per annum (CAGR 2021-2025).

The presence of the pandemic and the ensuing epidemiological restrictions and lockdowns also negatively impacted Capri’s revenue, which declined 27% in fiscal 2021 (the fiscal year ended on March 27, 2021). Capri’s revenue dynamics in recent years and the current structure (after the acquisition of Versace in 2018) is as follows:

(Figure 1 – Capri’s Revenue by Fiscal Years Ended in million US dollars)

In the first quarter of fiscal 2022 (March 28 – June 26, 2021), total revenue of $1.25 billion increased by 178% compared to last year, with better than anticipated results across all three luxury houses. Gross profit was $856 million and gross margin was 68.3%, compared to $302 million and 67.0% in the prior year. Adjusted gross profit was $853 million and adjusted gross margin was 68.1%, compared to $303 million and 67.2% in the first quarter of fiscal 2021. This shows the rapid recovery in sales of the company after the peak of the pandemic. Given these numbers, it can be assumed that the year-end revenue forecast looks quite realistic.

(Figure 2 – Capri’s Revenue by Q1 Ended in million US dollars)

John D. Idol, the Company’s Chairman and Chief Executive Officer, said that all of Capri’s luxury houses significantly exceeded revenue and earnings expectations for the quarter, that is why Capri is raising Fiscal 2022 revenue and earnings outlook.

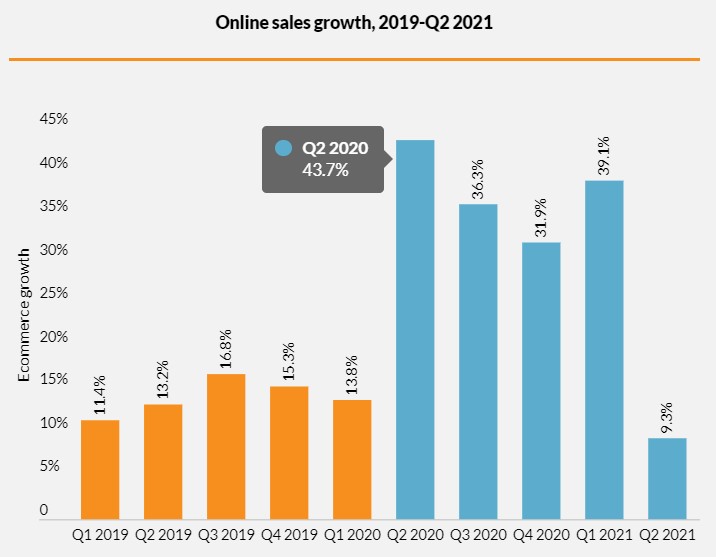

The COVID period shows how fast rise online shopping is and how rapidly people are ready to move from offline to online. E-commerce reached $196.66 billion in Q1 2021, up 39.0% year over year from $141.52 billion in the Q1 of 2020. Online growth in Q2 2020 (the period of the start of lockdowns) was 43.7% compared to the first quarter. Nearly $1 in every $5 spent on retail purchases came from digital orders, suggesting the pandemic-related boost to online shopping hasn’t decreased yet. At the same time, during the lockdowns, the companies were faced with an inefficient use of rental space. These factors give a clear signal to retailers to rebuild their sales model in the conditions that the world has faced over the past year.

(Figure 3 – Online sales growth, 2019-Q2 2021)

Considering these factors, Capri implements the operational program in order to increase the profitability of their stores. The Company intends to close approximately 170 of its retail stores over two fiscal years, which has begun during Fiscal 2021 and will continue into Fiscal 2022, in connection with its Capri Retail Store Optimization Program in order to improve the profitability of its retail store fleet. In addition, the Company expects to incur approximately $75 million of one-time costs related to this program. During Fiscal 2021, the Company closed 101 of its retail stores which have been incorporated into the Capri Retail Store Optimization Program.

(Figure 4 – Capri’s global network of retail stores and wholesale doors, including concessions (all three luxury houses), by Fiscal Years Ended)

Despite realizing the optimization program, the company has the repurchased program to allocate money to shareholders. During the First Quarter, Fiscal 2022 Capri repurchased approximately 0.9 million ordinary shares for approximately $50 million in open market transactions. As of June 26, 2021, the remaining availability under the Company’s share repurchase authorization was $350 million. The program resumed after being paused in the last fiscal year.

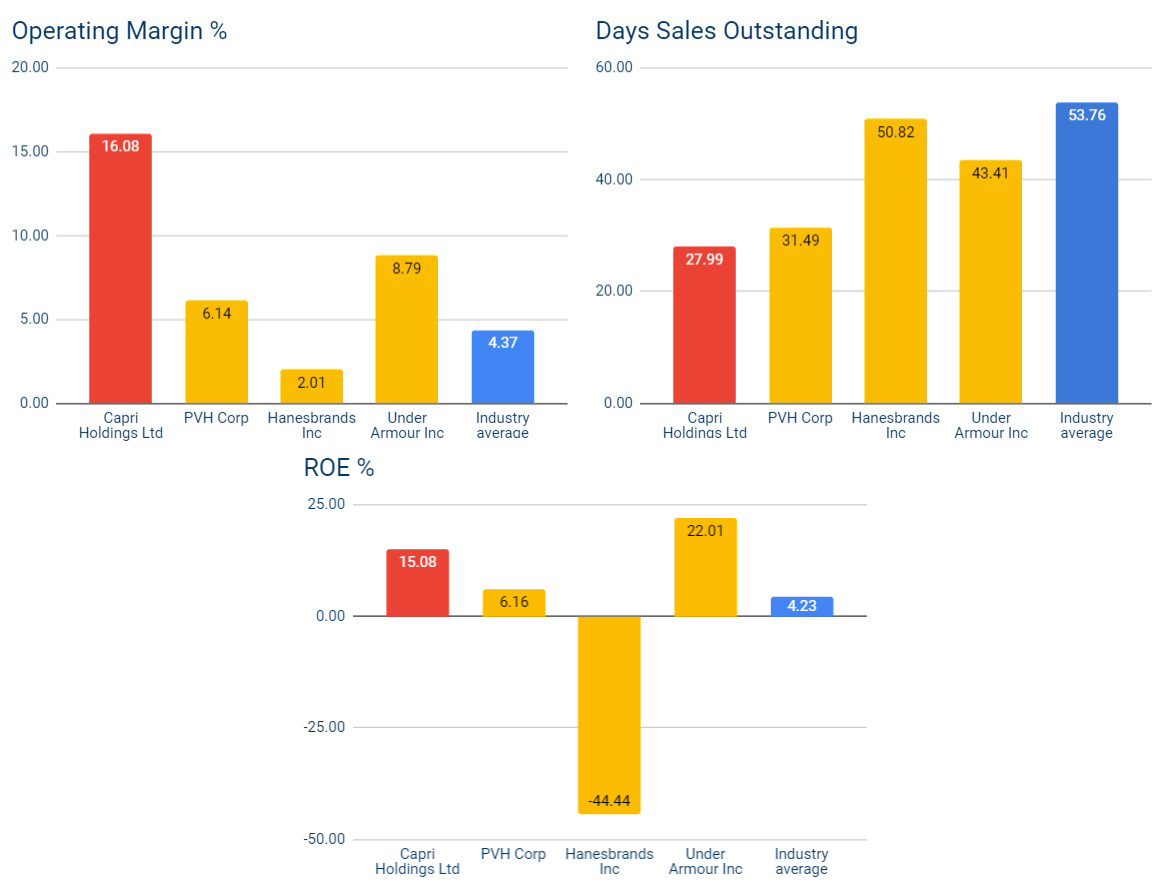

Next, we can choose several comparable companies of Capri Holdings and the manufacturing apparel & accessories industry benchmark to evaluate its financial competitiveness. These companies are PVH Corp (USD, PVH), Hanesbrands Inc (USD, HBI), Under Armour Inc (USD, UAA).

According to GuruFocus, CPRI’s ROE of 15.08% is higher than 79% of is higher than most of its peers and the industrial average. This can exhibit the company’s excellent profit generation ability from its equity. In addition, CPRI has a good Operating Margin level of 16.08%, which is ranked higher than 87% of its peers in the manufacturing apparel & accessories industry. This indicates that Capri Holdings is well managed with high profitability and less financial risk. Capri’s Days Sales Outstanding of 27.99 is ranked better than 82% of its peers. The company has a low DSO, which indicates good account management and favorable market conditions where buyers are able to pay their bills on time.

(Figure 5 – ROE, Days Sales Outstanding and Operating Margin)

Furthermore, in the last four quarters, the company’s earnings per share (EPS) beats analyst’s predictions. At the moment we have many Buy and Hold recommendations, and the average expected share price over the year horizon is 35% higher than current prices. That’s all indicates a positive sentiment for the company’s shares.

Technical Analysis

The weekly chart shows that the company’s shares have come close to a strong resistance level: $ 59.4, which they have been trying to overcome since the beginning of May this year. However, the uptrend continues in stocks since November 2020, which is confirmed by EMA-50 days, 100 days, and 200 days. So it is a matter of time before stocks move from accumulation to continued growth. Also, when the resistance level is passed, the growth may accelerate.

(Figure 6 – CPRI 1W: September 2018 – September 2021)

CPRI Stock Forecast: Conclusion

In a nutshell, CPRI is one of the most efficient companies in the Manufacturing – Apparel & Accessories industry with ROE 15.08, which is higher than 78% of its peers. Capri Holdings continues to expect a strong Fiscal 2022 based on the continued economic recovery and due to the increasing demand for its products. The company is optimizing its sales towards e-commerce. Despite the optimization, the company is implementing a buyback program. I have a positive look at the company and think that CPRI has an upside of more than 35% (close to 2018 maximum). While maintaining a favorable market environment, the goal for the year is $ 75 per share.

It is worth paying attention that the stock-picking AI of I Know First has a high signal on the one-year market trend forecasts, supporting my position for the CPRI stock forecast. CPRI has a strong signal for all time horizon forecasts.

Past Success with CPRI Stock Forecast

I Know First has been bullish on CPRI’s shares in past forecasts. On our January 14, 2020 premium article, the I Know First algorithm issued a bullish CPRI stock forecast. The algorithm successfully forecasted the movement of CPRI’s shares on the 3-month time horizons. CPRI’s shares rose by 18.72% in line with the I Know First algorithm’s forecast.

Disclosure: This article originally appeared on Iknowfirst.com, a financial services firm that utilizes an advanced ...

more