Courage Vs. Comfort

Philosophers have long argued that courage is the most essential human virtue because, without courage, all other virtues lie in jeopardy. Remarkably, the theorizing of ethicists has an implication for practical portfolio management.

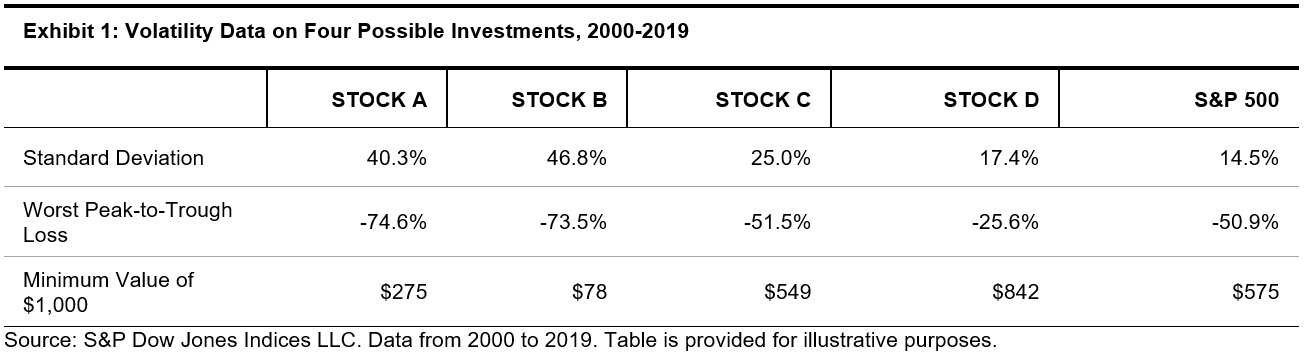

We can illustrate this with a simple example in Exhibit 1. It’s Dec. 31, 1999, and a professional investor is considering buying four different stocks for his clients’ portfolios. He obtains (never mind how; read the paper) correct data on the future volatility of the four candidates. All four possible purchases are more volatile than the market as a whole, but stocks A and B appear especially so.

(Click on image to enlarge)

Our investor has confidence in the analysts who recommended all four investments and realizes that volatility is the price you sometimes must pay to earn the stock market’s long-run returns. But he’s also mindful that positions in stocks A and B, in particular, might produce some very uncomfortable client meetings. When the $1,000 he invested in stock A is worth only $275, will he still have confidence in his analyst’s recommendation? More urgently, will his clients still have confidence in him? The volatility data make it clear that, regardless of the long-run outcome, stocks C and D will be much more comfortable holdings than A and B.

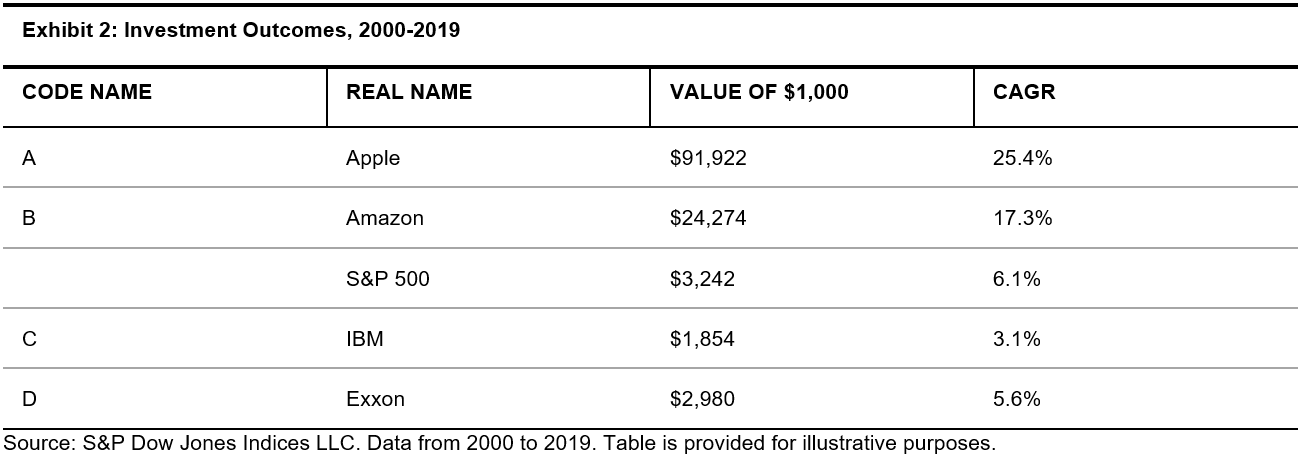

And this, as Exhibit 2 makes clear, is the problem. Stock A is Apple, which turned out to be the best performer in the S&P 500® for the 20 years ended December 2019. Stock B is Amazon, which lagged Apple but still beat the market handily. Stocks C and D, the comfortable choices, both underperformed the S&P 500. Pity our poor manager: the stocks that would have been easy to hold, and make for relatively stress-free client meetings, ultimately underperformed. The two winners, which would surely have enhanced his reputation as an astute stock picker, would have done the opposite.

(Click on image to enlarge)

Anyone conversant with our SPIVA® scorecards will realize that the average active manager fails most of the time. Why should this be? Active managers are smart, hard-working, well-trained, and highly motivated; the qualities that typically lead to success seem to avail relatively little. We have previously enumerated some of the reasons for active failure—for example, the professionalization of investment management, or the skewness of equity market returns. The simple example here adds another challenge to this list.

One of the reasons that active management is so difficult is that the correct investment choice may not be the easy choice. The challenge for an active manager is not limited to identifying the relatively small number of long-term winners. Success also requires holding the long-term winners when they go through painful periods of short-term underperformance. Conviction and confidence are not enough to win the day—courage is also needed, and most needed precisely when it’s hardest to muster.

Please read our Disclaimers.

Copyright © 2020 S&P Dow Jones Indices LLC, a division of S&P Global. All rights ...

more