Coronavirus Fears Select High-Yield Stocks Are On Sale Now

The Coronavirus outbreak is a real threat to human life and business results. However, when unexpected tragedies like this outbreak occur, the stock market almost always overreacts to the perceived risks to company results. During the sell-off, stock prices fall too far, even if short to intermediate-term business results will be affected. It takes guts to buy shares of stocks that are plummeting, but the rewards can be tremendous.

Here are some examples from the financial crisis, which started in 2007, resulting in a full stock bear market that bottomed in March 2009. Since it was a financial crisis, it was finance-related stocks that were the worst hit. Blue-chip finance company The Goldman Sachs Group (GS) was worth $250 per share in September 2007. By March 2009, GS shares were trading $88. Today GS lists for $237 per share.

Bank of America (BAC) a $50 stock before the financial crisis. At the 2009 bottom, BAC shares were worth $2.53 per. Today, BAC is trading for $34.50, up 1,300% from the crisis-related low.

Compared to a decade ago, the big difference I see now is that share prices react much faster to economic threats or negative news. The last time around, it took months and years for share prices to find the lows. Now it seems to take weeks. JPMorgan estimates that systematic trading accounts for 90% of U.S. equity trading volume.

Shifts in momentum and computer trend following trading can perpetuate market trends and cause violent shifts when the economic conditions change. The result is stock prices that reach a level I refer to as “stupid cheap” when you look at individual company business fundamentals and prospects.

While the major stock market averages have held up well during the Coronavirus crisis, there are market sectors that have been hammered. I want to highlight the sectors and some potential investments in those groups.

My focus for my newsletter subscribers is on income stocks and investing to build an attractive and growing income stream. Buying “stupid cheap” stocks that pay dividends will give the double benefit of high yields on the new shares and great potential for capital appreciation.

Energy prices have been hammered. Since China revealed the Coronavirus, the WTI crude price has dropped from over $60 to less than $50. Natural gas trades at record low prices. Stock prices across the energy sector have been devastated. Here is a couple to research.

For a conservative pick, Plains All American Pipelines LP (PAA) offers an 8% yield with distributable cash flow that is 2.2 times the distribution rate.

Plains primarily owns crude oil pipelines and crude oil storage facilities in North America.

This MLP trades for half the $30 it would be worth in a rational stock investing world.

If you want to be more aggressive in the energy midstream arena, consider EQT Midstream Partners LP (EQM). Two negative factors have hit this Marcellus shale focused natural gas gathering, processing, and transport MLP.

Warm weather in the U.S. has driven natural gas prices to record lows. Fears are that low gas prices will lead to a curtailment of upstream natural gas production. Also, EQM wants to complete a $5.5 billion interstate natural gas pipeline that is two years behind schedule due to environmentalist group legal challenges.

The current forecast is to have the pipeline in service by the end of this year. If that happens, the EQM price will soar. Another delay will damage the share value. Historically, EQM is a solid dividend growth investment.

The current sell-off pushes the yield up to 21%.

Global shipping has come to a screeching halt due to the virus fears shutting down international trade. Golar LNG Partners LP (GMLP) owns and operates LNG carrier ships and natural gas floating storage regasification units (FSRUs).

The GMLP share value faces several negative factors, including the low natural gas price, the shut down in shipping, and that a similar company just slashed its dividend by 76%.

Currently, the GMLP business and assets are worth several times the $4.70 share price, even if the company is forced to cut the dividend.

The current yield is over 30%.

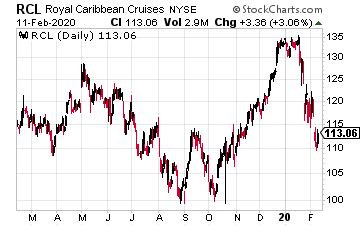

The Coronavirus outbreak has hammered tourism. Cruise ship stocks have fallen sharply. You may not want to yet jump in on the shares. Or start with a small investment and average down if the share prices keep falling.

Royal Caribbean Cruises Ltd. (RCL) is a dividend growth stock, increasing the payout for eight straight years, with 12% to 20% annual increases.

In normal times, RCL shares yield around 2.0%. After the virus outbreak induced an 18% share price drop, the current yield is up to 2.9%. RCL currently trades at $110.

I suggest watching for the price to go below $100 and then pick up some shares.

Carnival Corporation (CCL) is off 15% since the Coronavirus was announced, and off 29% from the 52-week high. The current yield is up to 4.8%.

The CCL dividend has increased every year since 2013, with mid-teens average growth in the dividend rate.

Again, I would not get into CCL right now. Put it on your daily watch list and start to pick up shares when the news is darkest, and it seems everyone is selling the stock.

Disclaimer: The information contained in this article is neither an offer nor a recommendation to buy or sell any security, options on equities, or cryptocurrency. Investors Alley Corp. and its ...

more