Coronavirus Fears Drive Telemedicine Stocks

Coronavirus cases continue to grow in the United States, as expected. Both the government and individuals are trying to address the virus in a number of ways.

Self quarantining, washing your hands, working from home, canceling events where lots of people will be in a small space. Some of the actions to contain the virus will be short term. Once the virus threat passes, we’ll go back to the old way of doing things.

But, I think there are other activities that will be fundamentally changed forever. There were some business themes that had begun prior to coronavirus, that have now been accelerated, and that will continue to grow post coronavirus.

Yesterday, President Trump, while meeting with large insurance company CEOs, made some important announcements. Coronavirus testing will be free, with no co-pay. Those that become ill with coronavirus will be covered by the insurance companies, no surprise billing.

And, insurance will cover the cost of telemedicine. This will especially help elderly patients who need to see a doctor but should not be in an area, like a waiting room, where sick people are present.

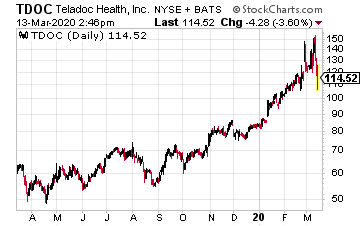

As we talked about last week, there is one company Wall Street has been focusing on for telemedicine, Teladoc (TDOC). The stock is doing very well in the current market.

But, many of the large insurers have also moved into the telemedicine arena. While not a large part of their business yet, I believe it will grow much larger, with coronavirus acting as an accelerant to this new business line. Here are three large companies that are already providing a telemedicine option.

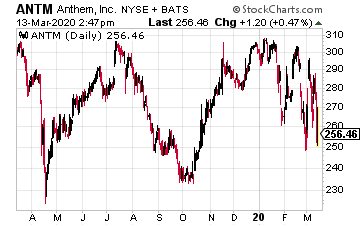

Anthem (ANTM) delivers doctor visits to your phone through its telemedicine platform called LiveHealth Online. Anthem has set up a clean, easy to use website that provides visitors with short videos on how LiveHealth works, and what the process is like to “see” a doctor.

This is an important piece of the puzzle for customers who may be elederly and not be as familiar with technology as younger users.

The process is very much like seeing a doctor in person. The patient tells the doctor what their symptoms are, the doctor conducts an exam via the telephone or tablet, and then a treatment plan is devised. This can include a prescription if that is what is needed.

Anthem, like other stocks, has been volatile the past month but has held up well overall. The company trades at a PE of 15.5 and yields 1.3%. Full year 2019 revenue grew 12.9% year-over-year to $103.1 billion.

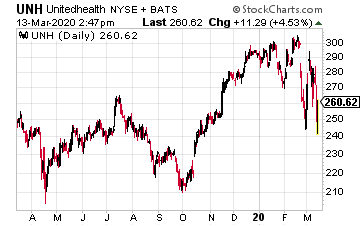

UnitedHealth Group (UNH) offers its Virtual Visits to anyone needing to see a doctor with a wide range of symptoms and afflictions, from seasonal flu to fever to pinkeye.

And, the platform offers the opportunity to speak directly with a doctor in 20 minutes or less, from the time you initiate the visit. I don’t know about you, but I don’t remember the last time I spent less than a half-hour in any waiting room for a doctor’s visit.

Like the other companies here, if your insurance plan covers a doctor visit, it also covers a telemedicine visit. Even mental health visits, if covered under your plan, are also available using the Virtual Visit.

UnitedHealth had revenue of $242 billion last year, which was a 7% year-over-year increase. Fourth-quarter earnings came in at $3.90 per share, representing 19% year-over-year growth for the company.

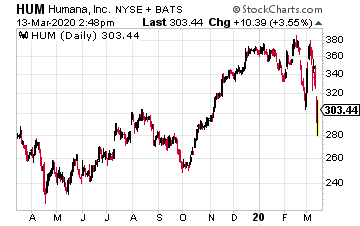

A few years ago, Humana (HUM) Humana Studio H in Boston to accelerate its technology push across a broad range of areas. This includes building a customer’s health history into a cradle to grave system, and a focus on areas such as telemedicine.

Humana emphasizes in its virtual visit that the doctor you are visiting on their telemedicine platform is board certified and that the connection for your virtual visit is secure.

This is an important selling point to an elderly clientele that wants assurances they are seeing the same caliber of doctor via a virtual visit. And, to both the elderly and younger market that wants a secure way to provide their confidential medical information.

Humana earned $3.84 per share in Q4 2019, a 48% year-over-year increase. The company is expected to grow it’s Medicare Advantage membership base by between 7.5% and 9.2% in 2020, which should provide a nice boost to 2020 earnings.

Each of these three companies has held up well in this market, have outstanding growth overall, and should continue to benefit from telemedicine offering long after coronavirus is a distant memory.

Disclosure: None.