Core Labs - Earnings Preview

Corelabs (CLB) reports quarterly earnings after-hours today. Analysts expect revenue of $150.57 million and eps of $0.39. The revenue estimate implies 1% growth sequentially. Investors should focus on the following key items:

Top Line Growth

Animal spirits returned to the oil patch in Q3 2016. When OPEC followed through on promised supply cuts in Q4, it only amplified the bullishness in energy-related names like CLB. The rise in oil prices into the mid-$50s has increased North America shale drilling. The U.S. rig count stands at 683 -- the highest it has been in nearly two years. That bodes well for the company's Production Enhancement segment (29% of total revenue), which provides products associated with completion of oil wells.

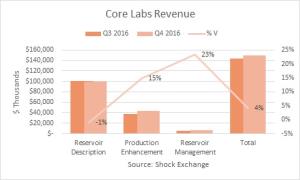

Last quarter revenue from this segment rose 15% sequentially -- on the high-end for oil services companies exposed to land drilling.

There were thousands of drilled, but uncompleted wells after Q4. Completing those wells could drive Product Enhancement revenue segment by double-digits again.

However, dismal results from Reservoir Description could stymie the company. This segment works on long-term crude oil and natural gas projects with an emphasis on deepwater. Deepwater has been in the doldrums for several quarters. Some do not expect capital expenditures to return to the segment until oil prices remain above $60 for a protracted period. The rub for Core Labs is that Reservoir Description represents 66% of total revenue and 98% of total operating income. I expect another pull back again this quarter, which could overshadow any gains in Product Enhancement.

CLB Is Still Overvalued

The key question for oil services firms is, "Will the company survive?" Oil is not going anywhere and with OPEC signaling a willingness to support oil prices, oil bulls will hold out hope that oil prices could rise over $100 again. Those firms with strong liquidity and cash flow tend to be bid up in this market, but that still does not mean they are not overvalued. Core Labs has working capital of over $80 million and net debt of $201 million; the company does not have the credit problems faced by larger firms like Weatherford (WFT) or Halliburton (HAL).

However, its enterprise value of $5.3 billion represents 48x run-rate EBITDA (last three quarters annualized). Flat growth in revenue and EBITDA do not justify CLB's robust valuation. In my opinion, there is no reason to own the stock at this level.

Conclusion

I expect flat top line growth again this quarter. Deepwater exposure remains a problem and CLB's valuation remains stretched. I recommend avoiding the stock long term.

Disclosure: I am/we are short WFT, HAL.