Consolidated Water Will Continue To Face A Rising Tide In 2017

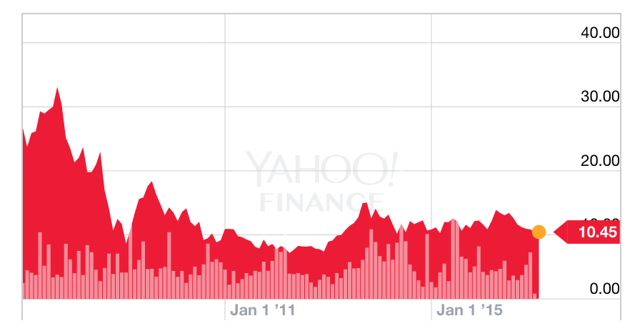

At first glance, it's hard not to compare the 10-year Consolidated Water Co. (Nasdaq:CWCO) chart to a wave that crested in 2007 above $33 before slamming downward to the mid $10 mark today. With shares losing 2/3 of their value during the aforementioned period, it doesn't look like relief will be coming anytime soon.

CWCO's business model makes the company's profitability reliant on uncertain government contracts while increased competition and the company's Tortola problem aren't helping matters.

We recommend that investors get short shares of CWCO ahead of the expiration of the company's contract with the BVI government in March of 2017.

The CWCO Business Model is Troubling

Consolidated Water Co. was founded in 1973 as a private water utility in Grand Cayman. While investing in water companies has become a somewhat trendy theme in the last 10 years - just do a quick search for water ETFs - CWCO was ahead of its time. The company focuses on delivering potable water to areas where naturally occurring supplies are virtually non-existent. The company does this by operating desalination plants that use reverse osmosis technology.

Sounds good so far, right? Here's where we hit a snag: To operate desalination plants, the company obviously needs access to salt water. In CWCO's case, the only access that it has to seawater is via government contracts, licenses and agreements in countries and territories where the plants operate.

So, while the majority of other water utilities utilize other methods like reservoirs, wells, and the treatment of groundwater, CWCO is 100% reliant on the desalination plants. This becomes a major risk - and a major problem - when a territory like, say, Tortola (see below) decides to pump the breaks, turn to rivals for lower prices, and decides to renegotiate your contract and access at a much lower rate than you've been collecting.

Another water-as-a-service investment in trouble: AquaVenture

Rival AquaVenture (NYSE:WAAS), my short pick for 2017, is a rival company that's poised to take on water in the months ahead. In my recent article about WAAS, I highlighted how serious questions about that company's profitability - and the looming prospect of the IPO lockup expiration - could push shares lower in the short term.

In the case of AquaVenture, the lack of profits and impending lockup expiration are perhaps the most serious obstacles.

AquaVenture and Consolidated: A Common Challenge Looms

Both CWCO and WAAS face challenges ahead in one market that they have in common: The Island of Tortola in the British Virgin Islands. CWCO has a significant government contract in Tortola, and the BVI Government recently cut the rate that they are willing to pay for the services of that desalination plant. The battle with the BVI has been a long one, and investors have watched shares slip all along the way.

When CWCO's contract in Tortola come up for renewal in March of 2017, commentators have noted that it's likely that the BVI government will renew at a much lower rate than the one that they're currently paying to CWCO.

While AquaVenture's contract in Tortola doesn't expire for another 15 years, it doesn't mean that the firm won't soon find itself under government pressure. The BVI government has already claimed that WAAS is running afoul of its government contract, claiming that the company didn't have permission from the government to buy the plant.

In Tortola, it's likely that CWCO is going to continue to feel the pressure from both sides. The larger WAAS desalination plant will likely continue to take market share away from the CWCO plant in the short term. Second, Tensions between the BVI Government and CWCO will likely not let up during the duration of the company's contract and rate cuts will drag on CWCO's bottom line.

Troubled Waters Elsewhere

Unfortunately, for CWCO, Tortola isn't the only plant location where a lack of certainty has weighed on the company. When CWCO's contract with the Water Authority of Cayman expired in 2010, investors were granted a unique look at the type of drawn out negotiations that can prove so problematic for a company like CWCO. When the time for discussing renewal of the Cayman contract arrived, negotiations quickly stalled. Instead of entering into another long-term contract, there have been a series of one-year contracts between the Water Authority of Cayman and CWCO. This dragged-out negotiation has still not been resolved.

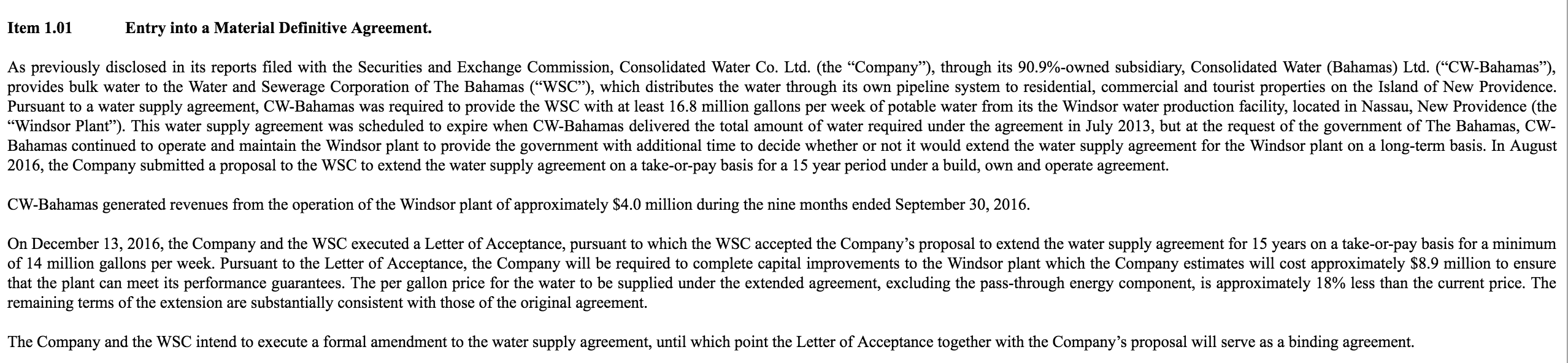

Most recently, CWCO saw their rate cut by 18% when its contract with the Water and Sewerage Company of the Bahamas (WSC) was extended, at long last, in mid-December. According to an 8-K filed by the company on December 13, 2016, the company has finally come to an agreement with regards to its contract with the WSC, which expired in 2013. Since 2013, CWCO has continued to operate its Windsor Plant to "provide the government with additional time to decide whether or not it would extend the water supply agreement for the Windsor plant on a long-term basis."

Fortunately, for company executives and shareholders alike, it appears that the Water and Sewage Company of the Bahamas has made a decision: The contract will be extended at a cost to CWCO of $8.9 million in capital improvements (to make sure the company can deliver the agreed-upon 14 million gallons a week), and that the current price per gallon rate would now be reduced by 18%.

(Click on image to enlarge)

Source: SEC Filings

Conclusion: Get Back to the Beach

The problems that CWCO has had negotiating the renewal of existing contracts, threats from competition, and pressure from jurisdictions demanding lower rates will likely not let up anytime soon.

CWCO is being held hostage by its business model: By relying almost solely on desalination plants - whose access to saltwater is contingent on government contracts and agreements - the company is continually subject to changing political pressures. With so many unknowns, it's no wonder that investors have seen CWCO's share price decline by two-thirds since 2007.

In the short term, we don't see this pressure letting up. The impending expiration of CWCO's Tortola contract will only drag these worries about lower, renegotiated rates front and center once again.

We would recommend that risk-tolerant investors get short shares of CWCO ahead of the March 2017 contract expiration and consider covering positions after news of a likely-lower negotiated rate weighs on the common shares.

Disclosure: I am/we are short CWCO, WAAS.

Disclaimer: I wrote this article myself, and it expresses my own opinions. I ...

more