Commerce Bancshares: Rich Dividend History, Richer Valuation

The Dividend Kings are an exclusive group of dividend stocks that satisfy our most stringent criteria for dividend history.

More specifically, each Dividend King has increased its dividend for a remarkable 50 consecutive years. You can see the full list of all 26 Dividend Kings here.

Commerce Bancshares (CBSH) is one example of a slow-and-steady Dividend King. With that said, the company flies under the radar of many dividend growth investors because it has a low market capitalization of just $6.5 billion

In this article, we will examine Commerce Bancshares investment appeal by considering its business model, growth prospects, and current valuation in detail.

Business Overview

Commerce Bancshares has an easy-to-understand business model. The company is a bank holding company whose principal subsidiary is Commerce Bank.

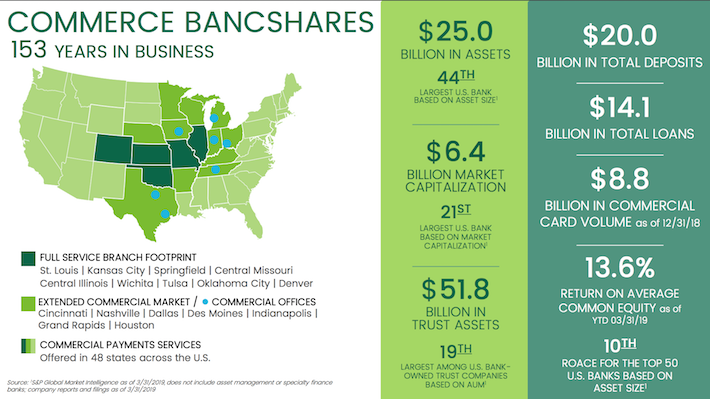

Source: Commerce Bancshares Investor Presentation, slide 3

Commerce Bank offers general baking services to both retail and business customers, with offers ranging from vanilla retail and corporate banking to more exotic offerings like asset management and investment banking. Commerce Bank was founded in 1865 and operates branches in the following states:

- Colorado

- Missouri

- Kansas

- Illinois

- Oklahoma

The company is currently headquartered in Kansas City, Missouri.

Recent Financial Performance

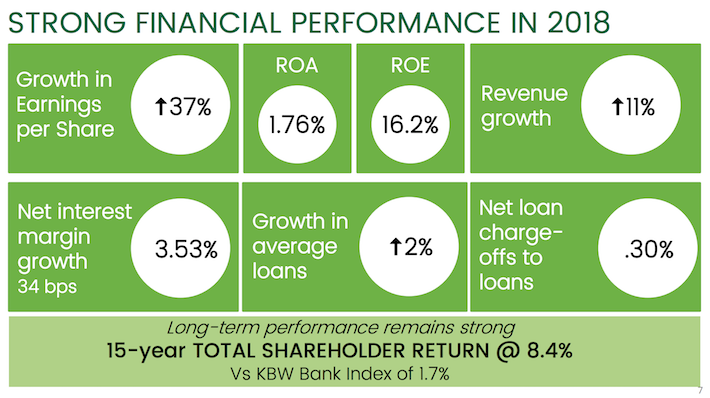

Commerce Bancshares delivered strong financial results in the most recent fiscal year. A summary of the bank’s performance can be seen below.

Source: Commerce Bancshares Investor Presentation, slide 5

More recently, Commerce Bancshares’ momentum has continued. The bank generated revenues of $325 million in the first quarter of fiscal 2019, which represents growth of 3.9% over the same period a year ago.

Commerce Bancshares’ revenue growth in the first quarter was driven by growth in its loan portfolio (where commercial loans contributed the largest amount of growth) as well as by expanding net interest margin (net interest margin expanded by 15 basis points year-on-year).

On the bottom line, however, Commerce Bancshares’ results were not as positive. The company generated earnings-per-share of $0.85 in the quarter, which represented a decline of 4% over the first quarter of 2018.

For financial companies, an important metric is book value per common share. On this measure, Commerce Bancshares performed admirably. The company’s book value per common share increased 14% from the same period a year ago.

Growth Prospects

Commerce Bancshares has a solid if unspectacular growth track record. Through the ten-year period ending last fiscal year (2018), the bank managed to increase its earnings-per-share by 6.8% per year.

Looking ahead, Commerce Bancshares’ growth prospects have not changed by much over the last decade. The bank’s growth continues to be dependent on the following factors:

- Net Interest Margin: the company’s financial results are very sensitive to the spread between the interest rates it pays on its deposits and the interest rates it earns on its loans.

- Loan Growth: The company’s revenue is very dependent on the continued expansion of its loan portfolio.

- The Yield Curve: The tightening monetary policy of the Federal Reserve over the last several years has generally been a positive factor for earnings within the banking sector. The central bank’s future actions are quite uncertain, so investors with an interest in this company should monitor this trend closely moving forward.

- Share Repurchases: Commerce Bancshares has done a nice job of reducing its share count over the last decade. More specifically, Commerce Bancshares has lowered its share count by 13% over the last 10 years, which has boosted its shareholder yield by a tidy 1.4% per year during this time period.

Overall, we believe the company is likely to replicate its historical growth moving forward, and are forecasting 6.8% growth in earnings-per-share through the next half-decade.

Competitive Advantages & Recession Performance

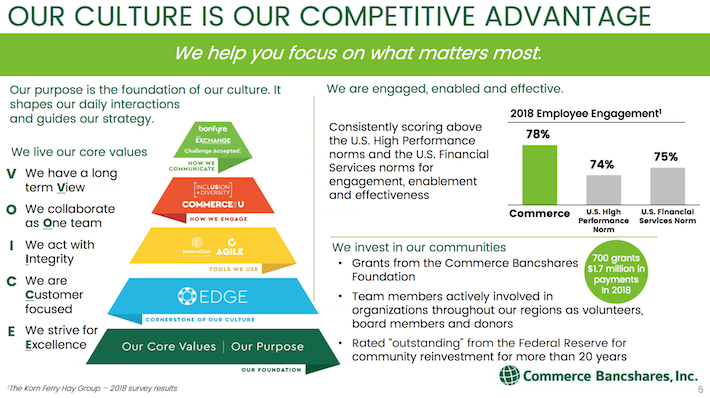

As the following image indicates, Commerce Bancshares believes that its culture is a source of competitive advantage for the firm.

Source: Commerce Bancshares Investor Presentation, slide 5

Commerce Bancshares performed exceptionally well during the last recession compared to its peers in the lending industry. The company’s earnings trajectory during the 2007-2009 financial crisis is shown below:

- 2006 adjusted earnings-per-share: $1.72

- 2007 adjusted earnings-per-share: $1.65

- 2008 adjusted earnings-per-share: $1.52

- 2009 adjusted earnings-per-share: $1.33

- 2010 adjusted earnings-per-share: $1.71

- 2011 adjusted earnings-per-share: $2.00

Commerce Bancshares’ adjusted earnings-per-share declined by 19.4% peak-to-trough during the worst of the Great Recession during a time period when many larger lenders executed recapitalization programs that were devastating to continuing shareholders. Perhaps more importantly, Commerce Bancshares continued its multi-decade streak of consecutive dividend increases. Because of this, we believe the company will perform very well during any future economic downturns.

Valuation & Expected Returns

As with all common equities, Commerce Bancshares future returns can be estimated by looking at each of the three contributors to returns: dividend payments, earnings growth, and valuation changes.

Dividend payments are the most predictable contributor to total returns. Commerce Bancshares currently pays a quarterly dividend of $0.26 per share, which yields 1.8% on the company’s current stock price of $58.97. Given the bank’ multi-decade streak of consecutive dividend increases, investors who buy this stock today are virtually guaranteed to receive this cash return on investment for years to come.

The second most predictable source of returns is business growth. As we outlined earlier in this article, Commerce Bancshares’ current growth prospects are very similar to its historical growth prospects, so we believe the company will be capable of matching its historical growth rate moving forward. We expect 6.8% annual earnings growth over full economic cycles.

Lastly, let’s discuss the bank’s current valuation. Commerce Bancshares is on pace to generate earnings-per-share of about $4.17 in fiscal 2019, which means it is trading at a current price-to-earnings ratio of 14.1. The company’s 10-year average price-to-earnings ratio is 16.5, but we believe that fair value for Commerce Bancshares lies somewhere closer to 13 times earnings given comparable valuations in the lending sector. If the company’s valuation were to contract to 13 times earnings over the next 5 years, this would reduce the company’s returns by an amount roughly equal to the company’s current dividend yield.

Because of this, Commerce Bancshares’ future returns are likely to roughly equal its earnings growth – which we estimate to be around 6.8% per year. The bank earns a hold recommendation from Sure Dividend at current prices.

Final Thoughts

Commerce Bancshares has a dividend history that few companies in the financial services industry can match.

Unfortunately, the company’s valuation is even richer than its dividend history. We suspect that valuation contraction will be a negative contributor to Commerce Bancshares’ future returns.

Because of this, the company earns a hold recommendation today. Prospective investors would do well to monitor its stock price and perhaps accumulate shares on any meaningful dips.

Disclaimer: Sure Dividend is published as an information service. It includes opinions as to buying, selling and holding various stocks and other securities. However, the publishers of Sure ...

more