Coca-Cola And A Non-Sugar Shift

Coca-Cola (KO) has a vast global distribution system that offers it the capability of reaching essentially every human on the planet.

The company is best known for its iconic soft drinks but nearly 40% of its revenues come from non-soda brands across the non-alcoholic spectrum, including PowerAde, Fuze Tea, Glaceau, Dasani, Minute Maid and Schweppes.

While the near-term outlook is clouded by pandemic-related stay-at-home restrictions, secular trends away from sugary sodas, high exposure to foreign currencies (now perhaps a positive) and always-aggressive competition, Coca-Cola’s longer-term picture looks bright.

Relatively new CEO James Quincey (2017), a highly regarded company veteran with a track record of producing profit growth and making successful acquisitions, is reinvigorating the company by narrowing its oversized brand portfolio, boosting its innovation and improving its efficiency.

The company is also working to improve its image (and reality) of selling sugar-intensive beverages that are packaged in environmentally insensitive plastic.

Coca-Cola is supported by over $21 billion in cash which offsets much of its $53 billion in debt. Its growth investing, debt service and $0.41/share quarterly dividend are well covered by free cash flow.

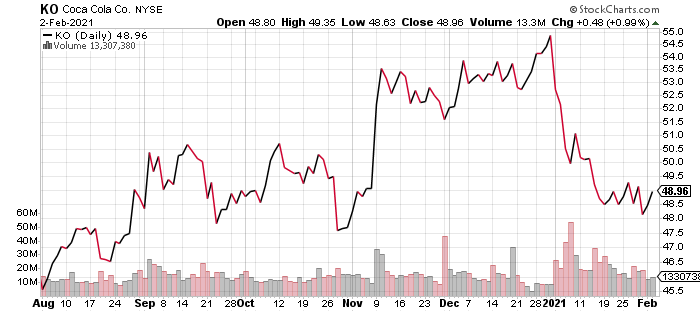

The stock has about 30% upside to our $64 price target. While the valuation is not statistically cheap, at 23.6x estimated 2021 earnings of $2.09 and 21.6x estimated 2022 earnings of $2.28 (both estimates slipped a cent in the past week), the shares are undervalued while also offering an attractive 3.3% dividend yield. We rate the stock a buy.

Disclaimer: © 2020 MoneyShow.com, LLC. All Rights Reserved.