Cloud Stocks: Workday And Anaplan Executing Well Amid Pandemic

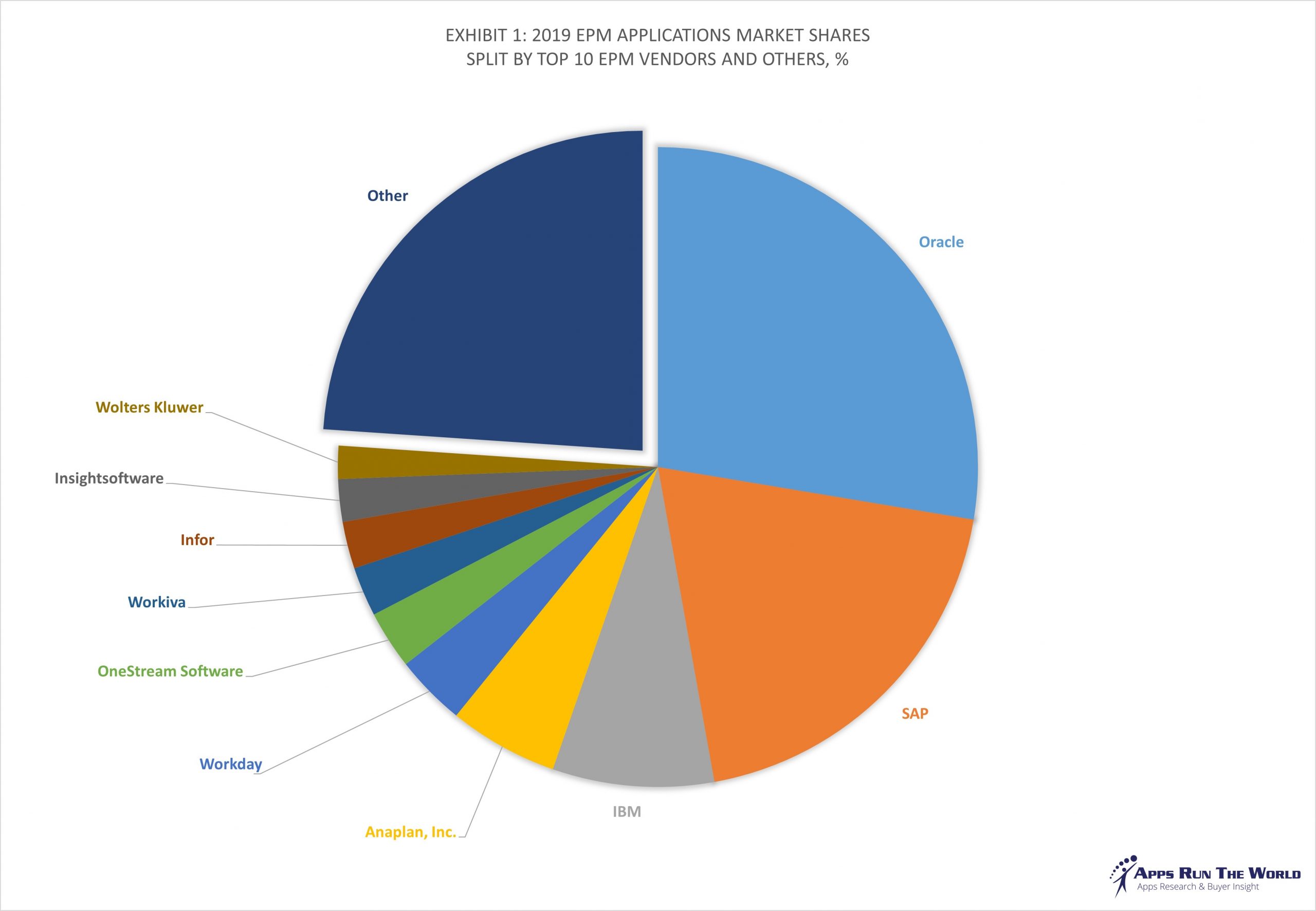

Enterprise services provider Workday (NASDAQ: WDAY) and planning software provider Anaplan (NYSE: PLAN) recently reported strong results for the third quarter that beat analyst estimates. Both Workday and Anaplan compete in the Enterprise Performance Management (EPM) market, which is expected to grow at a CAGR of 8.5% to $4.4 billion by 2024 from $3.9 billion in 2019.

Workday’s Financials

Workday’s third-quarter revenues grew 17.9% to $1.11 billion, beating analyst estimates of $1.09 billion. Non-GAAP EPS was $0.86, also ahead of the market’s forecast of $0.67. GAAP net loss narrowed to $24.3 million compared to loss of $115.7 million a year ago.

By segment, Subscription services revenues grew 21.3% to $968.5 million, ahead of the market’s forecast of $951.5 million. Professional services revenues declined 1.5% to $137.4 million.

Cash, cash equivalents, and marketable securities were $2.95 billion as of October 31, 2020.

For the fourth quarter, Workday expects revenue growth of 14%-16% versus analyst estimates of 17%. It guided for 18% growth in subscription revenue to $991-$993 million, while analysts had been expecting $976 million. Workday raised its FY21 subscription revenue guidance to $3.773 – $3.775 billion or a 22% growth, ahead of market estimates of $3.74 billion or 21% growth.

During the earnings call, Workday’s CFO Robynne Sisco cautioned that the effects of the COVID-19 pandemic will weigh on growth in the coming year, but did not disclose a full forecast for next year.

Workday’s Acquisitions

Workday, in the last two years, acquired Adaptive Insights in 2018 for $1.6 billion to compete in the planning space and Scout RFP in 2019 for $540 million to gain great talent, expand its product capabilities, and accelerate business transformations for its customers.

Scout RFP is now Workday Strategic Sourcing, reflecting Workday’s commitment to elevate and help transform the office of procurement.

Workday has constantly been upgrading Workday Adaptive Planning. Its latest release Workday 2020 Release 2 included the availability of Workday Accounting Center and machine learning-driven predictive forecasts for Workday Adaptive Planning, helping to bring new levels of visibility and control to the office of the chief financial officer.

The Adaptive Insights acquisition helped Workday prop its Enterprise Performance Management (EPM) offerings for planning and analytics. It is currently at No.5 position in the EPM market behind Oracle, SAP, IBM, and Anaplan.

Workday has executed well during the pandemic but faces some uncertainty in the near-term. Its stock is trading at $223.86 with a market capitalization of $53.7 billion. It hit a 52-week high of $248.75 in August and a 52-week low of $107.75 in March this year.

Anaplan’s Financials

Workday’s rival in the EPM market and former strategic partner Anaplan in September announced PlanIQ, a new intelligence framework that delivers advanced Artificial Intelligence (AI) and Machine Learning (ML) capabilities for predictive forecasting and continuous, agile scenario modeling.

Anaplan’s revenues for the third quarter grew 28% to $114.9 million, ahead of the Street’s forecast of $109.6 million. Adjusted loss was $0.05 per share, beating market estimates of a loss of $0.10 per share.

By segment, subscription revenues grew 31% to $104.7 million and professional services revenues grew 4.7% to $10.2 million.

Cash and Cash Equivalents were $296.8 million as of October 31, 2020.

Among key business highlights, Anaplan announced a multi-year deal to support Shell with digital transformation. It also announced a new go-to-market partnership to offer the Anaplan platform on Google Cloud.

For the fourth quarter, Anaplan expects revenue between $118.5 and $119.5 million and billings in the range of $152 million to $153 million. It raised its revenue guidance for full-year fiscal 2021 revenue from $437-$439 million to $444-$445 million.

Anaplan had a rough patch following the onset of the pandemic, but it seems to have weathered the storm. Its stock is currently trading at $68.81 with a market capitalization of $9.6 billion. It touched a 52-week high of $71.53 last week following its earnings announcement. The stock hit a 52-week low of $26.04 in March. Anaplan had listed at $17 in October 2018 when it raised $263.5 million at a valuation of $1.8 billion.

Sramana Mitra is the founder of One Million by One Million (1M/1M), a global virtual incubator that aims to help one million entrepreneurs ...

more